Back

Anonymous 2

Hey I am on Medial • 10m

Who would’ve thought a ₹25 chai payment via QR could trigger digital adoption faster than Aadhaar-linked accounts? UPI normalized fintech for the streets before it did for the suits.

Replies (1)

More like this

Recommendations from Medial

Gyananjaya Behera

Helping an Idea to S... • 1y

UPI Transactions Jump 5% MoM In May To 1,404 Cr Monthly Growth: UPI transactions rose 5% month-on-month in May to 14.04 billion, with transaction volume increasing 4.1% to INR 20.45 lakh crore. Yearly Growth: Year-on-year, transaction count surged

See More

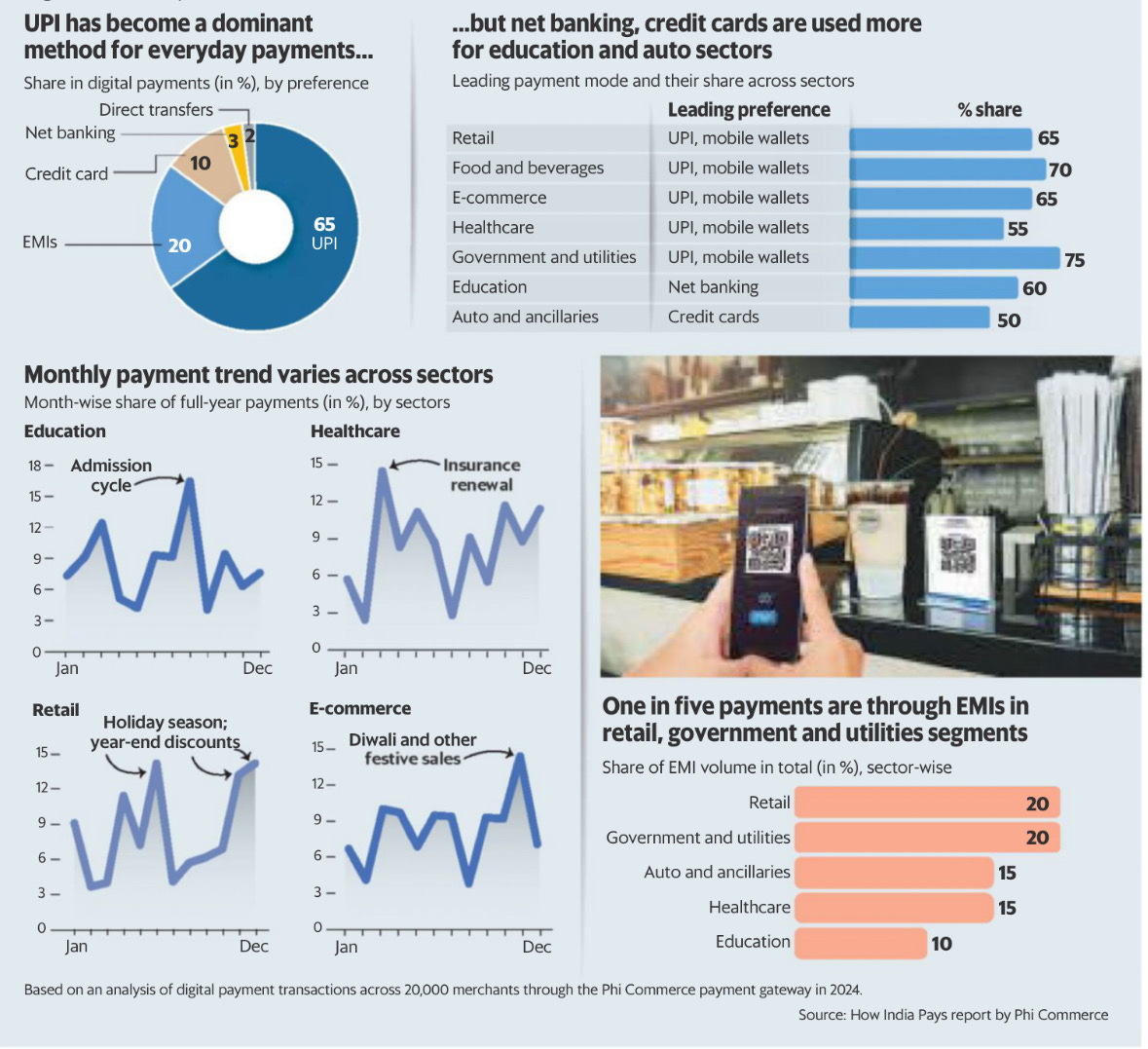

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreVikas Chokkar

Chief Technical Offi... • 9m

🚨 Shocking UK #Drug Trade Exposed! *QR code* stickers with cannabis leaves are popping up on streets, from London to small towns, leading to slick websites selling weed vapes, gummies & more. Linked to Lithuanian nationals, these sites use Royal Mai

See More

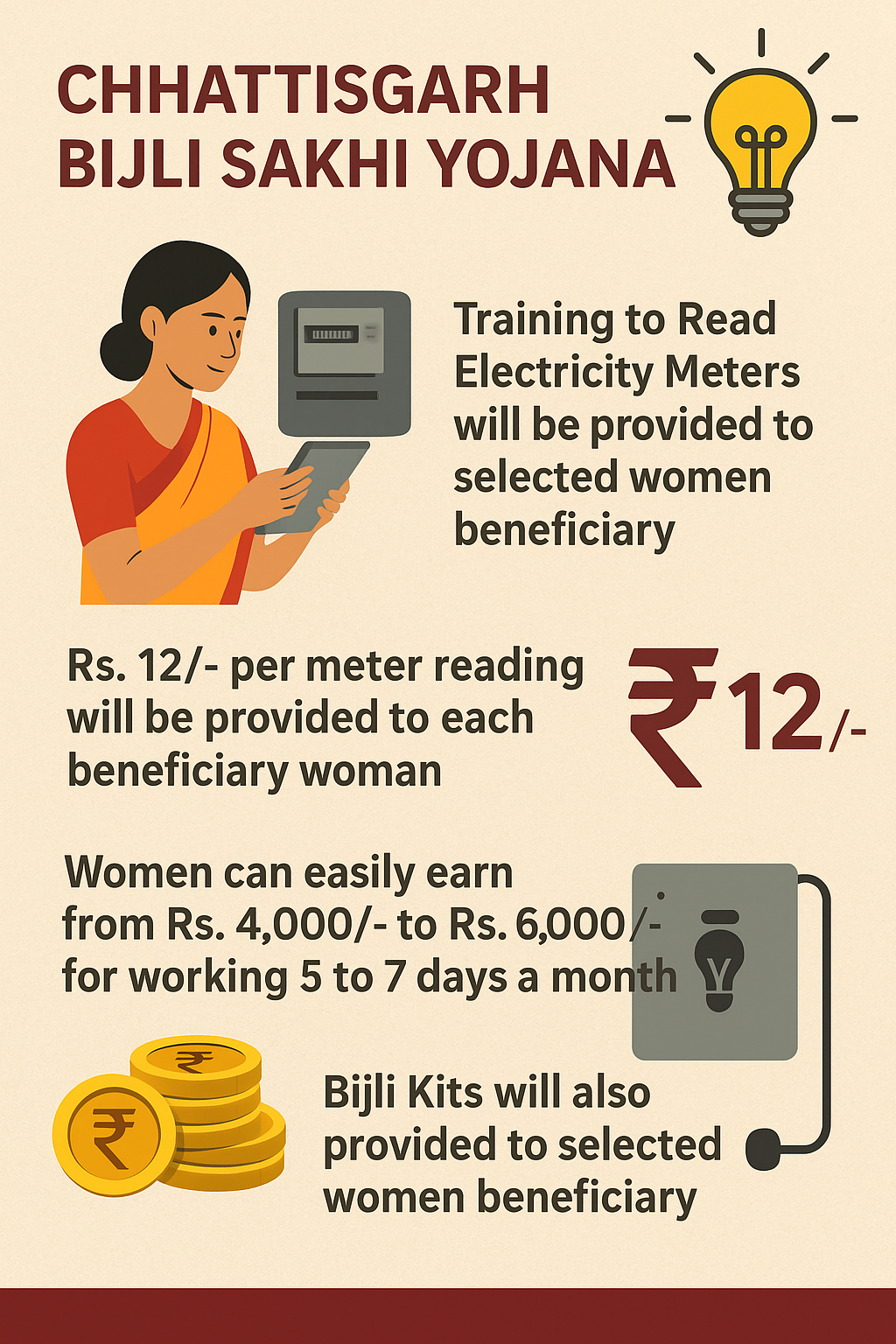

Government Schemes Updates

We provide updates o... • 3m

Chhattisgarh Government Lights the Way for Women – Bijli Sakhi Yojana With the launch of the Bijli Sakhi Yojana, the Chhattisgarh Government is creating new income avenues for women Self Help Group members. Each woman trained under this program beco

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)