Back

Vamshi Yadav

•

SucSEED Ventures • 9m

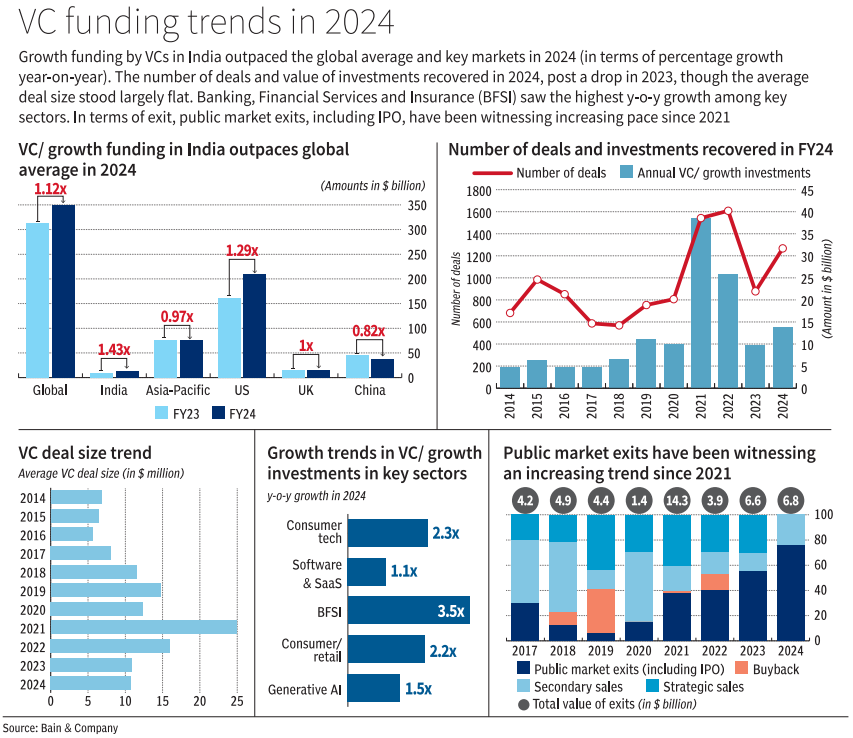

Indian VC ecosystem defies global trends and drives economic transformation While VC is down 9% globally, India reported an annualized 40% growth ($2.52B across 312 deals in Q1 2025), the backbone of innovation power in the country. Now the splittings: • Capital Inflows: Betting On The Rise Of India $350B odd in alternative capital from pensions, SWFs, and family offices. • Leaders in sectors: 60% of funds in consumer tech/SaaS/fintech; climate-and-spacetech deals rose 41-56% • Global pivot: China VC halved to $6B; India, by default, has become the Asian startup hub. Resilience and maturity • 6.2% GDP growth forecast for 2025; the fastest among the major economies • 100+ Unicorns, 159K+ startups (account for 5-7% of GDP), aiming to hit $1 trillion by 2030 • A bit of post-2008 feeling: Startups like Eon Space Labs (spacetech) and Peppermint Robotics (AI) trying to tackle the big problems Flywheel Effect: Capital → Innovation → Exits • $6.8B exits (2024): IPOs (Lenskart) & acquisitions • Vertical integration: Acquiring hospital chains for AI healthcare experimentation (General Catalyst) • Global R&D hub: Tech talent working cost-efficiently for markets in the West Sectoral Rebalancing Digitisation channelled 25-80 per cent growth into funds from traditional sectors (banking, health and manufacturing) • Climate tech: $1.2B for EV and green H2 startups in Q1 2025 • Govt aid: ₹580Cr to 10K+ early ventures through Startup India/SAMRIDH Risks and Opportunities • Regulatory changes: SEBI’s ESG norms, global trade turmoil • AI-native models: Thrive Capital’s $1B fund to reboot legacy firms • AI-native models. A $1 billion fund to revive legacy firms by Thrive Capital • Untapped opportunity: India VC per capita stands at 19 as compared to 325 for the U.S. Why It Matters India's VC boom, rather than merely financing startups, is transforming the entire economy: • Consumer shifts: Hyperlocal (10-minute delivery at Zepto) • Industrial AI: Smart supply chains/manufacturing • Global exports: Homegrown solutions to mature markets The Road Ahead Like late 2008 in Silicon Valley (time of Uber/Airbnb), 2025 in India could become an inflection point for the next 10 years. To build/grow founders/investors: → Work toward sustainable forms → Leverage cost-tech edge → Align with global demand

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 8m

PE/VC Flows in India - Q1 2025 Recap Despite a tough funding environment in #Asia, India’s startup ecosystem showed resilience in early 2025. Indian startups raised around $2.5-3.1B in Q1, up ~8-9% YoY. Deal flow remained healthy, with ~270 deals,

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

The global startup credit market is rapidly evolving beyond traditional VC. In Q4 2024, VC funding hit $120B (4,000 deals), with AI leading. Venture debt surged 46% to $83.4B, now 20–30% of total VC in US/Europe, offering non-dilutive capital for CAP

See More

Vamshi Yadav

•

SucSEED Ventures • 11m

India led global VC growth in 2024, outpacing major markets with 1.43x growth. Investments gained momentum with BFSI (3.5x growth), Consumer Tech (2.3x), and Generative AI (1.5x) attracting the most capital. Public market exits have been rising since

See More

Vamshi Yadav

•

SucSEED Ventures • 11m

Daily Recap- 1) India's Technology Startups Raise $2.5 Billion in Q1 2025: Indian technology startups have raised $2.5 billion in Q1 2025, which is a 13.64% growth from the last quarter. It was driven by late-stage investment and top-performing cate

See MoreAshish Singh

Finding my self 😶�... • 10m

🚀Here are 10 Indian startups likely to have received the highest funding in March 2025, based on Q1 2025 trends: 1. Impetus Technologies - $350M (Enterprise Solutions) 2. Innovaccer - $275M (Health Tech) 3. Zolve - $251M (FinTech) 4. Zepto -

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)