Back

Greg

👤 • 8m

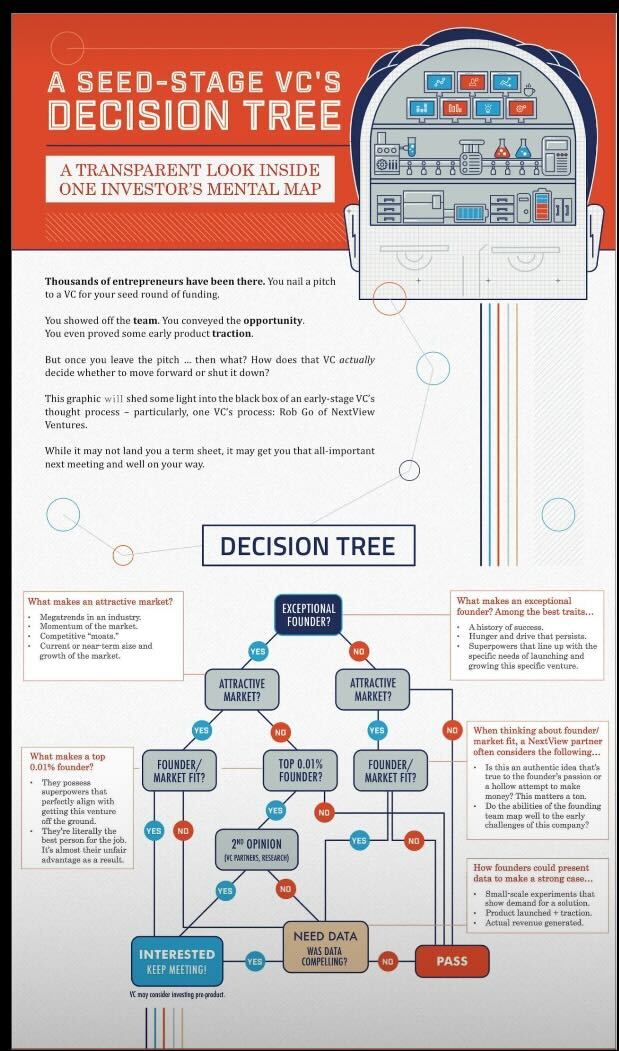

Nah, TAM isn't the sole factor; VCs deeply assess the team, execution, and market fit. "Problems" can include engagement or community building, not just traditional pain points. Those startups were funded on perceived potential or network effects, which sometimes just don't materialize.

Replies (1)

More like this

Recommendations from Medial

DKS Incorporate

Hey I am on Medial • 9m

DKS Incorporate is a trailblazing company specializing in bioplastic (PHA) production, with a focus on medical applications. Market Opportunity The bioplastic market is projected to grow significantly. Competitive Advantage Our proprietary producti

See MoreNishant Mittal

Entrepreneur, musici... • 5m

Groww is going public at a valuation of $9B. The company started in 2017 as a mutual fund platform, and ventured into broking only by 2020. But why? After all, Zerodha launched in 2010. And by 2020, Zerodha was already a ₹1,093Cr revenue company wit

See MoreAnkush Sharma

Business Consultant ... • 4m

Struggling to Secure Funding for Your Startup? Let’s Change That. Turning a great idea into a funded business isn’t just about having potential — it’s about showing investors that you’re ready for growth. Over the years, I’ve helped founders: 💡 Re

See More

The Vc Girl

Not a Vc Yet, just O... • 6m

Uber’s 2008 pitch deck raised $200K pre-product. Let’s break it down with real numbers & founder-level insight. { There were 5 more slides} Slides 1–3:[Problem] → US taxi market: $4.2B (2008). → Key inefficiencies: 40% idle time, zero dispatch opti

See MoreDr Bappa Dittya Saha

We're gonna extinct ... • 11m

Medicine is shifting. Not just in tech adoption, but in its very foundation. From germ theory to complex causation effects. Modern medical practice is struggling to solve it. Multi-system, multi-factor diseases need a holistic, broader approach. B

See More

Vamshi Yadav

•

SucSEED Ventures • 9m

Is Fund-Dredging Really a Market Blame? I have had over 14 such meetings with early-stage founders over the past 70 days. And the refrain is so familiar: "Investors are hibernating." "No one is writing cheques." "We just need ₹5Cr to survive." Here

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 9m

Why Metrics Matter More Than Ideas in VC Funding. 🚀✨️ Be good at your numbers. You’ve got a bold vision and a slick pitch deck. But the moment you step into a VC meeting, the conversation shifts from your idea to your numbers. Why? Because VCs d

See More

VCGuy

Believe me, it’s not... • 1y

A few months ago, @nikhilkamathcio launched India’s first non-dilutive grant for founders 25 and under: WTFund. 1,500+ applications. 160 shortlists. 15 founders. 9 companies. That’s cohort 1. Applications for Cohort 2 are live now, with the deadline

See More

SamCtrlPlusAltMan

•

OpenAI • 7m

🚀 Sequoia Capital’s Pitch Deck Format The 10 slides that could get you funded. In early-stage fundraising, your deck is your weapon. Before the investor hears you, they read you. No meeting = no money. Here’s what Sequoia says you need: 👇 1. Titl

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)