Back

Vivek Joshi

Director & CEO @ Exc... • 2m

Funding Insight: Debt Done Right Many SME and project owners focus solely on the size of the loan. The truly powerful insight? Focus on the structure and source. * Structure: Is the repayment schedule aligned with your project's cash flow cycles, not just standard monthly terms? A flexible structure reduces early-stage pressure. * Source: Are you talking only to banks? Niche non-bank lenders and private debt funds often offer more customized, project-specific, and covenant-lite terms. Debt funding is a partnership, not just a transaction. Negotiate for terms that fuel growth, not just cover principal. Your Homework: Before your next meeting, sketch out your ideal repayment structure based on your revenue projections. #DebtFinancing #SME #ProjectFinance #SmallBusiness #Funding

More like this

Recommendations from Medial

Tarun Suthar

•

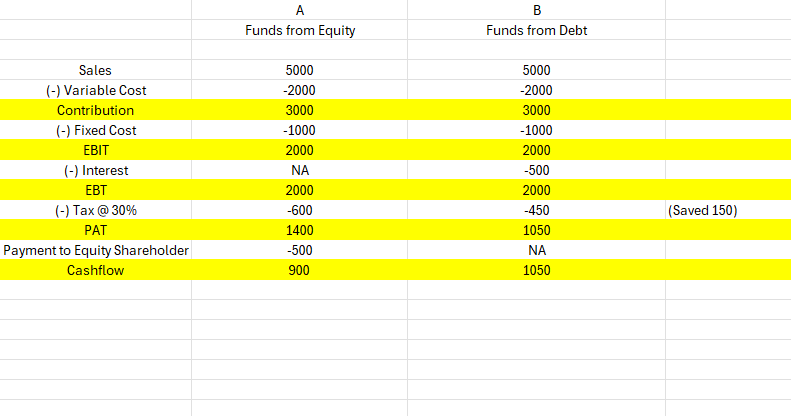

The Institute of Chartered Accountants of India • 9m

Equity vs. Debt - What’s Better for Business Funding? 🤔 Let’s break it down with a simple example: Both scenarios (A & B) start with the same revenue and cost structure. But there's one key difference - the funding source. Scenario A: Funded ent

See More

Account Deleted

Hey I am on Medial • 1y

why indian Startups are opting for Debt financing? 1. Preserving equity: Debt financing allows startups to raise capital without diluting their equity and ownership. This is important for founders who want to maintain control of their company. 2

See More

Sairaj Kadam

Student & Financial ... • 1y

Understanding Debt Financing: A Crucial Funding Option Hey everyone! Today, let’s dive into debt financing, a vital funding method for startups. Unlike equity funding, where you give up ownership, debt financing involves borrowing money that you’ll

See MoreNikhil Chaudhari

Venture Partner • 1d

*✅ Needs Funds To Grow Your Business in India & UAE* *Scale up with Unsecured debt funding up to ₹20 crore in < 5 days.* *#Business loan* *#Working capital loan* *#Home loan* *#Private debt funding* *#Loan against property* *🛑We also do large pr

See MoreVivek Joshi

Director & CEO @ Exc... • 2m

STOP WAITING. FUNDING IS READY. (INR 3–5 Crore Debt) Is your high-growth business ready to scale NOW? We're connecting ambitious founders directly to capital that moves as fast as they do. We know your sweet spot is INR 3–5 CRORE in debt funding. Tha

See More

VENTURE NAVIGATOR

INVESTOR | Start up ... • 1y

Scaling a Traditional Business with Debt Funding 💰🍦 Recently, I had the opportunity to consult the founder of an ice cream brand looking to raise funds—not for an exit, but for scaling up! 🚀 With an annual turnover of ₹2 Cr, he needed ₹30 Lakhs

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)