Back

Jayant Mundhra

•

Dexter Capital Advisors • 4m

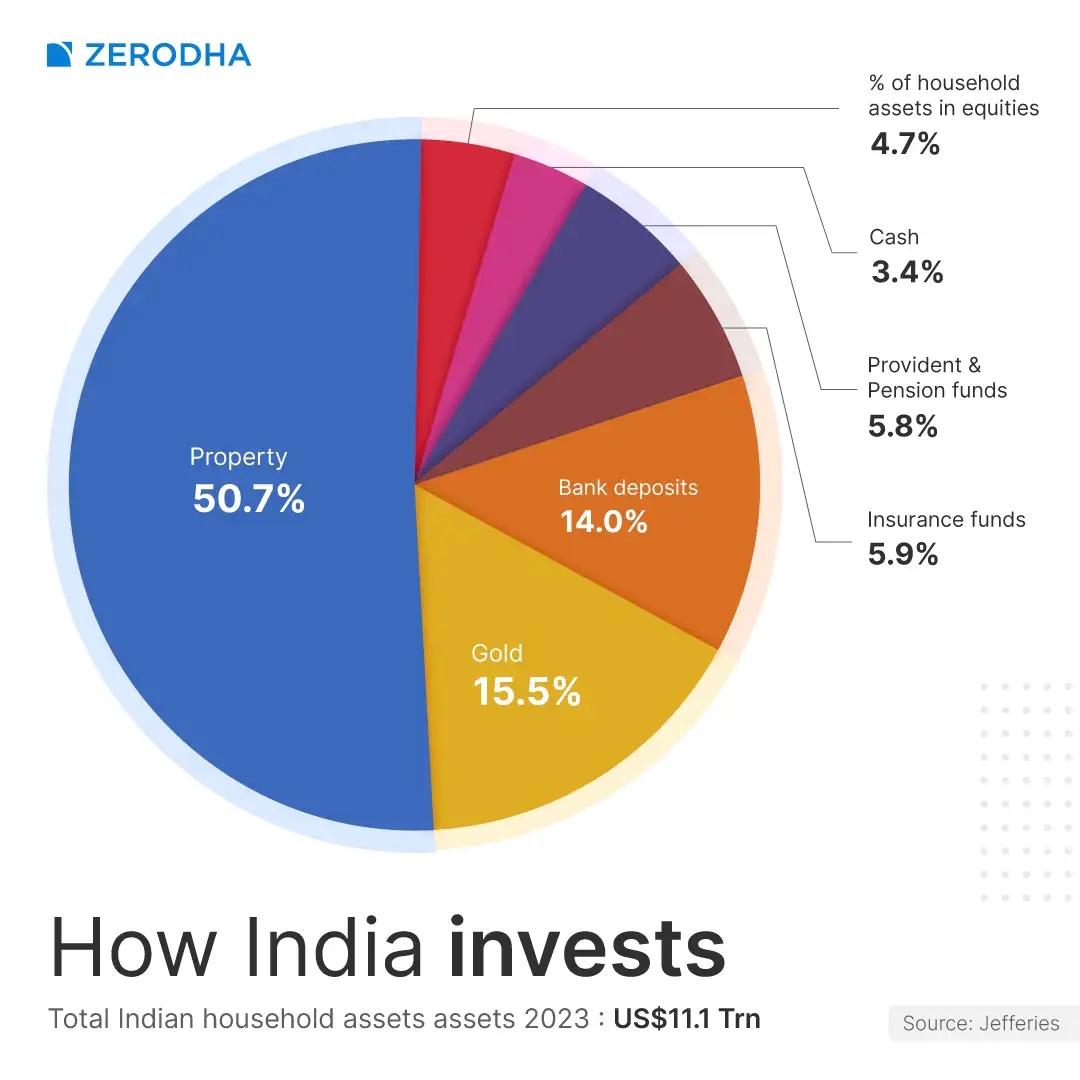

The crazy rise in gold prices are GREAT FOR INDIA 🇮🇳🙏 I had written a big deepdive on this 5 months ago, and was ridiculed by many, but the impact is much visible now. And the same is also playing out in Turkey, where the central bank's governor has openly shared insights and numbers on this (details below). Thus, this Dhanteras, here is a deepdive for every Indian! .. My thesis was simple. They claimed this gold is "locked up" and just sits in lockers. They said it has NO real economic impact. They were wrong. Completely wrong. Let's look at the sheer scale. - Firstly, my old post used a 25,000-ton estimate for Indian household gold (which is out of the financial system). - New Morgan Stanley reports (mid-2025) are 34,600 tons of gold. Now, let's use the REAL market price. Not the paper price. The effective price for a 24k coin today, with all charges, is ~₹1.45 lakhs per 10g in the market. At that valuation, our household hoard is worth: ₹501.7 LAKH CRORES. Let that sink in. That’s ~$5.64 trillion (at an ₹89/USD rate). .. Now consider this. We have ~30 crore households in India. This translates to an average of ₹16.7 lakhs for EVERY single household. This isn't an economic problem. It is the single biggest, most inclusive wealth stimulus in our nation's modern history. Imagine if even 1% of the 30cr Indian households decide to tap on 10% of this wealth. That’s a consumption boost of ₹50k crore! 💰💰 And this is a big factor helping India stay so strong despite global geopolitics going against it right now. .. Now, for everyone who still says this gold is "locked up." Look at Turkey. It’s the perfect case study. - Their central bank governor has openly shared how Turkish households have a similar "under the bed" hoard worth ~$500bn - As prices surged, what did they do? They started monetising it. FAST. How? - Selling it for cash - Using it as collateral for gold loans to fund their consumption/needs The impact is so massive, it’s actually making it HARD for the Turkish Govt to control inflation. Their household stimulus is actively fighting the central bank's policy! Turkey proves the "locked up" thesis is WRONG. .. And the data in India proves it too. Look at our gold loan market. It is EXPLODING. - ICRA even says that the organised gold loan market is set to hit ₹15 TRILLION by FY26. That's a full year ahead of schedule - The market is projected to grow 30-35% this year ALONE - The key driver? The report states it clearly: "steady uptrend in gold prices" Certainly, a portion of this is households/businesses in distress using the higher value of their gold to get liquidity. Either way, it is a massive wealth unlock for Indian households, however you cut it. This is the REAL story of the gold price rise. Did you know this?

Replies (1)

More like this

Recommendations from Medial

Muttu Havalagi

🎥-🎵-🏏-⚽ "You'll N... • 1y

Decline in India's Household Savings Net household savings in India declined to a 47-year low of 5.1% of gross domestic product in FY23, compared to 7.2% in the previous year. The finance ministry attributes this to changing consumer preferences for

See More

Jayant Mundhra

•

Dexter Capital Advisors • 7m

To one’s who bet against India: This is “THE MATH” you have never considered. - Indian households have 25k tonnes of gold, which at current valuations is worth approximately Rs 245 lakh crore - If prices were to double, the resulting gain of Rs 245

See MoreAarihant Aaryan

Prev- Founder & CEO ... • 1y

Indians love gold and have so much emotional connection, afterall Indian households own 11% of total gold in the world But what you need to know is how malabar gold won just by understanding consumer emotions towards gold Malabar Gold was launche

See MorePoosarla Sai Karthik

Tech guy with a busi... • 3m

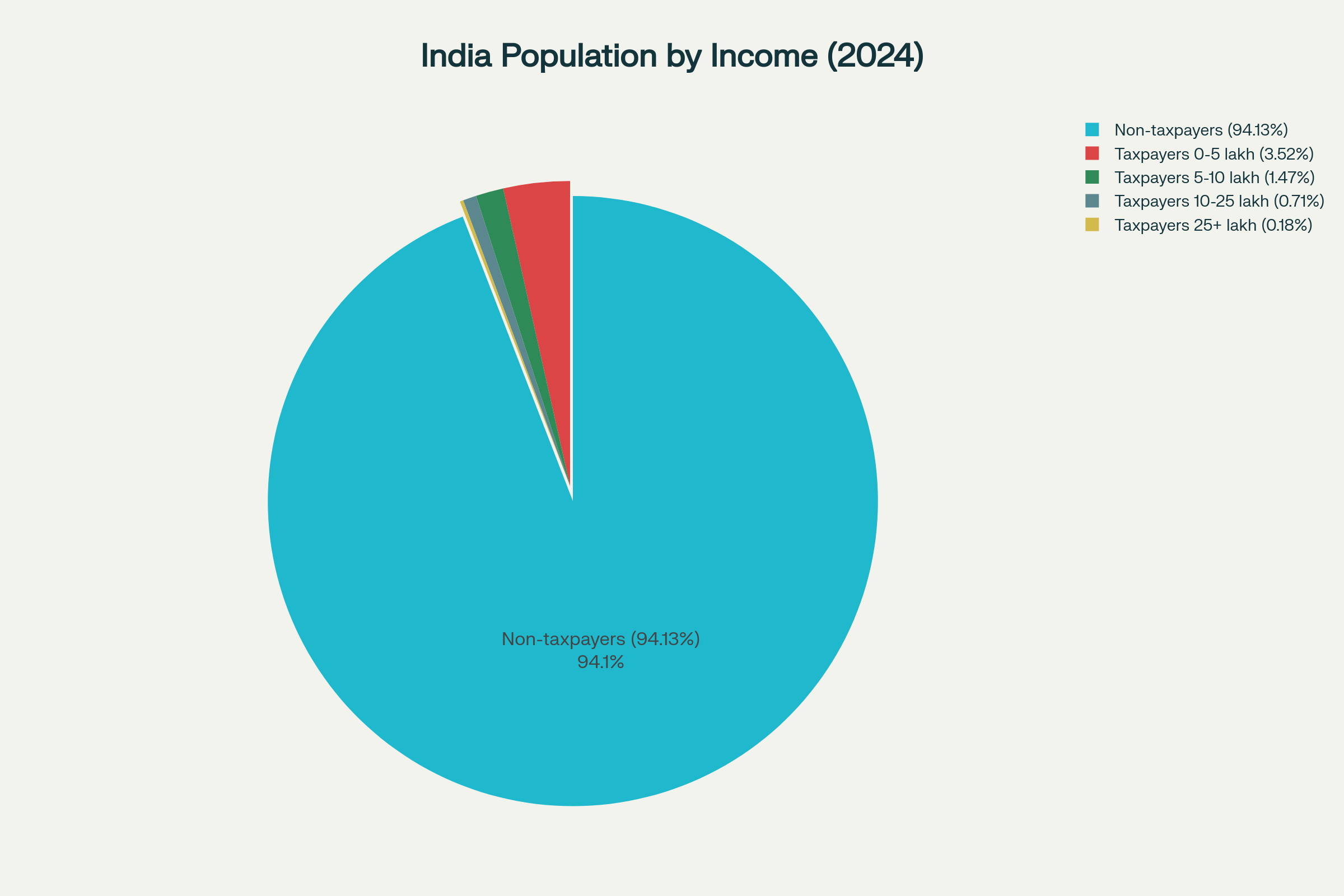

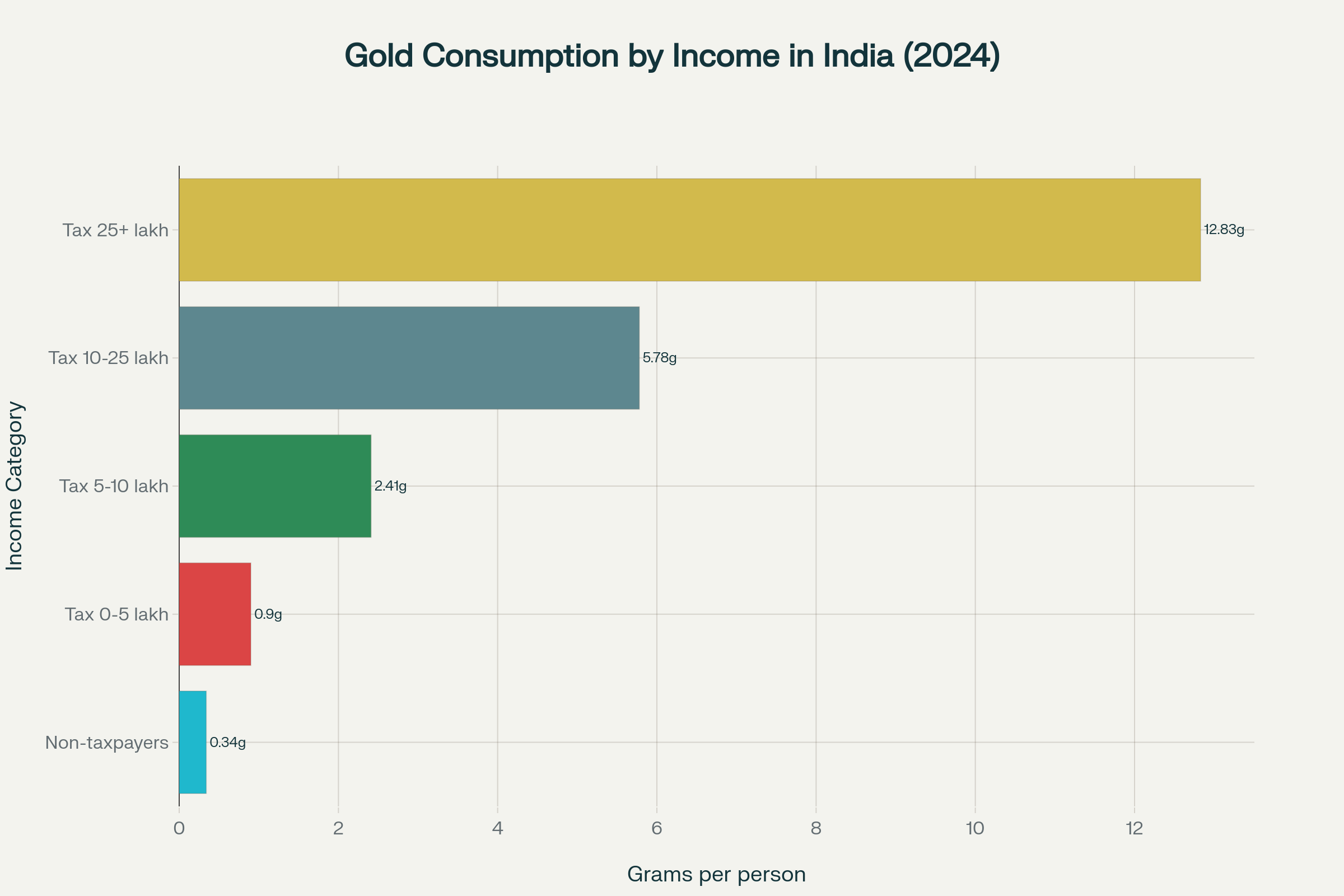

Why India’s Tax Stats and Gold Love Tell a Unique Investment Story Did you know only 5.9 percent of India’s vast population pays income tax, but nearly every household treasures gold not only as jewellery but as a trusted financial foundation? Here

See More

VIJAY PANJWANI

Learning is a key to... • 4m

Did you know? Indian housewives collectively own 25,000 tonnes of gold – more than the official reserves of the United States, France, and China combined. According to the World Gold Council, this represents nearly 11% of the world’s total gold re

See More

Rohan Saha

Founder - Burn Inves... • 9m

Some finance influencers have become so desperate for engagement these days that they'll say almost anything. I came across a video where a guy was acting like it's the end of the world urging people to hoard cash, sell their gold, and make other ext

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)