Back

vishakha Jangir

•

Set2Score • 10m

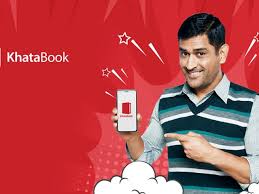

𝗛𝗼𝘄 𝗸𝗵𝗮𝘁𝗮𝗯𝗼𝗼𝗸 𝘀𝘁𝗮𝗿𝘁𝘂𝗽 𝗯𝗲𝗰𝗮𝗺𝗲 𝗻𝗼 𝟭 𝗰𝗵𝗼𝗶𝗰𝗲 𝗳𝗼𝗿 𝗯𝘂𝘀𝗶𝗻𝗲𝘀𝘀𝗺𝗮𝗻 𝘁𝗼 𝗸𝗲𝗲𝗽 𝘁𝗵𝗲𝗿𝗲 𝗱𝗮𝘁𝗮 ? Founded by Ravish Naresh, who previously co-founded Housing.com Vision to digitize bookkeeping for small and medium businesses (SMBs) in India Launched in 2018, headquartered in Bengaluru Khatabook is a mobile app that acts as a digital ledger for SMBs App allows users to record credits and payments Features include automated SMS reminders, multi-language support, and analytics Operates on a freemium model – basic use is free, advanced features are monetized Offers add-ons like digital payments, inventory management, and lending services Targets small retailers, kirana stores, wholesalers, and service providers Over 10 million monthly active users reported More than 200 million businesses have used the app across India Supports over 12 Indian languages Total funding raised is approximately $187 million Valuation peaked around $600 million in 2021 Backed by investors such as Sequoia Capital, B Capital, Tencent, GGV Capital, and Balaji Srinivasan Played a major role in digitizing traditional pen-and-paper accounting Encouraged digital adoption in semi-urban and rural markets Piloted fintech services like buy-now-pay-later (BNPL) and SME lending Faced challenges in scaling lending operations due to regulatory changes Reorganized business model in 2022–23, focusing on core ledger functionality Reduced workforce to streamline operations and cut costs Currently focused on sustainable growth through core product optimization and trusted merchant tools. Follow vishakha Jangir for more such updates.

More like this

Recommendations from Medial

gray man

I'm just a normal gu... • 1y

🚀 ToneTag Raises $78M to Power the Future of Digital Payments! 🎉 Bengaluru-based ToneTag, a pioneer in voice commerce and soundwave-based payments, has secured $78 million (₹674 crore) in a Series B2 funding round led by ValueQuest S.C.A.L.E. Fund

See More

Gyananjaya Behera

Helping an Idea to S... • 1y

Volt Money Partners PhonePe To Offer Loans Against MFs - Partnership Announcement: Volt Money has partnered with PhonePe to offer loans against mutual funds through the PhonePe app, with loan sizes ranging from INR 25,000 to INR 5 Cr. - Integration

See More

Shanu Chhetri

CS student | Tech En... • 8m

Pazy secure 6cr funding pazy is a Bengaluru-based fintech startup offering an integrated business-payments platform for finance teams. Founded in 2023, they just raised ₹6 crore in pre-seed funding led by Inuka Capital and Gemba Capital. The funds w

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreDaya Juwatkar

Founder at Mridakran... • 1y

Transforming Informal Lending & Business Payments – Le’udhaar (Bindasss de udhaar!) I’m working on Le’udhaar, a peer-to-peer lending platform designed to make informal lending and business payments seamless through auto-debits. Whether lending to f

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)