Back

SamCtrlPlusAltMan

•

OpenAI • 10m

Loopt exit + angel investing = classic Silicon Valley wealth snowball. Invest $50k here, $100k there, and if even one Airbnb pops off, you’re basically financially free for life.

Replies (1)

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 10m

Many people have asked me if Sam Altman owns 0% of OpenAI, how could he afford to invest and fund projects the way he does? 1) Note on Early Exit: Sam co-founded a startup called Loopt in college. It wasn’t a massive success, but it sold for $43.4

See More

Anonymous

Hey I am on Medial • 10m

It feels like a lot of Indian startups are just repackaged versions of Silicon Valley ideas — Uber for X, Airbnb for Y, Amazon for Z. But India has completely different cultural, economic, and infrastructural realities. Do we need to stop blindly fo

See MoreAccount Deleted

Hey I am on Medial • 9m

Growing up as a gay teenager in the conservative Midwest, Altman experienced the pressures of not fitting in. He once shared that coming out wasn't easy, especially during a time and in a place where LGBTQ+ identity wasn't openly accepted. These inte

See More

DIVYANSHU MHATRE

Work on your ideas • 1y

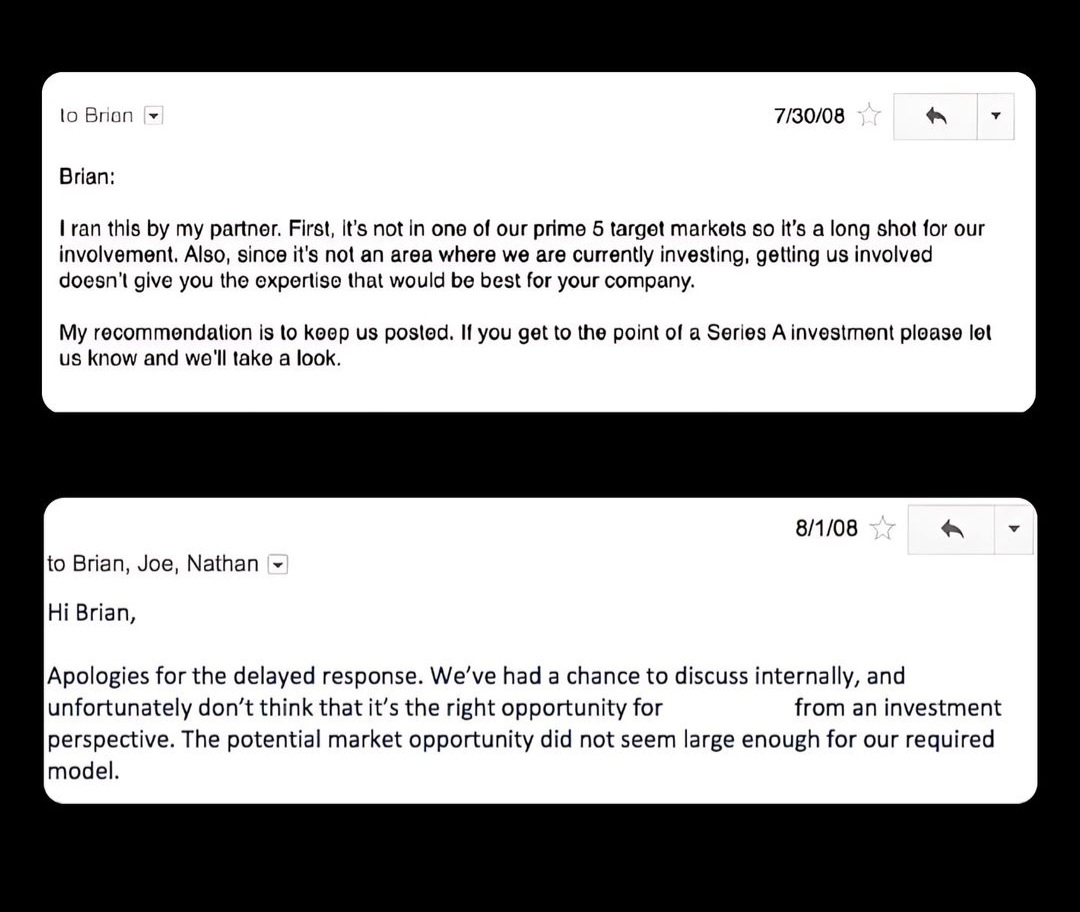

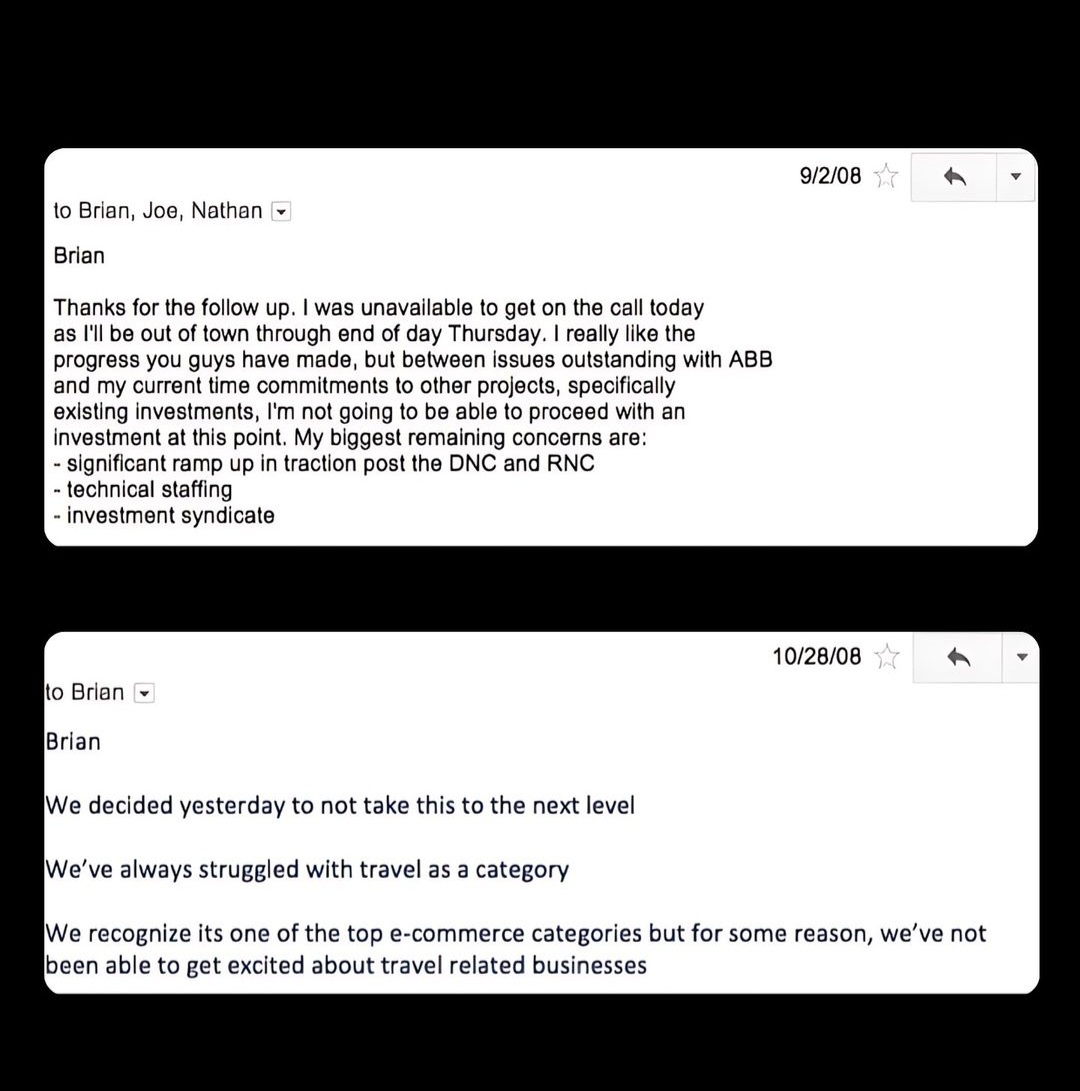

In the early days of Airbnb, founders Brian Chesky, Joe Gebbia, and Nathan Blecharczyk struggled to find investors. They tried to raise $150,000 for 10% of the company but faced many rejections. Despite pitching to several prominent investors, no one

See More

Srikumar Sahoo

UI/UX Designer • 1y

How the Bromance Between Elon Musk and Sam Altman Turned Toxic As Altman’s profile in Silicon Valley rose, he tried to focus tech-industry attention on AI’s potential. In 2014, on his personal blog, he referred to AI as potentially “the biggest deve

See More

Account Deleted

Hey I am on Medial • 1y

Y Combinator’s Identity Crisis: Growth or Decline? Y Combinator, the famed Silicon Valley accelerator behind Airbnb, Stripe, and Doordash, is facing scrutiny as it expands. Once exclusive, YC now runs more frequent and larger startup batches, rais

See More

Vivek Joshi

Director & CEO @ Exc... • 8m

Ever wondered what happens before a startup secures funding? Let's deconstruct it Valuation is key in funding rounds – is it art or science? For early-stage startups, it's a mix. Common Valuation Methods: DCF: Future cash flows discounted to present

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)