Back

Suprodip Bhattacharya

Entrepreneur || Star... • 1y

Need cofounder, from Kolkata will be best,the idea is:-Imagine teens confidently saving for his dream house,not just the next in-app purchase. Picture families sleeping soundly, debt-free. FinSavvy makes this reality by bringing financial guidance to EVERYONE The Silent Struggle: Existing tools are confusing, budgets feel like punishment. Teens lack guidance, low-income families-juggle bills. It's a broken system! The AI Revolution: FinSavvy's AI analyzes income, expenses, and goals to create personalized plans for teens, families, and low-income individuals. Conquer debt, save for college, build a secure future - step by step More Than Budgeting: Gamified challenges (coming soon!) make saving fun, a supportive community fosters connection (coming soon!). Forget spreadsheets, FinSavvy makes financial planning rewarding! Why FinSavvy? Unlike basic apps, we provide personalized guidance, not generic advice. It's financial freedom for ALL, not just the privileged few

Replies (2)

More like this

Recommendations from Medial

Suprodip Bhattacharya

Entrepreneur || Star... • 1y

Imagine teens confidently saving for his dream house,not just the next in-app purchase. Picture families sleeping soundly, debt-free. FinSavvy makes this reality by bringing financial guidance to EVERYONE The Silent Struggle: Existing tools are confu

See MoreSuprodip Bhattacharya

Entrepreneur || Star... • 1y

Imagine a world where teenagers are saving for their higher studies or dream house A world where low-income families can finally build a safety net, instead of living paycheck to paycheck. FinSavvy makes that world a reality!he Personalized AI Revolu

See MoreSuprodip Bhattacharya

Entrepreneur || Star... • 1y

I need technical co founder The idea is : Imagine a world where teenagers ate saving money for their future and low Income families Can build a safety net instead of living with big debts Tired of Vague Financial Dreams? Wealthyse helps you set clea

See MoreAdarsh Patél

Hey I am on Medial • 1y

Mastering Personal Finance: A Comprehensive Guide to Building Wealth In today’s fast-paced world, understanding personal finance is no longer optional—it’s essential. Whether you’re saving for a home, planning for retirement, or trying to pay off de

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 1y

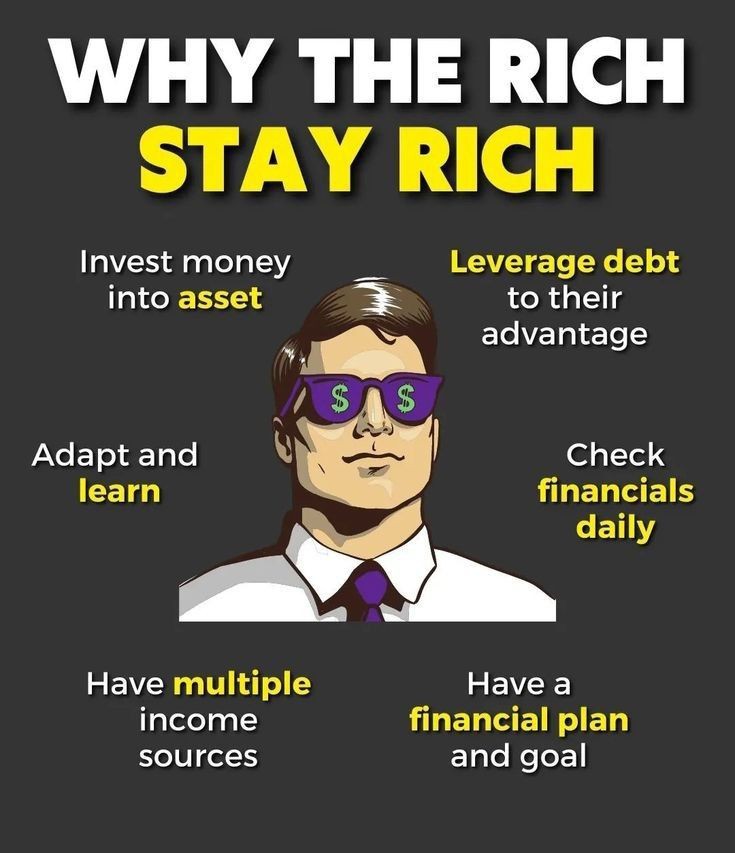

Why the Rich Stay Rich 💰 💼 Invest in assets, not just income. 📈 Leverage debt smartly. 📊 Review finances daily. 📚 Never stop learning and adapting. 💡 Diversify with multiple income streams. 🎯 Set clear financial goals and plans. Wealth isn't

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

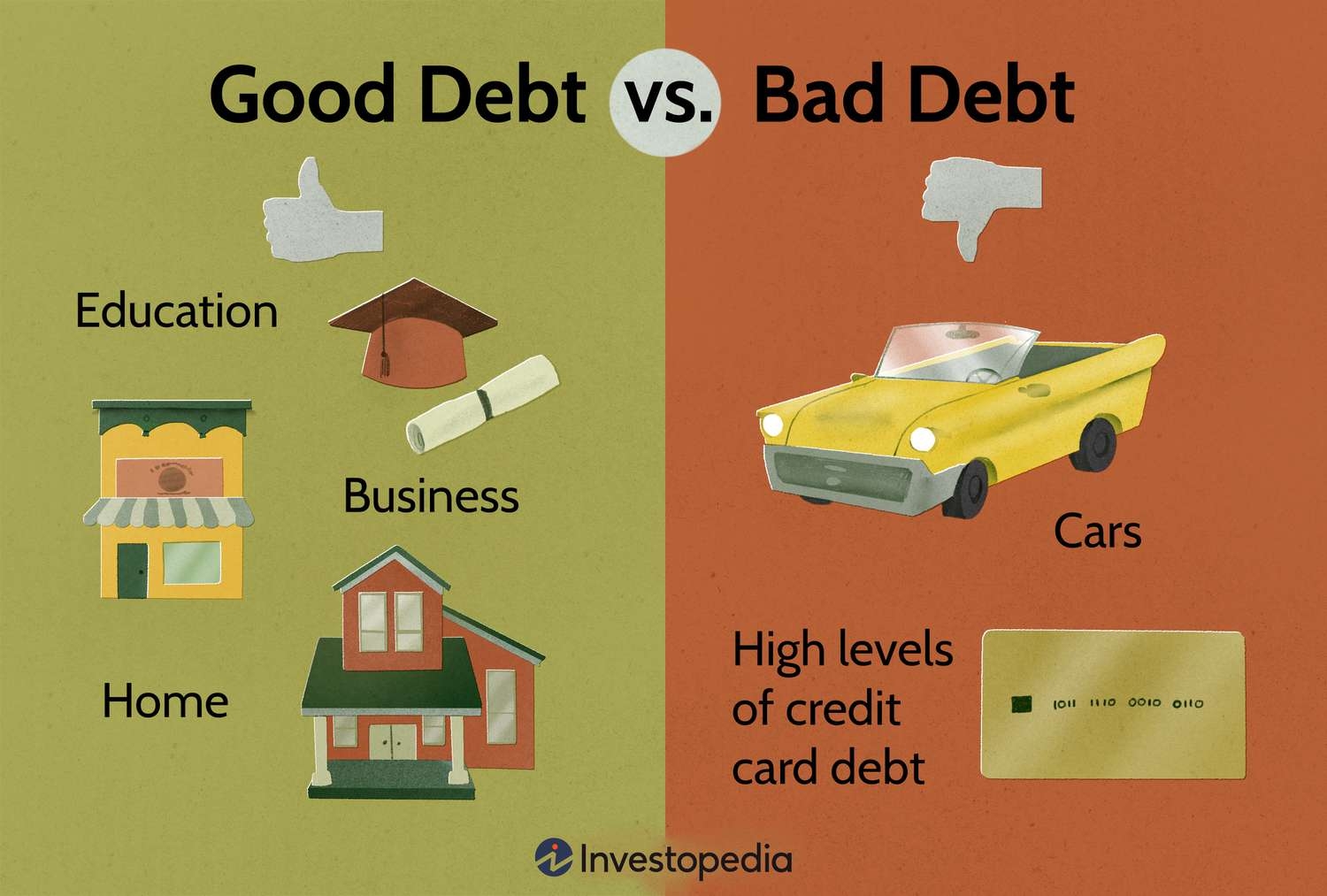

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Unique Financial And Investment Solution

Your Financial Partn... • 8m

*Unique Financial & Investment Solution: A Trusted Partner for Your Financial Future* Unique Financial & Investment Solution is a leading financial services company that has been empowering individuals and businesses to achieve their financial goals

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)