Back

More like this

Recommendations from Medial

Ramgopal Bagh

Full Stack & Mobile ... • 1m

Came across a site called Mivvo while looking for prep resources. It’s more structured and reading-based (not video-heavy), which makes it decent for quick revision. They’re offering lifetime access for early users, so I thought it might be worth tr

See MoreKarnivesh

Simplifying finance.... • 1m

When I analyse businesses, free cash flow is the metric I trust the most. Profits can look strong on paper, but cash flow shows whether a company can actually fund growth, service debt, and survive tough cycles. What free cash flow quietly tells us:

See Morepreetam yadav

Find Your Space Shar... • 1y

Subject: Fundraising Opportunity for livein - buddy Hi, I hope you’re doing well. I’m Pritam, founder of livein - buddy, a tech startup focused on redefining live-in space sharing. We’re currently in the MVP development stage, and our initial mar

See MoreKarnivesh

Simplifying finance.... • 2m

A realization that changed my perspective: monetary tightening doesn't impact businesses uniformly. The same rate hike helps some while hurting others. 🔸When prices surge, central banks lift borrowing costs to slow spending. Lenders benefit from im

See More

Karnivesh

Simplifying finance.... • 1m

Most investors don’t lose money because they miss data. They lose money because they track the wrong metrics. Every sector runs on a different economic engine. What drives profits in FMCG won’t work for Banking. What works in Banking won’t explain

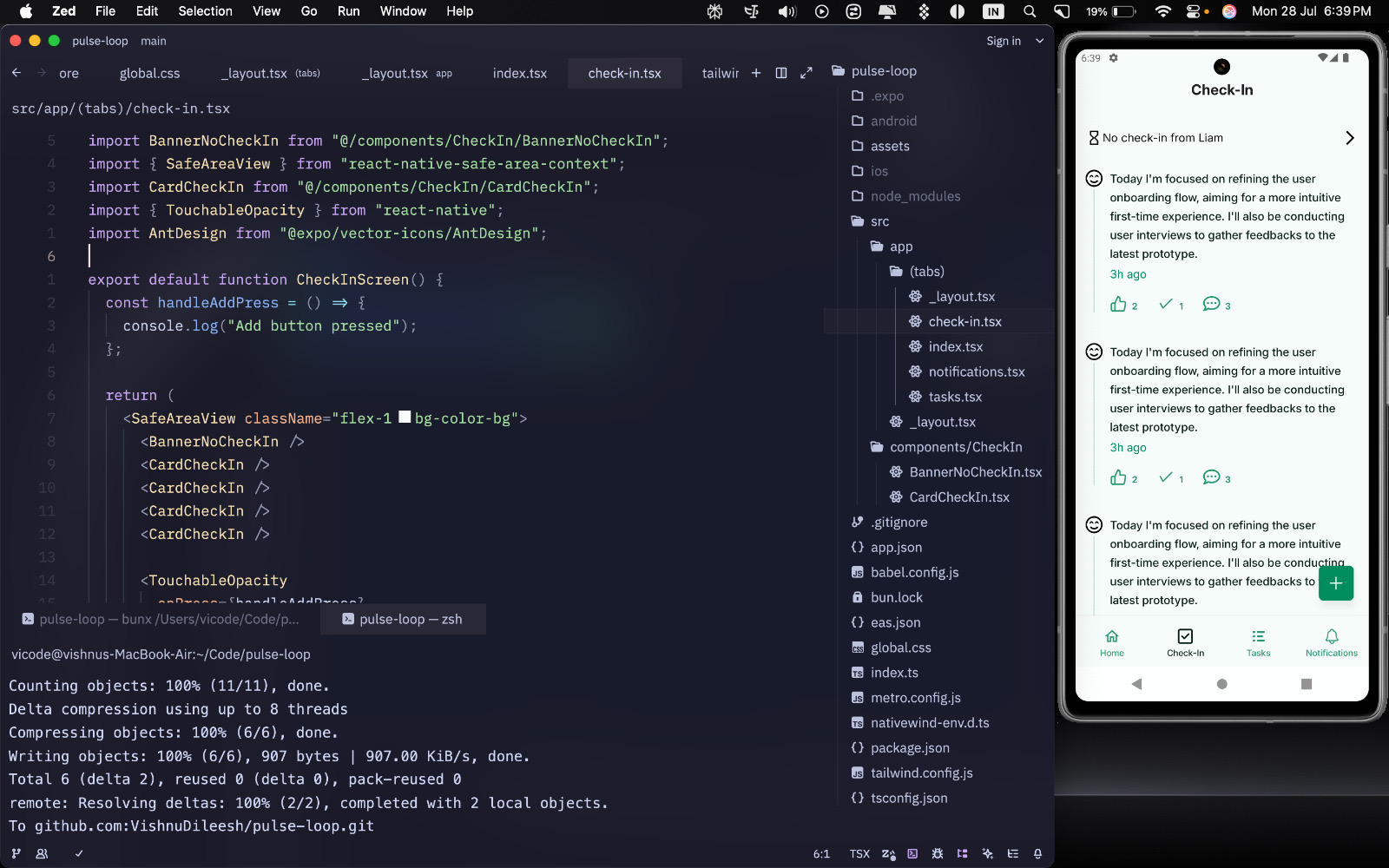

See MoreVishnu Dileesh

Engineer | Entrepren... • 6m

As the saying goes — never chase ideas, chase problems. That’s exactly what led me here. Over the past few weeks, I’ve been thinking about how small startup teams like mine stay in sync. Slack threads get lost. Standups feel forced. Accountability

See More

Only Buziness

Everything about Mar... • 8m

“Fix What Fails: How Data-Driven Tweaks Turn Good Content Into Great Conversions” Data-driven content tweaks are small changes made to headlines, visuals, CTAs, or layout—based on how real users interact with your content. It’s not about guessing—

See MoreAccount Deleted

Hey I am on Medial • 8m

ARR vs MRR vs Cash Flow It’s easy to feel like things are going well when your ARR looks strong. Or when MRR keeps ticking up. But if your bank account is saying otherwise, something's off. Breakdown: 1) ARR shows the big picture. Great for invest

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)