Back

Anonymous 3

Hey I am on Medial • 8m

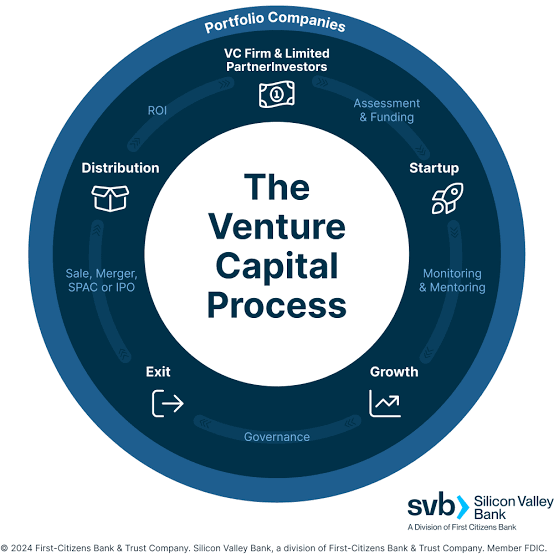

Context matters though. These companies had massive addressable markets and clear unit economics that would work at scale. Today's funding environment is completely different. VCs aren't writing blank checks anymore. The "grow first, profit later" playbook only works if you can actually achieve meaningful scale.

Replies (1)

More like this

Recommendations from Medial

Vivek Joshi

Director & CEO @ Exc... • 7m

Got a great product, team, and traction but VCs are still passing?here are 6 common reasons: * Market Size Too Small: Your concept's proven, but is the total addressable market large enough for VC-level returns (10x+)? VCs seek massive scale, not ju

See More

Vivek Joshi

Director & CEO @ Exc... • 9m

Decoding Unit Economics for Early-Stage Startups Unit economics is your startup’s compass. It tells you if scaling will make you rich—or broke. Here’s how to decode it, step by step: 1. Define a Unit: This could be a customer, order, or subscriptio

See More

Karnivesh

Simplifying finance.... • 1m

I’ve noticed that many startups celebrate users, orders, and revenue before asking the hardest question: does each unit actually make money? That’s what unit economics reveals. Strip away the hype, and it comes down to whether a business earns more

See MoreVivek Joshi

Director & CEO @ Exc... • 7m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Beyond the Buzzwords: India’s Revenue-Making Startups & the VC Lens India’s startup scene isn’t just about hype—it’s about real, revenue-generating ventures ready to scale. Founders who’ve proven product-market fit and built solid revenue engines no

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)