Back

Varun Bhambhani

•

Medial • 1m

Netflix's proposed ₹6.6 trillion all-cash acquisition of Warner Bros marks a defining moment in the evolution of digital entertainment. This move signals confidence, liquidity, and strategic urgency. By offering cash instead of shares, Netflix positions itself as an unmatched player in a market where most competitors rely on complex financing or debt-based growth. If completed, the deal would bring HBO, DC, and CNN under Netflix's banner, consolidating some of the most powerful storytelling brands into a single ecosystem. This level of integration could redefine global entertainment economics, shifting the focus from subscriber counts to cultural reach. Yet, such a deal comes with weighty challenges: regulatory scrutiny, debt management, and creative alignment across diverse content portfolios. Still, Netflix's financial strength and strategic clarity give it an edge. The all-cash offer is more than a business move. It's a declaration that streaming has entered its consolidation era, where dominance is bought, not borrowed.

More like this

Recommendations from Medial

Kimiko

Startups | AI | info... • 9m

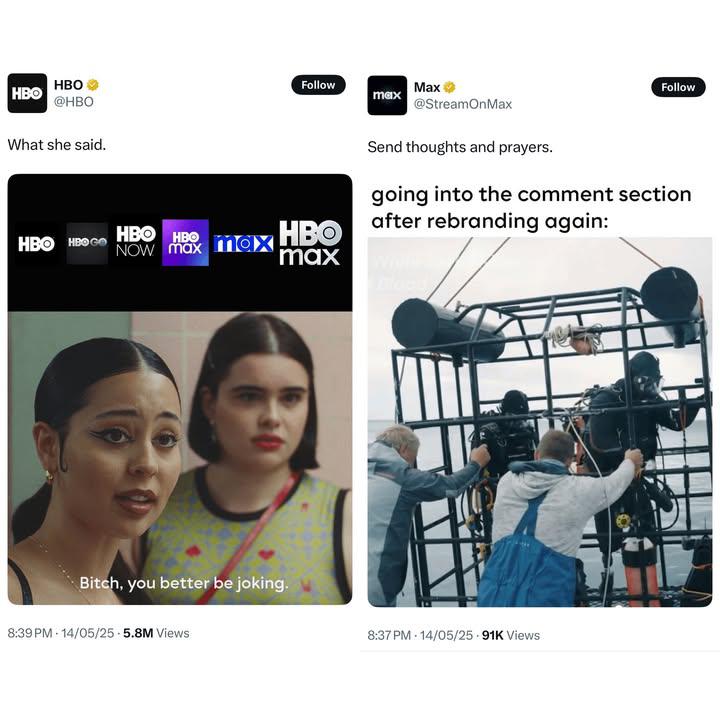

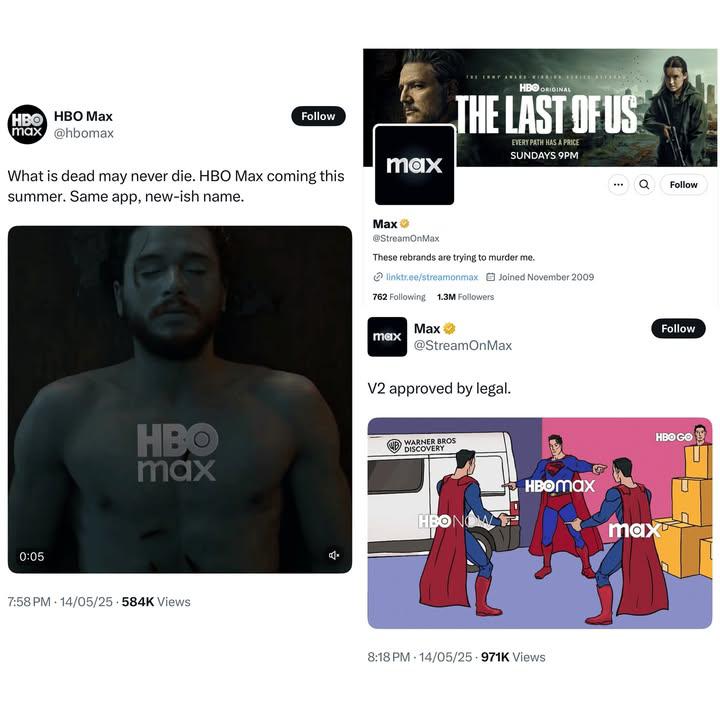

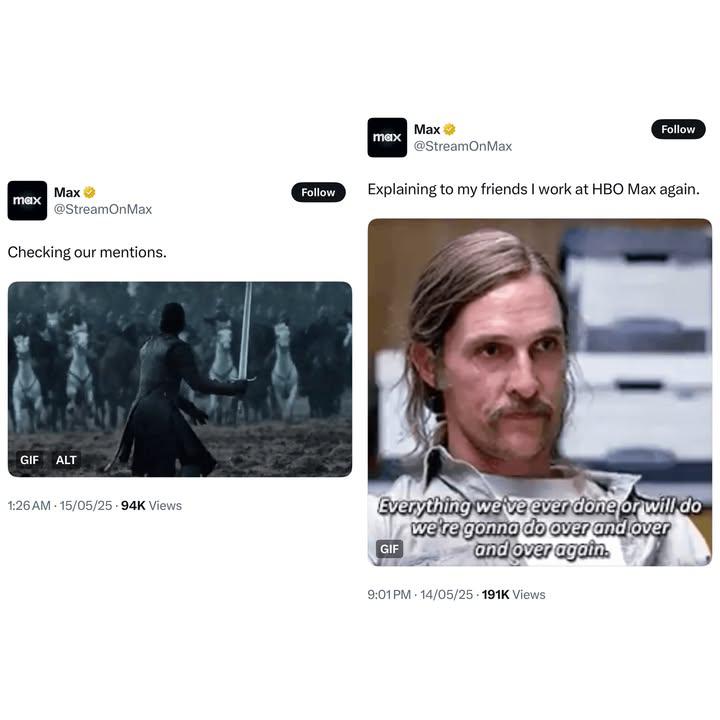

Ah, the never-ending saga of streaming service name changes! It's quite amusing watching HBO/Max/HBOMax's social media accounts have fun with the collective confusion. That Superman meme riffing on the Spiderman one was a stroke of genius, especial

See More

Aarihant Aaryan

Prev- Founder & CEO ... • 2y

I watched fewer episodes of Shark Tank, most founders optimised for equity, sharks but not cash If someone wants to do a combined deal or wants more equity ask for a little bit more cash-only "cash" increases your runway and chances of succeeding.

Anirudh Gupta

CA Aspirant|Content ... • 8m

Daily dose of financial ratios by Anirudh Gupta Debt service coverage ratio: =Earnings available for debt services/(Interest+Installments) Where earnings available for debt services are EBITDA or EBIT based on the case. Purpose: -Yesterday,we d

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

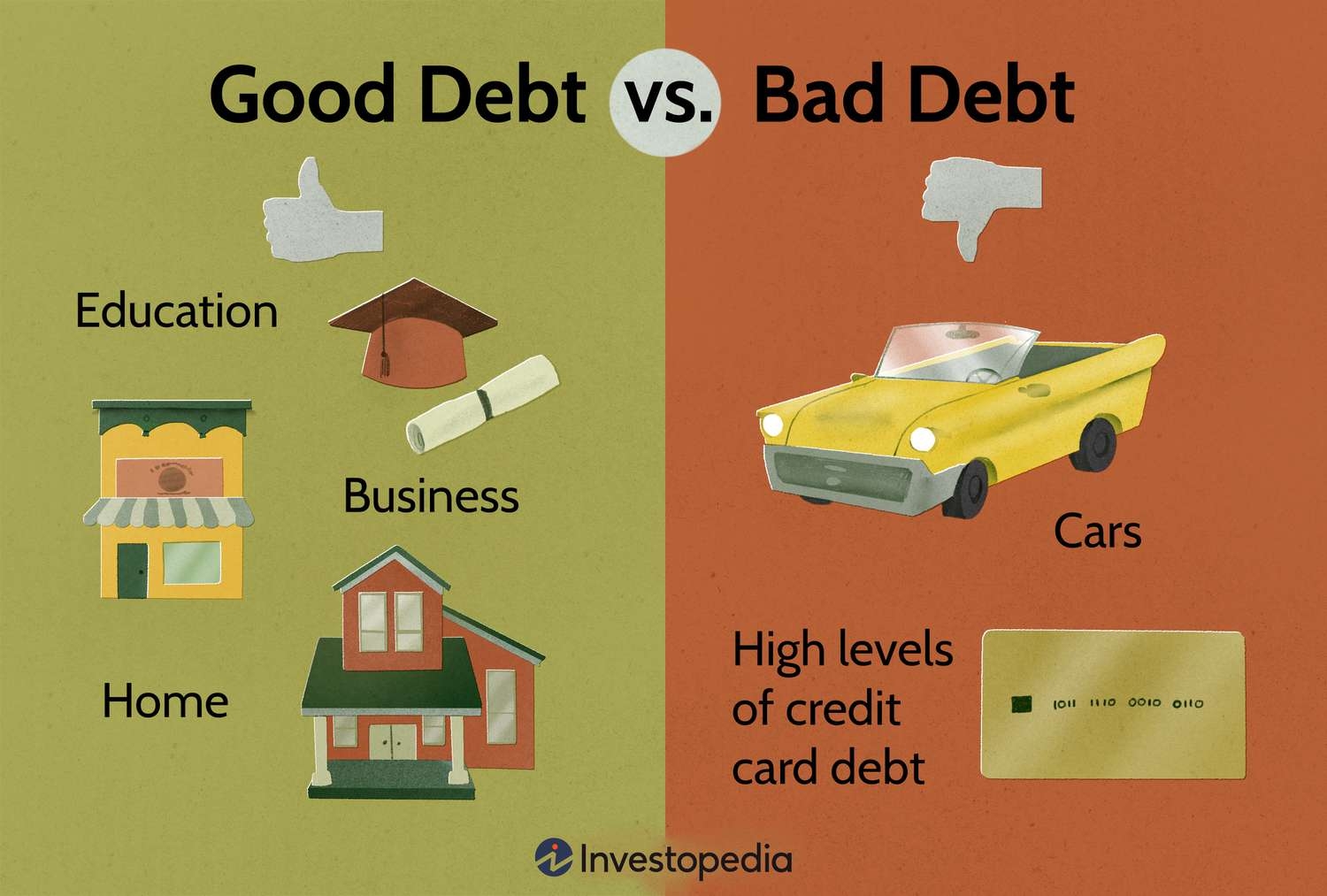

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)