Back

Achint Sachdeva

Accelerating 0-1 pla... • 8m

Go on and create a “No-Business”! The relentless pursuit of hyper-growth often blinds founders to a more liberating path: building what VCs dismissively call a "No-Business." But what if that "No-Business" is precisely where true freedom and sustainable wealth lie? We're conditioned to believe that if you're not chasing unicorn status, you're not truly succeeding. This narrative, perpetuated by the venture capital model, can force founders into unsustainable growth trajectories, diluting equity, sacrificing control, and often leading to burnout. Imagine a different reality: a company generating consistent, healthy cash flows, steadily growing, and funding a comfortable lifestyle for its founder. This isn't about stagnation. It's about intentional, profitable growth. It's about designing a business that serves your life, not the other way around. Think robust SaaS tools with solid retention, niche e-commerce brands with loyal customers, or highly specialized service firms with predictable revenue streams. These businesses often don't fit the exponential, hockey-stick model VCs demand, yet they represent formidable, resilient enterprises. Recognize the power of a "No-Business". It signifies a departure from the "grow at all costs" mentality to a focus on sustainable profitability and founder optionality. Is your definition of success truly your own? hashtag#SustainableBusiness hashtag#FounderFreedom hashtag#Bootstrapped

More like this

Recommendations from Medial

Digant Malviya

Smarter Automation, ... • 5m

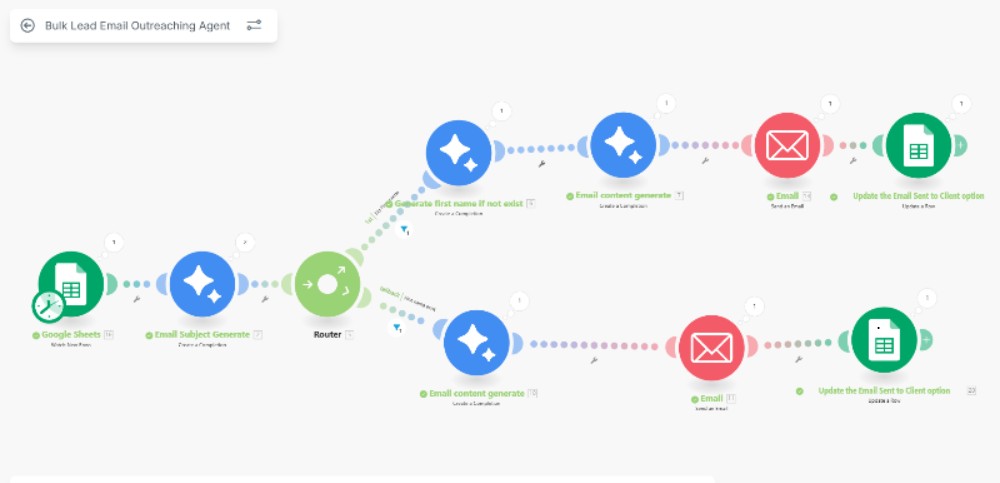

🚀 Just built a new automation with Make.com and AI — a Bulk Lead Email Outreach Agent. It automates the full cold email flow: ✔️ Pulls lead data from Google Sheets ✔️ Generates personalized subject lines ✔️ Extracts first names (with smart fallba

See More

Vikram Yadav

Hey I am on Medial • 1y

🚀 Co-Founder Required for a Growing Automobile Service Startup – 3 Years Strong! To fuel our growth and expansion, I am looking for a Co-Founder to join me on this journey. Who I’m Looking For: Business development, marketing, or operations expertis

See MoreVenture Linkup

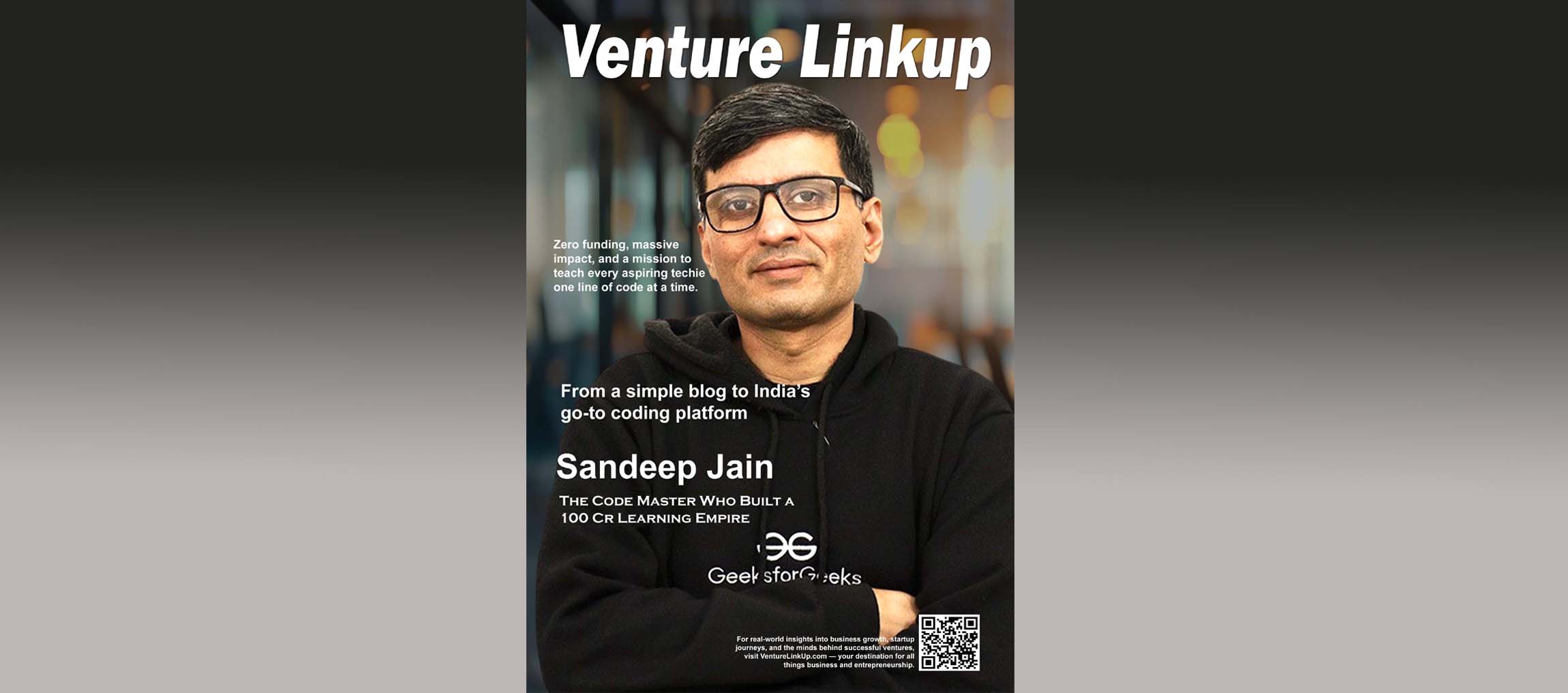

Where Businesses Con... • 9m

Venture Linkup – Founder Files 🚀 From Blog to ₹100 Crore EdTech Giant Meet Sandeep Jain, the IIT Roorkee grad who turned a personal coding struggle into GeeksforGeeks—one of India’s biggest tech learning platforms. No VC funding. No hype. Just solid

See More

Ankush Sharma

Business Consultant ... • 9m

Seeking Visionary Co-Founders for a Bold Consulting Venture I'm building a consulting agency that challenges the status quo—where strategy meets execution, creativity blends with clarity, and bold ideas become business breakthroughs. But no great ven

See More

Vivek Joshi

Director & CEO @ Exc... • 5m

The Direct Comparison Family Offices vs. VCs: The Investor Showdown When you're a startup founder seeking capital, not all money is created equal. While both family offices and institutional VCs provide crucial funding, their impact and approach coul

See More

Vivek Joshi

Director & CEO @ Exc... • 7m

Got a great product, team, and traction but VCs are still passing?here are 6 common reasons: * Market Size Too Small: Your concept's proven, but is the total addressable market large enough for VC-level returns (10x+)? VCs seek massive scale, not ju

See More

sushant gadge

Founder SphereMind T... • 11m

Personal Insight from a Founder’s Desk When I started SphereMind Technologies, I thought success would come from big projects and fancy numbers. But here’s what I’ve learned — Success is built on small, consistent actions: • One message sent with

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)