Back

Tushar Aher Patil

Trying to do better • 1y

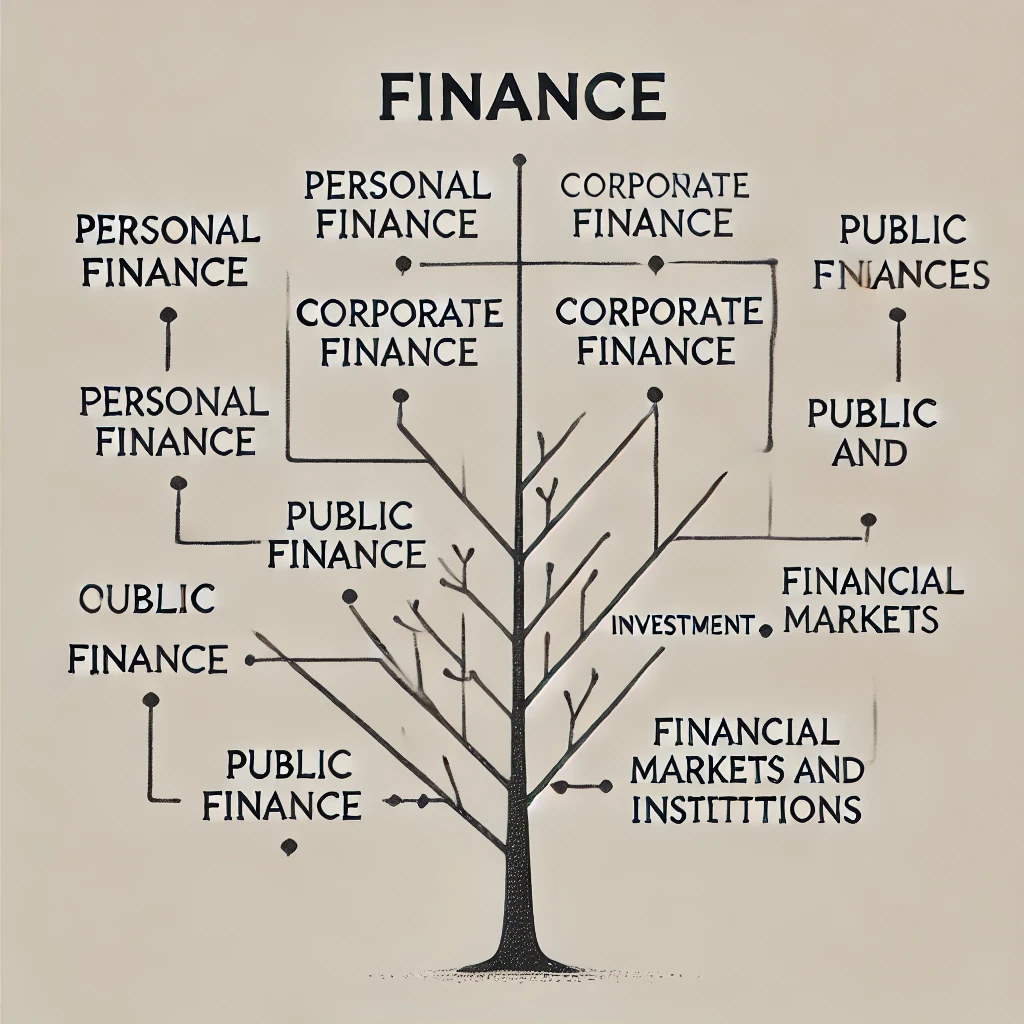

Hey medial family. I am starting a new series of basic finance concepts. For the first time in my life I have to explain a lot. If I do something wrong, then correct me as a little brother. 1. Personal Finance Budgeting: Planning how to allocate income towards expenses, savings, and debt repayment. Saving: Setting aside money for future needs or emergencies. Investing: Putting money into financial assets like stocks, bonds, or real estate to grow wealth over time. Retirement Planning: Preparing financially for life after retirement, often through pension funds or retirement accounts. Insurance: Protecting against financial losses from unforeseen events (e.g., health insurance, life insurance) stay tuned for more concept

Replies (2)

More like this

Recommendations from Medial

Bharat Yadav

Betterment, Harmony ... • 1y

Key Financial Considerations for Medical Professionals 1 . Debt Management: Strategize student loan repayment, credit cards, and personal loans. 2. Retirement Planning: Maximize tax-advantaged accounts (401(k), IRA). 3. Investments: Diversify portfol

See MoreAdarsh Patél

Hey I am on Medial • 1y

Mastering Personal Finance: A Comprehensive Guide to Building Wealth In today’s fast-paced world, understanding personal finance is no longer optional—it’s essential. Whether you’re saving for a home, planning for retirement, or trying to pay off de

See MoreBharat Yadav

Betterment, Harmony ... • 1y

BSNL is planning a second Voluntary Retirement Scheme (VRS) to cut its workforce by 18,000-19,000 and ease financial pressures. The proposal, seeking ₹1,500 crore for implementation, has been submitted to the Department of Telecommunications (DoT)

See More

Kiran aiwale

The business solutio... • 9m

Bajaj Allianz Life insurance Term insurance 1. *Affordable premiums*: Lower premiums compared to whole life insurance. 2. *High coverage*: Provides a high death benefit to ensure financial security for loved ones. 3. *Flexibility*: Choose term le

See MoreNitesh Vishwakarma

•

Ritco Logistics • 8m

Embedded Finance: The Future of Financial Services for Startups Ever heard of embedded finance? It’s revolutionizing how startups do business! 🚀 What is Embedded Finance? It’s the seamless integration of financial services—like payments, lending,

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)