Back

Vamshi Yadav

•

SucSEED Ventures • 9m

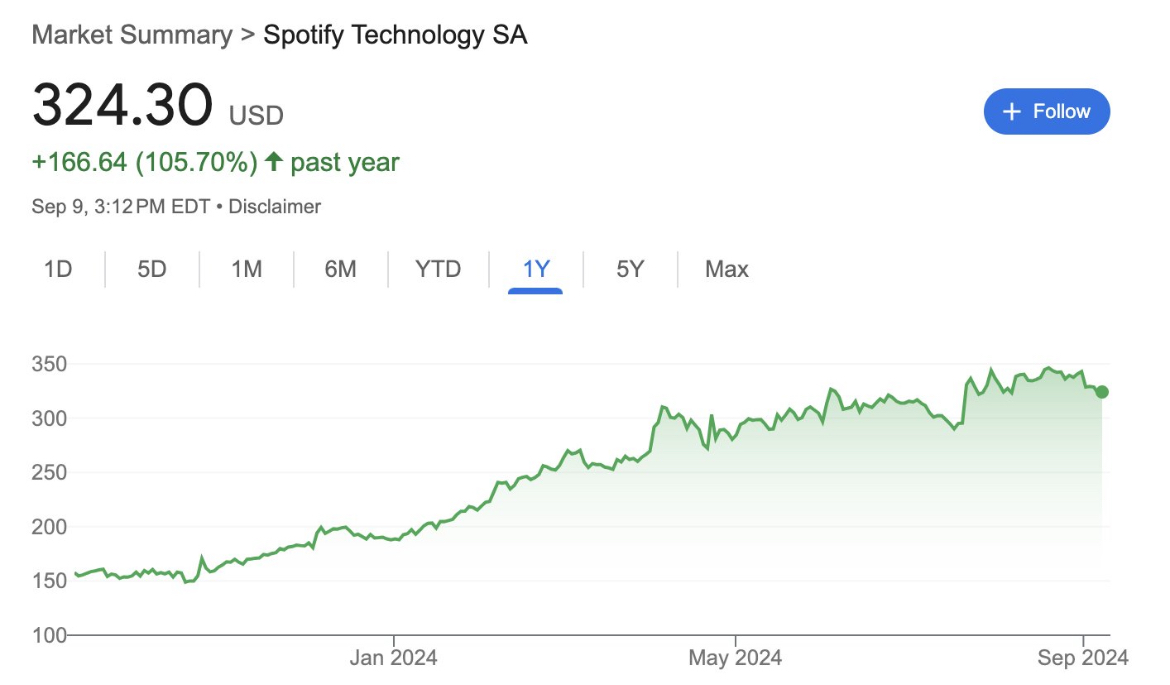

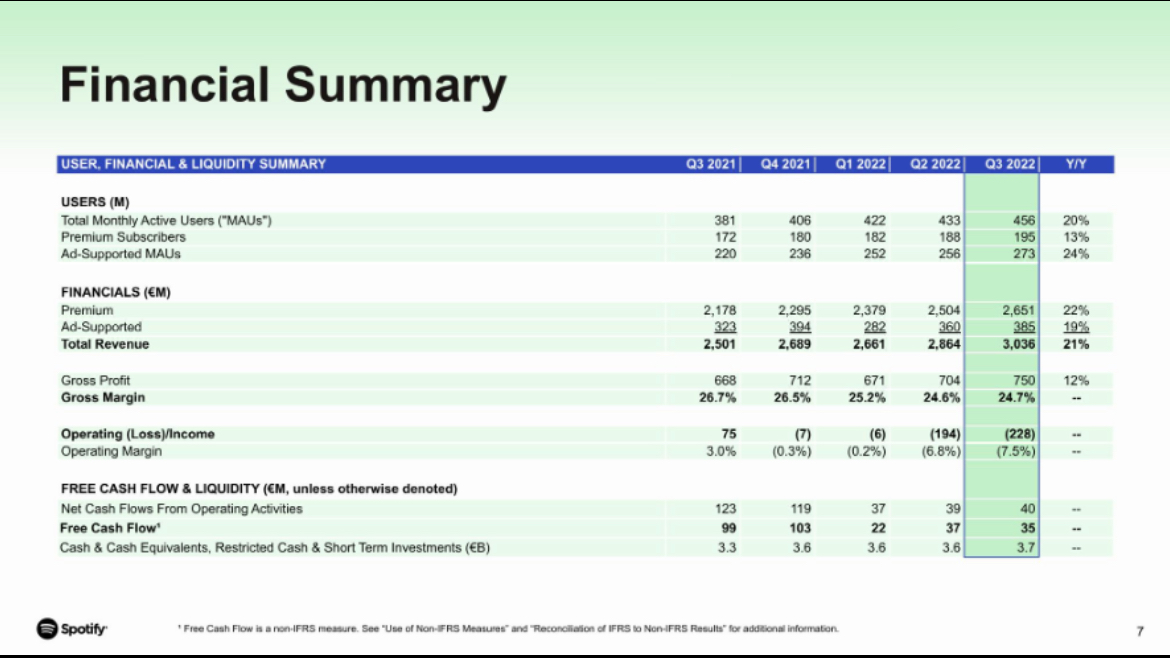

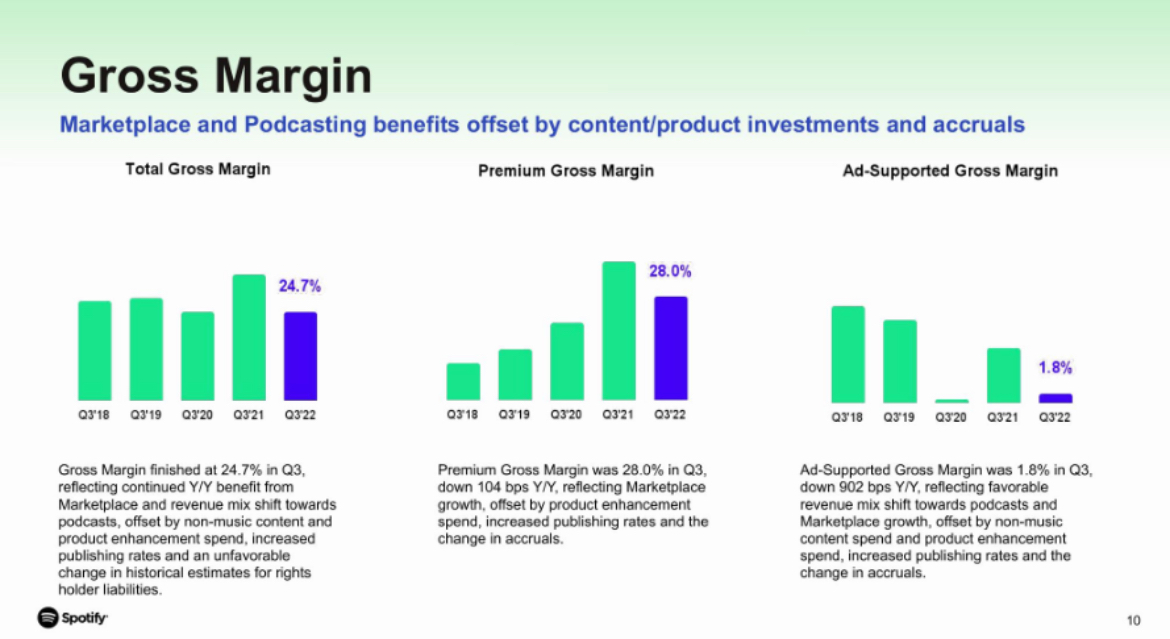

Is Fund-Dredging Really a Market Blame? I have had over 14 such meetings with early-stage founders over the past 70 days. And the refrain is so familiar: "Investors are hibernating." "No one is writing cheques." "We just need ₹5Cr to survive." Here comes an uncomfortable truth: Investors are deploying capital -- but, not to startups that have remained stuck in the dreamscape of 2021. Three Harsh Reasons You Are Having a Hard Time 1. Valuation ≠ Validation Asking for ₹20Cr pre revenue with 100 beta users? That worked when ZIRP was our economy. Today, traction trumps TAM slides. Fix: Earn your valuation. Prove that users don't just like your product; they need it. 2. Pitch-Deck Theater If you spend weeks making fancy animations but only days talking to customers, investors will smell the scent of storytelling over solving from miles away. Fix: Let the numbers talk. If your LTV/CAC is not on slide 3, redo the deck. 3. Trend-chasing instead of Problem-Solving Building an "AI-first Web3 social app for Gen Z pet owners"? New is not necessarily needed. Fix: Solve a hair-on-fire problem you understand deeply. The New Fundability Checklist • Built in broad daylight - Beta? Clock 1,000 paying users first. • Talk to users, not VCs - 50 customer calls > 50 investor meetings. • Show, don't sell - MRR > Vision slides. Fund until market validation is a realistic hope. Let's Fix This Together → Founders: What is your #1 hurdle right now? (Team? Traction? TAM?) → Investors: What makes you swipe left on early-stage pitches? #StartupReality #FounderMindset #RaisingCapital

Replies (8)

More like this

Recommendations from Medial

Jagriti Shreya

•

Predict Growth • 1y

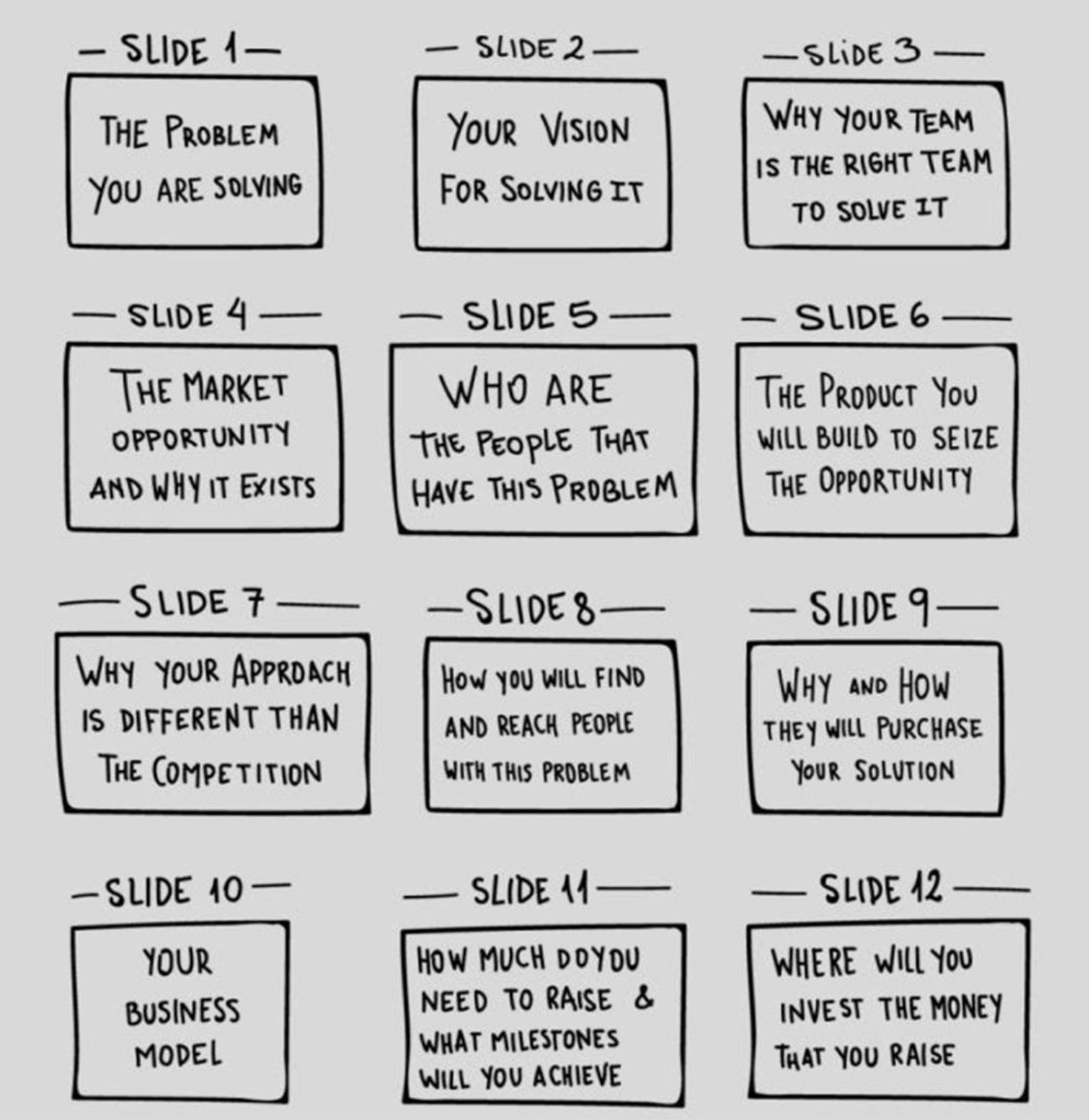

Know the difference between a Teaser Deck & a detailed Pitch Deck - Teaser decks are meant to be self explanatory slides of upto 4-5 slides smoothly but concisely defining your big idea to solve a problem for a market. Add who is on your team too. T

See MoreBhavin Bhagat

Helping Founders to ... • 10m

Over the years, We’ve seen smart business owners lose good deals for simple reasons: - Not telling their story clearly. - Not showing a buyer how the business runs without them. - Missing key slides in their pitch deck. We prepared this to help o

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)