Back

IncorpX

Your partner from St... • 9m

🚨 🚨 The Hidden Legal Landmines: Why Startups and Businesses Struggle with Registrations & Compliance🚨 🚨 By IncorpX | Business Consultancy | Startup Advisor Starting a business is exciting, but for many entrepreneurs and even seasoned business owners, navigating the legalities of company formation, registration, and compliance often feels like walking through a minefield blindfolded. From bureaucratic bottlenecks to confusing regulatory landscapes, the challenges are real and costly. Let’s dive into the most pressing legal issues businesses face today and how to manage them proactively. 1️⃣ Choosing the Right Business Structure: LLP, Pvt Ltd, or Sole Proprietorship? For most new entrepreneurs, this is the first and most confusing decision. Each structure has implications for: 💸 Taxation 🛡️ Liability 🗂️ Compliance requirements 📈 Funding potential ❗ Mistake to avoid: Choosing a sole proprietorship for a scalable startup just to avoid initial compliance costs. 2️⃣ The Endless Maze of Registrations Even after incorporation, businesses often fail to register for critical licenses and certifications on time. These include: 🧾 GST registration 🏢 Shops & Establishments Act license 🏭 MSME/Udyam registration 🌐 Import Export Code (IEC) 🧑💼 Professional Tax, PF & ESIC (for teams) ⚠️ Many founders believe company incorporation = complete registration. In reality, it’s only the start. 3️⃣ Compliance Fatigue: Annual Filings, ROC, and More Startups often underestimate the annual compliance burden. Missing deadlines for filing annual returns with the Registrar of Companies (ROC), or failing to maintain proper accounting records, can lead to: 💰 Hefty penalties 🚫 Director disqualification 📌 Common compliance oversights include: ❌ Not filing Form MGT-7 or AOC-4 🔄 Ignoring DIN KYC updates 🤷 Misunderstanding TDS and tax deadlines 4️⃣ IP Protection: Often Ignored, Always Regretted Many startups create unique: 🖼️ Logos 📱 Product names 💻 Technology …but fail to register trademarks or patents, leaving them exposed. ✅ Registering your IP early gives you a competitive edge in: 💼 Fundraising 🔒 Brand protection 💹 Valuation 5️⃣ Employment Laws: The Compliance Most Ignored Hiring without proper contracts, NDAs, or payroll setup can result in: ❓ Unclear job roles ⚖️ Legal disputes 🧾 Government penalties 📃 Even early-stage startups must draft: 📑 Solid employment contracts 🤝 NDAs 🧮 Payroll compliances (EPF, ESI, PT) 6️⃣ Fundraising Legal Readiness Investors care about your legal hygiene. If you haven’t: 📘 Maintained statutory registers 📄 Followed proper share allotment 📝 Filed shareholders' agreements 📊 Updated your cap table 💥 Your deal might collapse during due diligence. ✅ What Can Be Done? Here’s how to stay legally compliant and startup-smart: 🔍 Consult a Startup-Ready Legal Advisor: Choose specialists who understand startup dynamics. 🗓️ Set Compliance Alerts: Use tech tools or professionals to avoid missed filings. 📁 Keep Your Documents Centralized: Make shareholder agreements, ROC filings, PAN/TAN, and GST easily accessible. 💼 Educate Your Team: Founders should grasp basic legal and tax obligations. 💡 Think Ahead: Don’t just aim to survive—set up to scale confidently. 🧠 Final Thoughts Legal compliance may not be glamorous, but it’s foundational. Whether you're a first-time founder or a seasoned entrepreneur, addressing these legalities early: 💸 Saves money 🛡️ Preserves reputation 🔐 Protects your business 📚 Invest in legal literacy—it’s one of the smartest decisions your startup can make. 🔗 If you're a founder needing clarity or legal support, feel free to connect or drop us a message. Let’s build businesses that last. 💼🚀

More like this

Recommendations from Medial

Charchit Vishwakarma

Startup enthusiast w... • 11m

🚀 Hello Startup Founders! Need Help with Legal & Compliance? 🚀 Hi everyone, I’m Charchit Vishwakarma q, a Company Secretary (CS) student passionate about helping startups with their legal, compliance, and business setup needs. ✅ Need guidance on

See MoreVAIBHAV MISHRA

founder in making • 5m

Founders – Compliance Deadlines Ahead! Annual filings don’t have to be stressful. Join a live session by CA Priya Darisini Sukumar (Founder & CEO, Ploughback) on: The Founder’s Guide to Annual Filings Date: Sep 10th 2025 Time: 5:30PM to 6:30PM Zoom

See More

CA Jasmeet Singh

In God We Trust, The... • 11m

Free Consultation From your CA Friend for your Startups. 🌸 Holi Special Offer from Your Trusted CA! 🌸 This Holi, let’s clear not just the colors but also your compliance worries! 🎨✨ I am offering a FREE Business Compliance Consultation until Su

See MoreHatchLegal

You Build the Dream,... • 1y

Early-stage founders and entrepreneurs, we’re here to help you focus on building your businesses while we handle the legal complexities. At Hatch Legal, we offer a one-stop solution for all your legal needs, from business registration and trademark p

See MoreSaurabh Mishra

Building a tech gian... • 8m

🚀 Now offering complete Tax, Compliance & Bookkeeping Services for Startups, Freelancers & Small Businesses! ✅ Income Tax Return (ITR) Filing ✅ GST Registration & Returns ✅ ROC/MCA Compliance ✅ Bookkeeping & Monthly Accounting ✅ MSME, Startup India

See MoreCA Jasmeet Singh

In God We Trust, The... • 11m

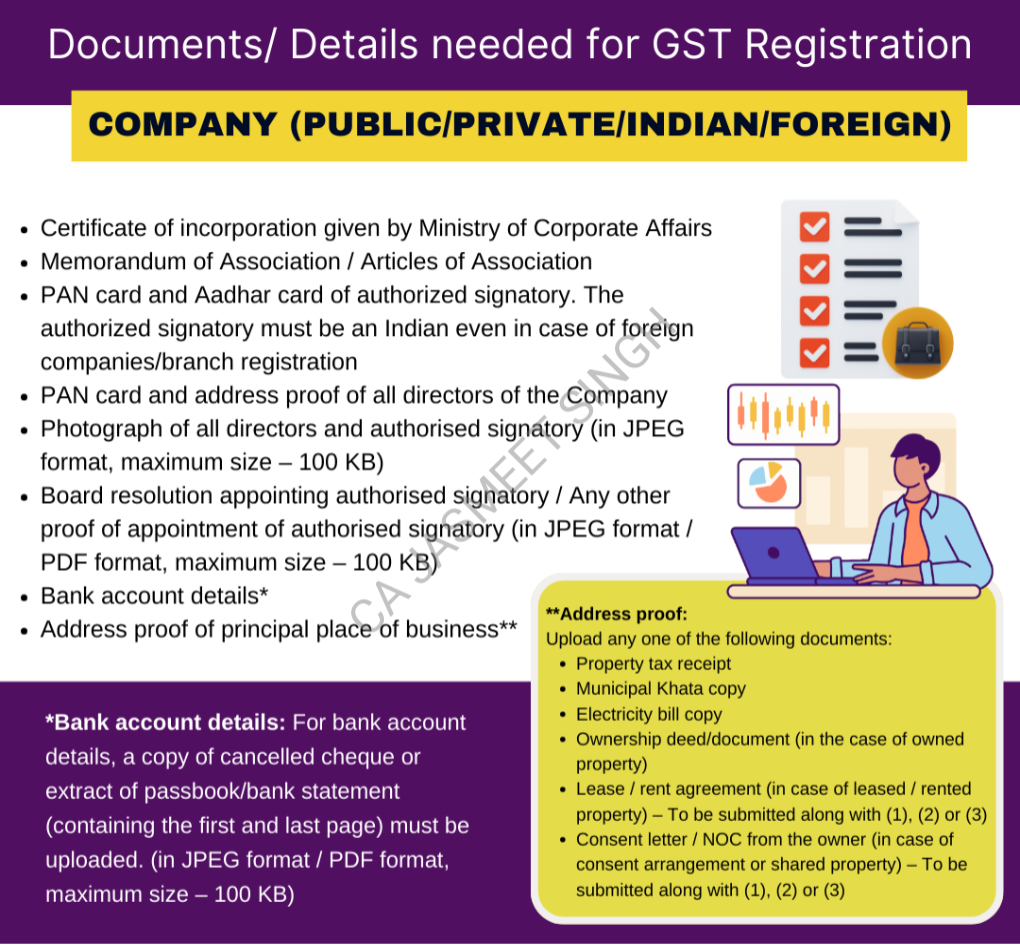

📢 GST Registration for Companies – Everything You Need to Know! 🚀 Starting a company? One of the first legal steps is getting GST registration! ✅ It not only gives your business a legal identity but also opens doors to seamless tax compliance, inp

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)