Back

Anonymous 1

Hey I am on Medial • 6m

getting a loan is not easy my friend. not everyone is a salaried person or rich with a collateral. and startups take time to generate revenue, so repaying debt is also a hard thing that can kill startup before u even do anything.

Replies (2)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Praveen Kumar

Start now or Regret ... • 1y

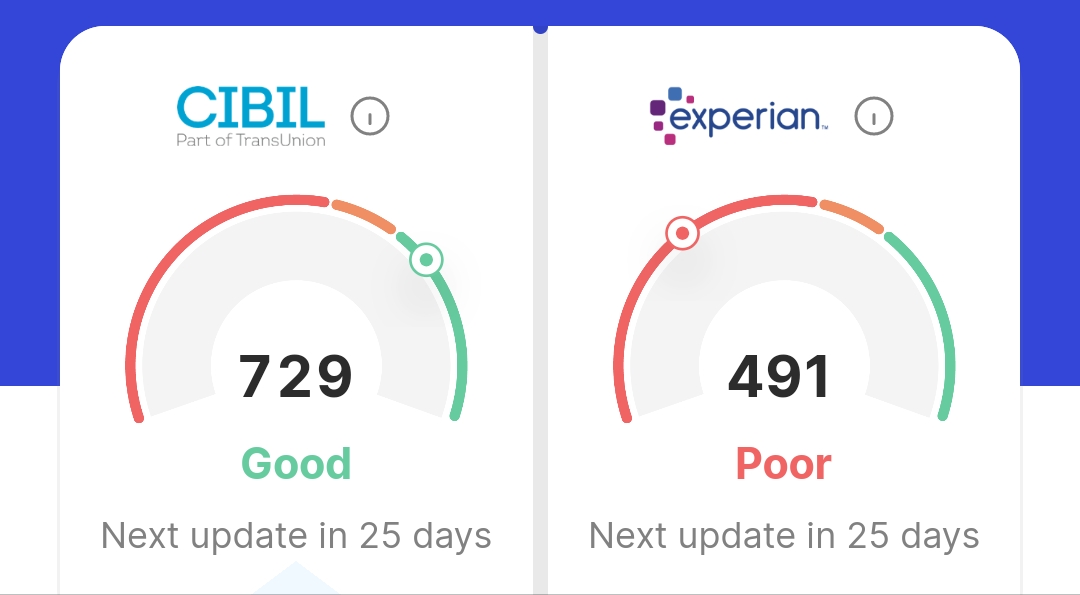

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

srinivasa karthikeya dixith

Passionate about new... • 8m

The Silent Struggles of Salaried Employees: Can Fintech Step In? In a world driven by EMIs, rent, and rising aspirations, salaried employees—especially in urban India—are silently battling with financial mismanagement, stress, and uncertainty. Many

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

How to save Taxes!!! iykiyk -- Part 1. Taking Debt/Loan as funds is best way eliminate taxes than raising Equity shares. as Debt is charged against profits and interest is deducted before imposing tax rate. Also, Be sure that the ROI is higher tha

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)