Back

VCGuy

Believe me, it’s not... • 5m

Prestige began in 1955 as a pressure cooker brand. Back then, India’s middle class was small, urban kitchens were basic, and cookware was purely functional. 'Jo biwi se kare pyaar, woh Prestige se kaise kare inkaar?' More than a slogan, it became India’s culinary love story ⤵️ In the 1980s, many Indian households were still wary of pressure cookers due to fear of accidents. Prestige flipped the script. They introduced safety valves, gasket release systems(GRS), and later, pressure indicators → making 'safety' their USP. Cook 'fast and safe'. Trust became Prestige's biggest ingredient. By the late 80s & 90s, Indian kitchens were evolving – and so was Prestige. From pressure cookers, they moved into non-stick cookware, gas stoves & later, a full range of kitchen appliances. TTK Prestige operates at revenues of ₹2,500 Cr but even after 70 years, their growth story seems far from over. Pressure cooker penetration in rural India is low (<35%). CEO Venkatesh Vijayaraghavan is betting on a multi-pronged growth strategy to get to ₹5,000 Cr revenue by FY27⤵️ ⤷ Expanding store footprint by 30% over four years, especially into smaller towns, to tap rising rural consumption. ⤷ Injecting fresh energy via a strategic roadmap built with a global consultant, investing ₹12 Cr to reboot growth. ⤷ Doubling down on premium products, new SKUs, and exports (exports alone aiming for ₹500 Cr by FY27). Rural India drives just 20–25% of small appliance sales, and gas stove penetration is still under 70% despite Ujjwala Yojana. ⏭️With 15–18% of households upgrading to premium & smart cookware, the growth runway is wide open.

Replies (1)

More like this

Recommendations from Medial

VCGuy

Believe me, it’s not... • 10m

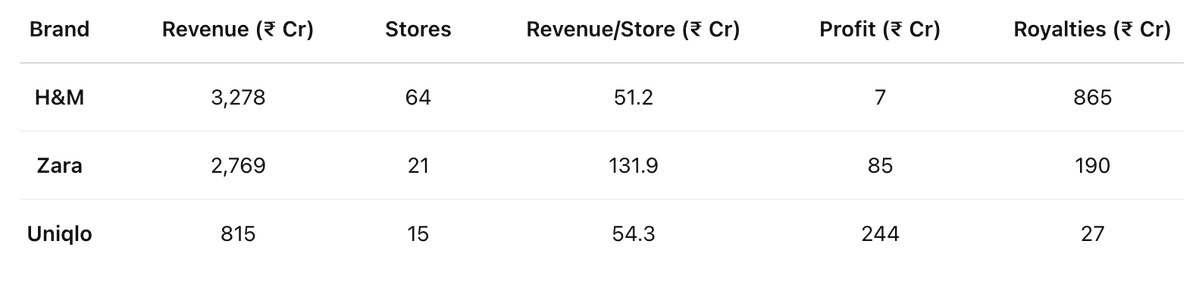

I assumed H&M’s lower price point would translate into healthier profits. H&M may lead in total sales, but it’s shelling out 4.5× what Zara pays in royalties — ₹865 Cr vs Zara’s ₹190 Cr, eating into margins⤵️ (source - Entrackr) From what I’ve seen

See More

Dhandho Marwadi

Welcome to the possi... • 10m

📊 HDFC Securities FY25 Performance Analysis A) Strong Growth Across Core Metrics Operating Revenue jumped 23% YoY to ₹3,264 Cr (vs ₹2,660 Cr in FY24), reflecting a robust uptick in broking, distribution, and retail activity. Operating Profit rose

See MoreMohammad Asaad Sayed

My mind to me a king... • 1y

Consumer’s Preference for LG Air Conditioners in India 🚀 1. Key Drivers of Preference : -Energy Efficiency : Consumers prioritize 5-star ratings for cost savings. -Innovative Features : Dual Inverter, AI Smart Control = premium appeal. -After-Sales

See MoreVCGuy

Believe me, it’s not... • 11m

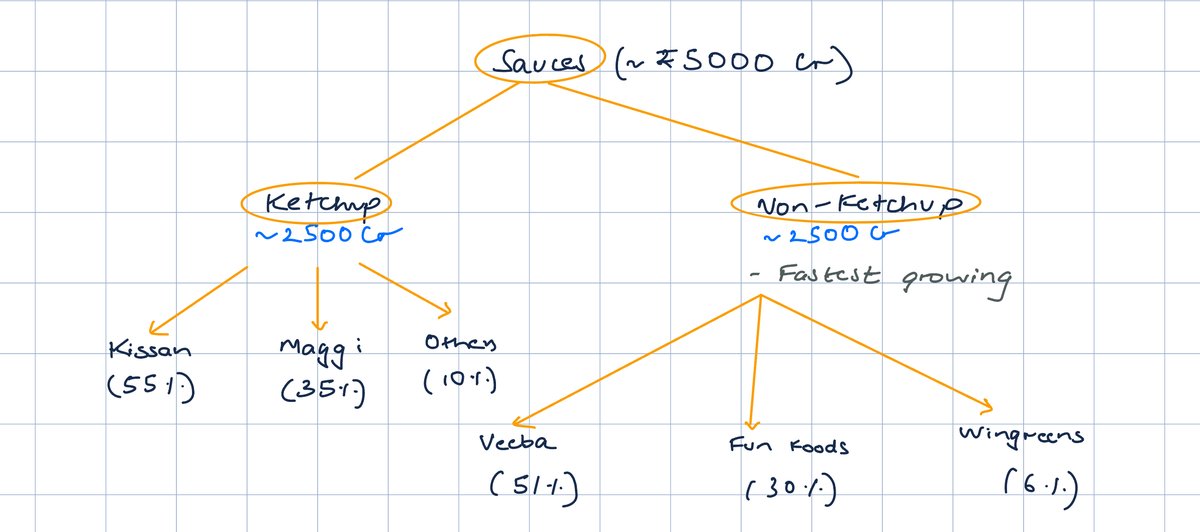

I ordered from Burger King🍔 and noticed the Veeba sauce that comes with it. Didn't know Veeba had a B2B 'Food Service' segment —turns out, this was their first offering. Veeba operates in two verticals - a) B2B 🍽️ → 'Veeba Food Service' (~8-10%

See More

Ankush Sharma

Business Consultant ... • 8m

How Battery Energy Storage Systems Can Boost Rural Economies in India India's rural heartland—home to over 65% of its population—faces a persistent challenge: unreliable electricity. Despite significant rural electrification efforts, issues like pow

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)