Back

Larren Square

Your Financial Docto... • 20d

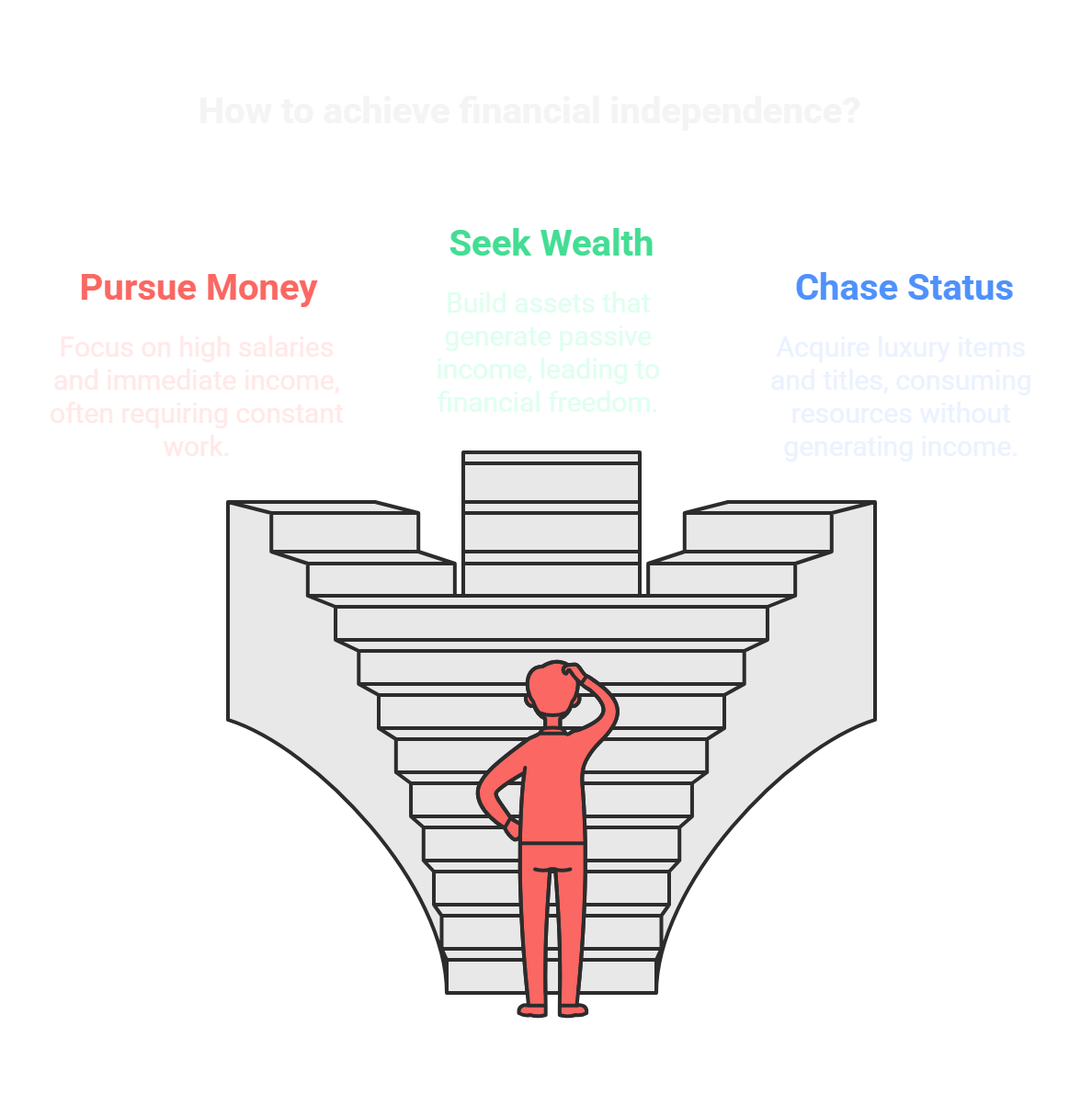

India’s wealth management industry is growing at a remarkable pace, driven by rising incomes, greater financial awareness, and a strong shift away from traditional assets like gold and real estate toward mutual funds, equities, bonds, PMS, AIFs, and insurance-based solutions. The financialisation of savings and rising equity participation have pushed industry assets under management (AUM) into tens of lakh crores of rupees. India is also seeing rapid growth in affluent and HNI investors, along with strong SIP inflows and digital adoption. The industry is clearly moving from product distribution to goal-based financial planning focused on long-term wealth creation, retirement planning, tax efficiency, and risk management. The market is dominated by large institutions and private wealth platforms. Major players include 360 ONE Wealth (formerly IIFL Wealth), managing several lakh crores of rupees, Motilal Oswal Private Wealth with over ₹1.5 lakh crore+ in AUM, Kotak Wealth and Kotak AMC managing multiple lakh crores, Edelweiss with a strong presence in alternatives and structured products, and bank-led platforms such as HDFC, ICICI, Axis, and SBI managing very large pools of investor assets. While these players lead in scale, the future of wealth management lies in personalised, transparent, and goal-driven advisory. This is where Larren Square (https://larrensquare.com ) plays a strong role. Larren Square is a new-age wealth management and financial planning firm focused on goal-based investing, long-term wealth creation, retirement and child future planning, and tax-efficient investing through mutual funds and insurance solutions. Instead of pushing products, Larren Square works as a long-term financial partner, helping clients build disciplined, structured, and stress-free financial journeys. As Indian investors increasingly seek clarity, simplicity, and trust in their financial decisions, boutique advisory firms like Larren Square are becoming an important part of the country’s wealth management ecosystem.

More like this

Recommendations from Medial

Rutuja Sutar

Finance Enthusiast! • 1y

As a financial enthusiast, I am passionate about empowering youth and women to take control of their financial futures. With a strong foundation built on personal investment experience, I’ve learned the power of discipline, patience, and emotional ma

See More

Shivam Singh

"Igniting My Startup... • 1y

Fundamental Challenges of Finance #Valuation . How are financial assets valued? How should financial assets be valued? How do financial markets determine asset values? How well do financial markets work? #Management . How much should I save

See MoreBharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreAdithya Pappala

Busy in creating typ... • 1y

All are murmuring about today's Nirmala Sitharaman India's Financial Budget Okay ~0 tax until 12 lakhs of Income ~4 lakh crores to repay ~48,000+ Crores for welfare schemes & etc ~Finally, The whole of India(144Cr+) People have to burn 55,00000+ C

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)