Back

Replies (1)

More like this

Recommendations from Medial

Ashutosh Mishra

Chartered Accountant • 1y

GST Thread 2 What GST brings along with it - 1. Value added tax and no cascading of taxes - GST is only on the value added by the manufacturer and being a value added tax at each stage it avoids double taxation Example - If I purchase plastic fr

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

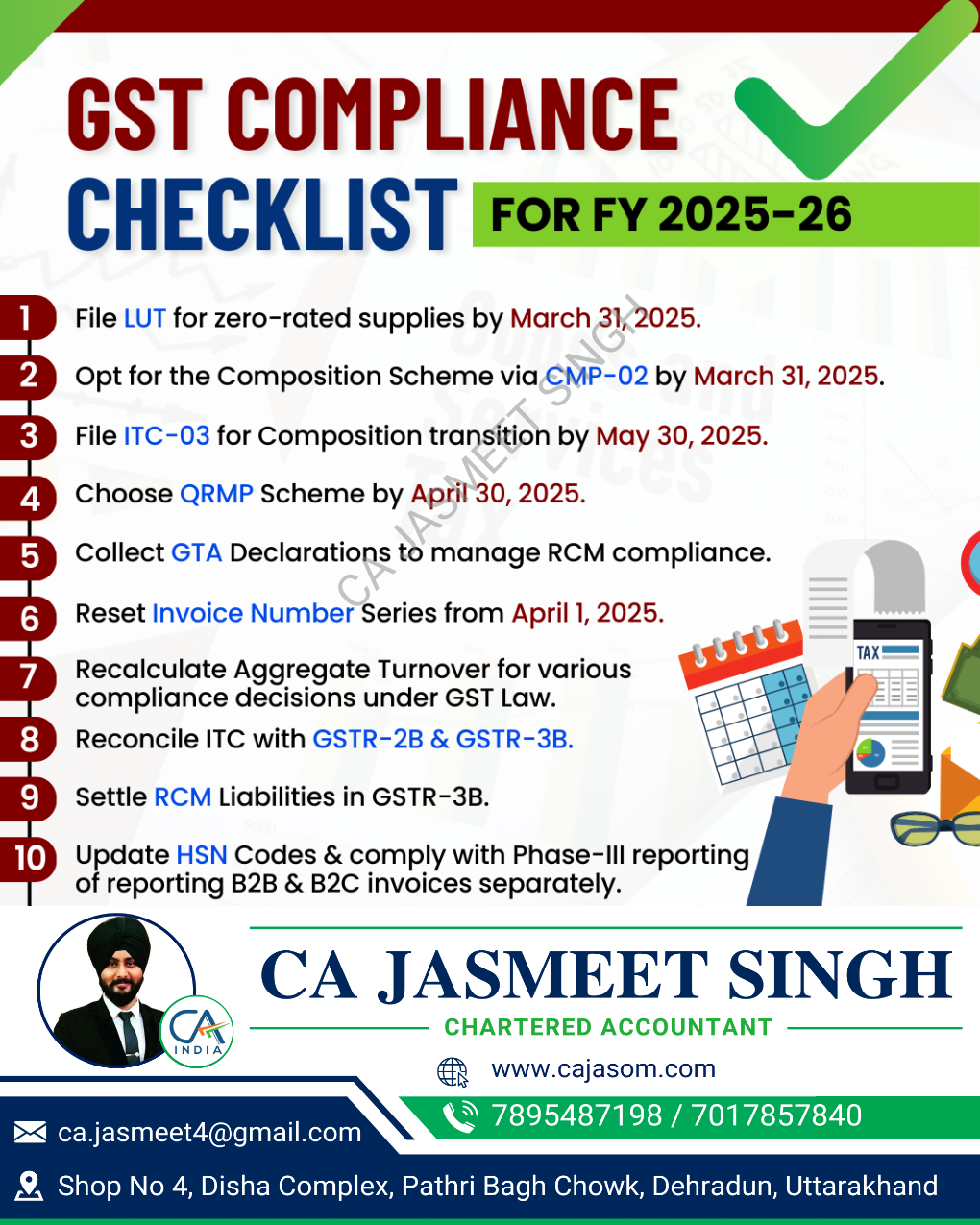

🚀 GST Compliance Checklist for the New Financial Year ✅ A new financial year means a fresh start for your GST compliance! 📆✅ Stay ahead of deadlines, avoid penalties, and ensure smooth tax filings with this essential checklist. 📊💼 🔹 Review GST

See More

CA Jasmeet Singh

In God We Trust, The... • 11m

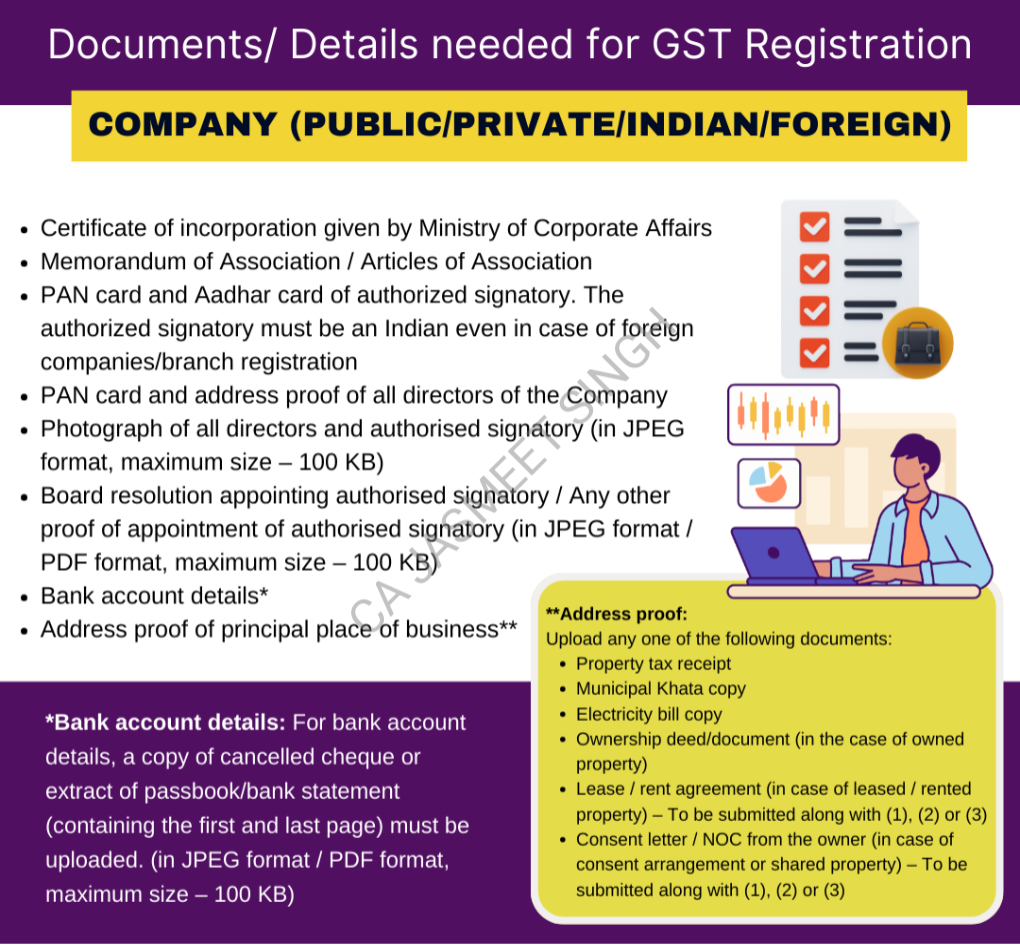

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Premsukh kumawat

Hey I am on Medial • 6m

Proudly sharing Bizrelievo's upcoming launch on July 27th! Your Partner for Seamless Business & Tax Compliance. What is Bizrelievo? It's your dedicated partner for comprehensive business incorporation, meticulous ongoing compliance, and expert in

See More

Deepak Kumar

Founder @erizo.in • 7m

koi CA ya accountant ho toh mere ek sawal ka jawab dijiye maan lijiye amazon par kisi seller ka Rs.100 ka saman sale hota hai aur uski item ki MRP bhi 100 hai jisme 28% GST included hai, amazon sirf delivery fee aur platform fee le sakta hai, amazon

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)