Back

RAKESH TAMBOT

Hey I am on Medial • 1y

Personalized Financial Wellness Platforms. • Develop a platform that offers personalized financial coaching using AI, tailored to individual goals like debt management, saving, investing, and retirement planning. Gamify the experience to keep users engaged.

More like this

Recommendations from Medial

Tushar Aher Patil

Trying to do better • 1y

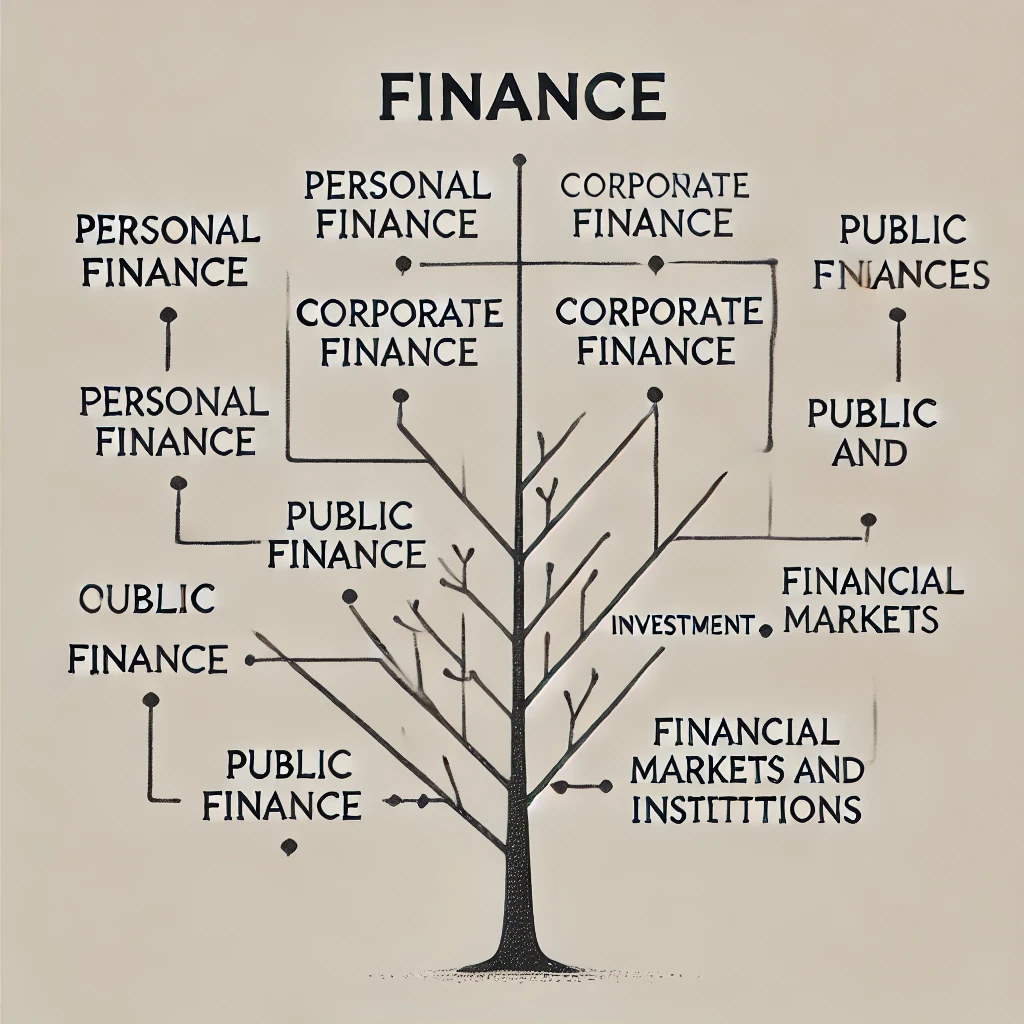

Hey medial family. I am starting a new series of basic finance concepts. For the first time in my life I have to explain a lot. If I do something wrong, then correct me as a little brother. 1. Personal Finance Budgeting: Planning how to allocate i

See More

Suprodip Bhattacharya

Entrepreneur || Star... • 1y

Need cofounder, from Kolkata will be best,the idea is:-Imagine teens confidently saving for his dream house,not just the next in-app purchase. Picture families sleeping soundly, debt-free. FinSavvy makes this reality by bringing financial guidance to

See MoreSuprodip Bhattacharya

Entrepreneur || Star... • 1y

Imagine teens confidently saving for his dream house,not just the next in-app purchase. Picture families sleeping soundly, debt-free. FinSavvy makes this reality by bringing financial guidance to EVERYONE The Silent Struggle: Existing tools are confu

See MoreAdarsh Patél

Hey I am on Medial • 1y

Mastering Personal Finance: A Comprehensive Guide to Building Wealth In today’s fast-paced world, understanding personal finance is no longer optional—it’s essential. Whether you’re saving for a home, planning for retirement, or trying to pay off de

See MoreSuprodip Bhattacharya

Entrepreneur || Star... • 1y

Imagine a world where teenagers are saving for their higher studies or dream house A world where low-income families can finally build a safety net, instead of living paycheck to paycheck. FinSavvy makes that world a reality!he Personalized AI Revolu

See MoreSuprodip Bhattacharya

Entrepreneur || Star... • 1y

I need technical co founder The idea is : Imagine a world where teenagers ate saving money for their future and low Income families Can build a safety net instead of living with big debts Tired of Vague Financial Dreams? Wealthyse helps you set clea

See MoreAlok k Jain

A Financial Professi... • 1y

The 18–30 age group is a transformative phase where financial habits define future success. Yet, young adults often lack accessible guidance for financial decisions. I envision a platform that serves as a personal financial partner, offering real-tim

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)