Back

Saket Sambhav

•

ADJUVA LEGAL® • 9m

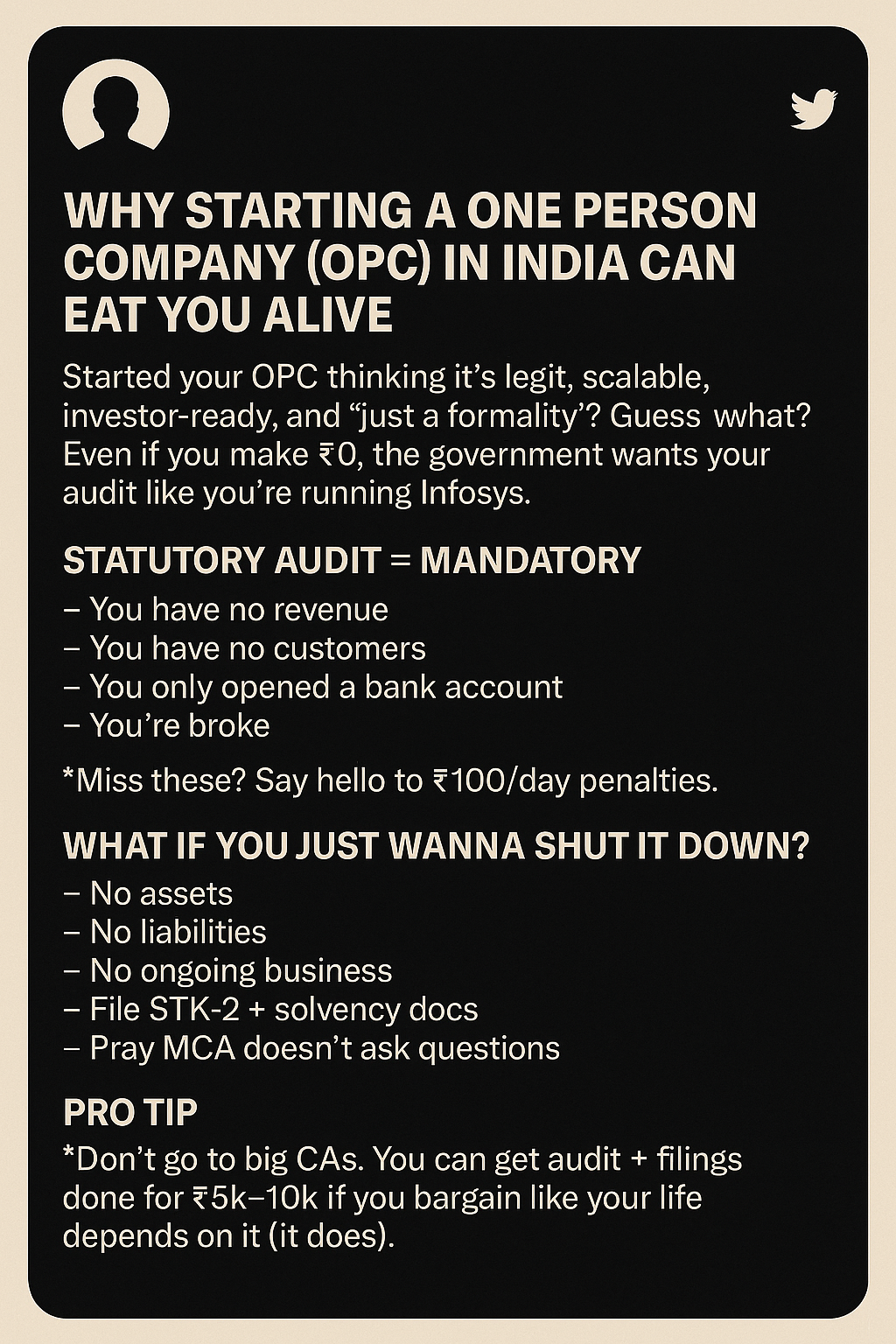

Damn. Some hard truth bombs there. I remember shifting to LLP was a nightmare for us too. The annual reporting, tax, etc. are certainly a distraction from the purpose of business, if you are a small company.

Replies (1)

More like this

Recommendations from Medial

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Why LLP is the Best Way to Launch a Startup? 🚀🚀 Starting a business is an exciting yet challenging journey. Choosing the right legal structure is crucial, as it impacts taxation, liability, compliance, and growth. Among various options, a Limited

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

Why LLP is the Best Way to Launch a Startup? 🚀🚀 Starting a business is an exciting yet challenging journey. Choosing the right legal structure is crucial, as it impacts taxation, liability, compliance, and growth. Among various options, a Limited

See More

Jayant Mundhra

•

Dexter Capital Advisors • 10m

It’s one of those rare instances when AMUL’s top man (Jayen Mehta) has got me a little worried about his plans 🙏🙏 In the last few days, Sir has expressed optimism about what Donald Trump’s reciprocal tariffs mean for Indian dairy exports. He has m

See More

Tarun Suthar

CA Inter | CS Execut... • 4m

DAY 1-Strategy Comes Before Execution 🚀 Clarity Over Chaos - The Foundation of Every Great Startup 🧭 Strategy comes before execution. Because without direction, speed becomes distraction. Most founders begin with excitement - a great idea, a few

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)