Back

Jayant Mundhra

•

Dexter Capital Advisors • 7m

To one’s who bet against India: This is “THE MATH” you have never considered. - Indian households have 25k tonnes of gold, which at current valuations is worth approximately Rs 245 lakh crore - If prices were to double, the resulting gain of Rs 245 lakh crore would add massively to national household wealth Consider this analysis below. .. Basis the latest data, India now has ~30 crore households. Thus, we are talking about a potential windfall of nearly Rs 8.2 lakh for each household, or Rs 1.68 lakh per capita. This is a humongous power. It would be an economic stimulus of a scale and inclusivity that is almost unparalleled in modern history. .. And to be frank, this vast, decentralised holding becomes critically important in the world we are entering. - As the dominance of the US dollar faces headwinds and global instability pushes investors towards hard assets, gold is poised for a significant revaluation (basis my analysis - no recommendations) - Our ancestors, through rituals and their invention of jewellery as a tool for inter-generational wealth transfer, have inadvertently prepared the nation for this exact moment. Or so I feel And, what happens when this revaluation occurs? The wealth effect will be staggering. Today gold retails at ~$3,350 an ounce. Imagine what happens when this number soars to $5k. Then $10k. A surge towards $8,000 an ounce itself would unleash a windfall delta of $3.7 trillion for Indian families, which is as much as the size of entire Indian economy today. .. And I know, some people would already be jumping to shout that I am speculating. But think people. Apple the brains. Gold’s price has jumped 3x in last 10 years. Why can’t it 3x again in next 10 years? It is very much possible! And here, for 2k I am simply talking about 2.4x gain. That’s even more possible! .. And consider this: This isn't wealth locked away in institutional vaults; it's capital sitting in cupboards and lockers across the length and breadth of the country. This is the key differentiator, and it matters. Why? Unlike an equity market rally that disproportionately benefits institutions and the top percentile of society, a gold price boom is the most democratic form of wealth creation for India. It directly empowers millions of middle-class and rural households, potentially igniting a consumption and business investment cycle from the grassroots up. .. In a world where the West's consumption engine may be sputtering, India's ancient fascination for a yellow stone could be the unlikely catalyst that funds our modern ambitions. This might just be the serendipitous blessing that ensures India's tryst with destiny is finally and gloriously fulfilled. What do you think?

Replies (4)

More like this

Recommendations from Medial

Om Gupta

Focus on work focus ... • 1y

RBI gave the government a record Rs 2.1 lakh crore dividend, boosting government finances. This windfall is seen as a sign of the RBI's strong management and could allow the government to invest more in the economy. Experts believe this reflects well

See MoreJayant Mundhra

•

Dexter Capital Advisors • 4m

The crazy rise in gold prices are GREAT FOR INDIA 🇮🇳🙏 I had written a big deepdive on this 5 months ago, and was ridiculed by many, but the impact is much visible now. And the same is also playing out in Turkey, where the central bank's governor

See MoreJeet Sarkar

Technology, Developm... • 1y

Nazara Technologies Ltd, a Mumbai-based mobile gaming and sports media company, has issued shares worth Rs 100 crore to Nithin Kamath and Nikhil Kamath, the founders of Zerodha. The move is part of a broader investment in which Nazara allocated 28.

See MorePoosarla Sai Karthik

Tech guy with a busi... • 4m

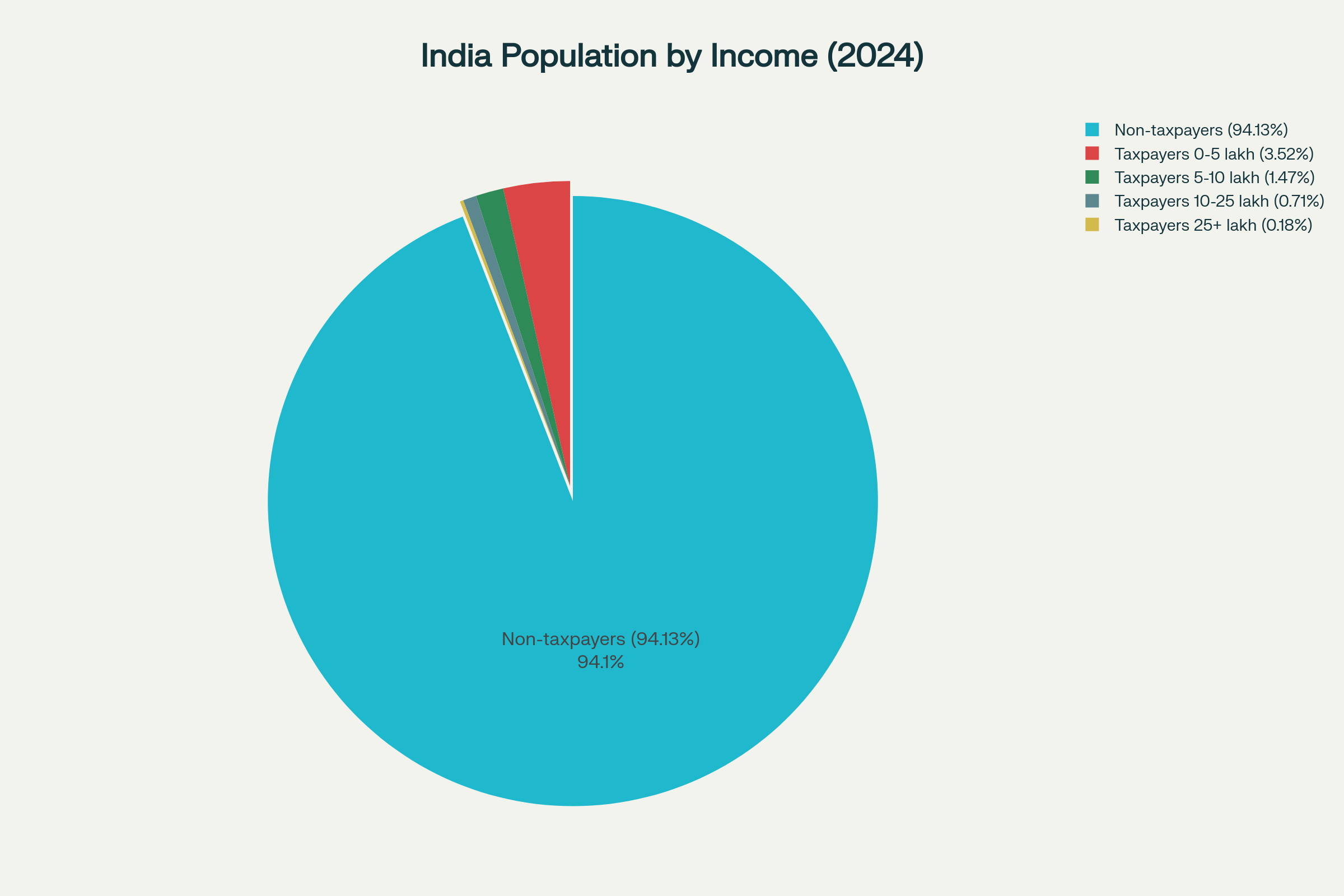

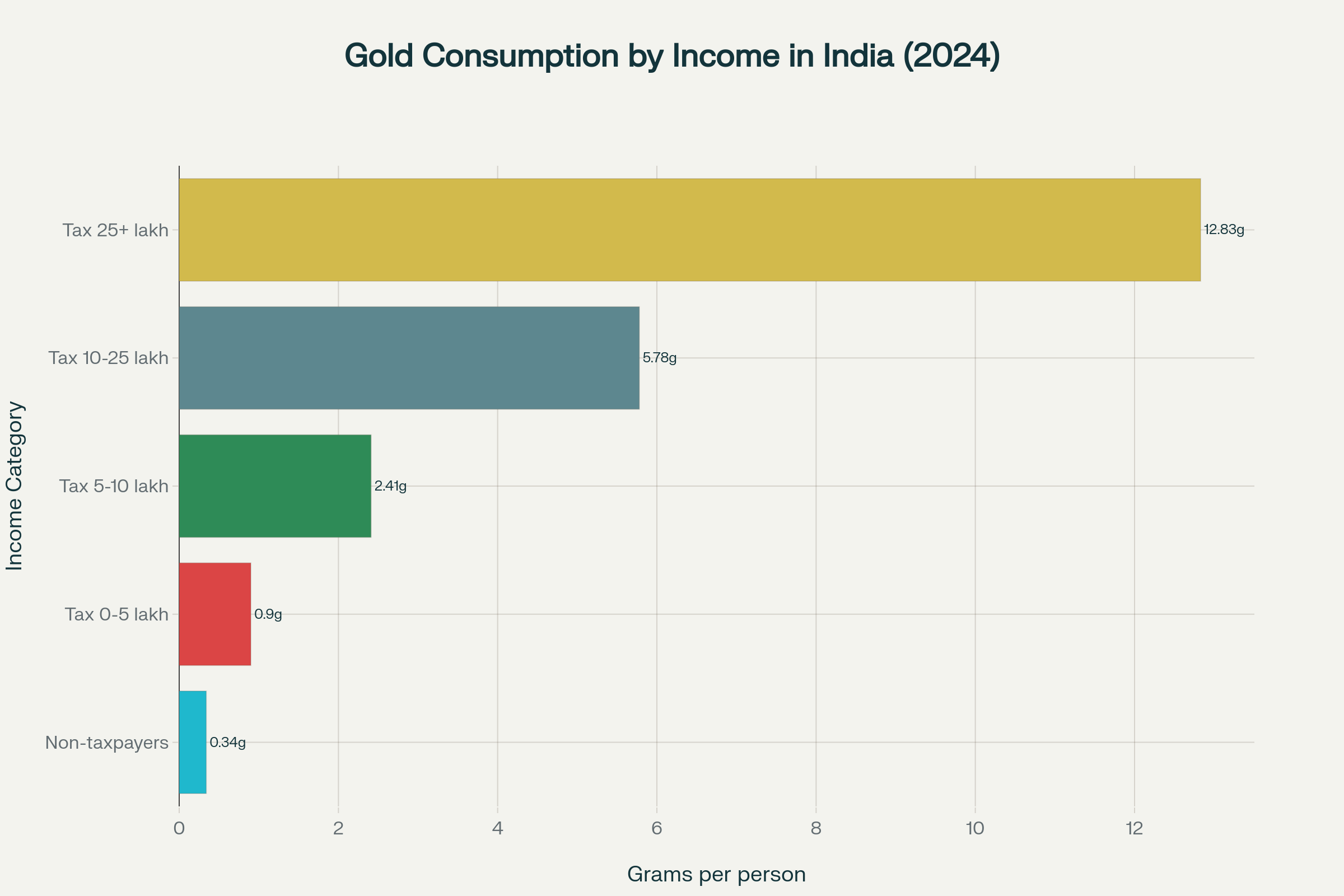

Why India’s Tax Stats and Gold Love Tell a Unique Investment Story Did you know only 5.9 percent of India’s vast population pays income tax, but nearly every household treasures gold not only as jewellery but as a trusted financial foundation? Here

See More

VIJAY PANJWANI

Learning is a key to... • 5m

Did you know? Indian housewives collectively own 25,000 tonnes of gold – more than the official reserves of the United States, France, and China combined. According to the World Gold Council, this represents nearly 11% of the world’s total gold re

See More

Startopia news

Your daily dose of s... • 10m

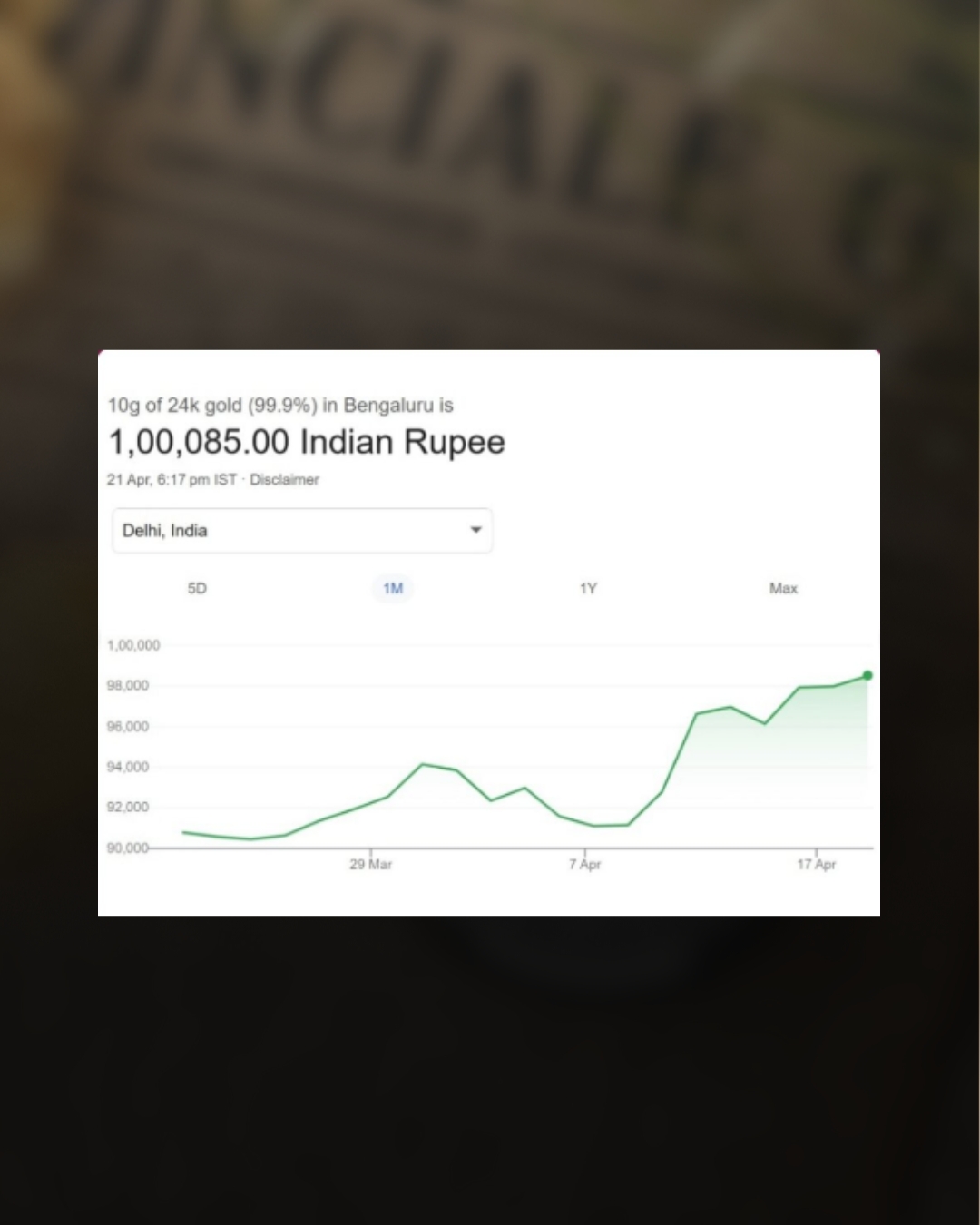

Goldflation Gold Hits All-Time High: ₹1 Lakh per 10g in Delhi! A Global uncertainty, Trump's remarks, and a falling dollar push investors toward the ultimate safe haven. Is this just the beginning of gold's golden run? For more follow Startopia n

See More

Aditya Arora

•

Faad Network • 1y

How is Kumbh Mela making a revenue of 4 lakh CR? i) Kumbh Budget - 7500 CR (Rs 5400 - UP govt., Rs 2100 - Centre) ii) Total Expected Indian visitors - 40 CR iii) Estimated Indian National Spending - Rs 5000/- (Golgappe, Sweet Corn, Water etc.) iv)

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)