Back

vishakha Jangir

•

Set2Score • 8m

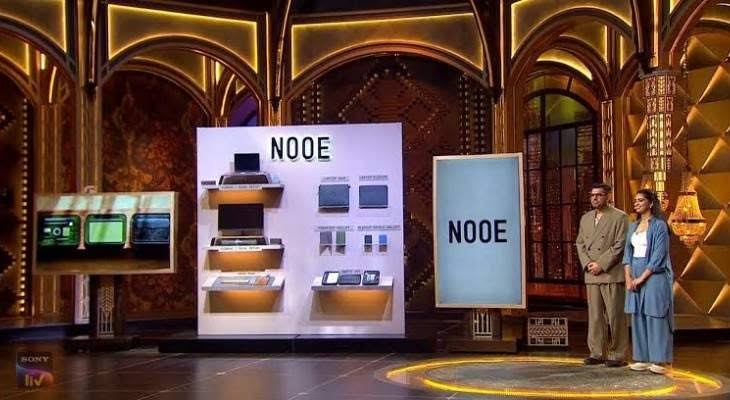

𝗧𝗵𝗶𝘀 𝘀𝘁𝗮𝗿𝘁𝘂𝗽 𝗿𝗲𝗰𝗲𝗶𝘃𝗲𝗱 𝗼𝗻𝗲 𝗼𝗳 𝘁𝗵𝗲 𝗹𝗮𝗿𝗴𝗲𝘀𝘁 𝗶𝗻𝘃𝗲𝘀𝘁𝗺𝗲𝗻𝘁𝘀 𝗼𝗻 𝗦𝗵𝗮𝗿𝗸 𝗧𝗮𝗻𝗸 𝗜𝗻𝗱𝗶𝗮 !! NOOE was founded by Piyush Suri, an engineer formerly with Accenture and Cred, and Neetica Prashant Pande, a Copenhagen-trained industrial designer. The name “NOOE” stands for “Never Odd Or Even,” representing symmetry and balance. They create premium desk accessories, stationery, and lifestyle products with minimalist “Japandi/Scandinavian” aesthetics using eco-friendly materials like Munken paper, oak, walnut, and aluminum. Their flagship product, CONFIG01 Desk Set, was honored with the prestigious Red Dot Design Award in 2022. They currently distribute to over 40 countries and maintain presence in nine premium retail outlets globally, including Harrods in London. In Shark Tank India Season 4, the founders sought ₹50 lakh for a 1% stake, valuing the company at ₹50 crore. Financial performance over recent years: 2022–23 revenue: ₹1.3 crore, with a burn rate of ₹0.5 crore 2023–24 revenue: ₹2.7 crore, burn rate ₹1.4 crore By September 2024, revenue reached ₹1.5 crore; projected ₹6 crore for 2024–25, with an estimated burn of ₹2.5 crore Revenue is split approximately 70% domestic and 30% export, with sales channels divided into 60% B2B, 25% direct (own website), and 15% via marketplaces. The company maintains around ₹2.7 crore worth of inventory, carries ₹1.2 crore in debt, and holds just ₹22 lakh in cash. Gross margins are around 40%, which investors viewed as relatively low for the premium segment. On the show: Sharks Anupam, Vineeta, and Kunal opted out due to concerns over valuation and margins. Aman Gupta made offers starting at ₹3 crore for a 50% stake, then ₹2 crore for 30%. Peyush Bansal eventually invested ₹5 crore for a 51% controlling stake, marking the largest cheque ever on Shark Tank India. Public and community reaction noted: General agreement that NOOE targets a niche, affluent customer base with long-term potential Recognition of the ₹5 crore deal as a record-breaking move in the franchise’s history Key challenges highlighted include margin constraints, high debt levels, lack of a single standout hero product, and pressure on operations and cash flow. Peyush Bansal’s investment is expected to help NOOE refocus strategy, optimize operations, introduce a flagship product, and manage debt effectively. Follow vishakha Jangir for more such insights.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 12m

MobiKwik Acquires 3.39% Stake in Blostem Fintech One MobiKwik Systems is acquiring a 3.39% stake in Blostem Fintech for Rs 1.49 crore as part of the second tranche of a share subscription agreement. Earlier, MobiKwik invested Rs 1.5 crore in March 2

See More

Vishal Kr Mohali

Hey I am on Medial • 6m

Fractal Posts ₹2,765 Cr Revenue in FY25, Turns Profitable Ahead of ₹4,900 Cr IPO AI and data analytics solutions provider Fractal has filed its DRHP with SEBI to raise up to ₹4,900 crore via fresh issue and OFS. The company posted a strong FY25, w

See More

Aarihant Aaryan

Prev- Founder & CEO ... • 1y

Indians hate startups, especially companies that burn money and raise money but the truth is that 99% of Indian businesses don't make money See in India there are only 13M small businesses,88% of them are sole proprietors Out of 13M businesses, 5M

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)