Back

mg

mysterious guy • 10m

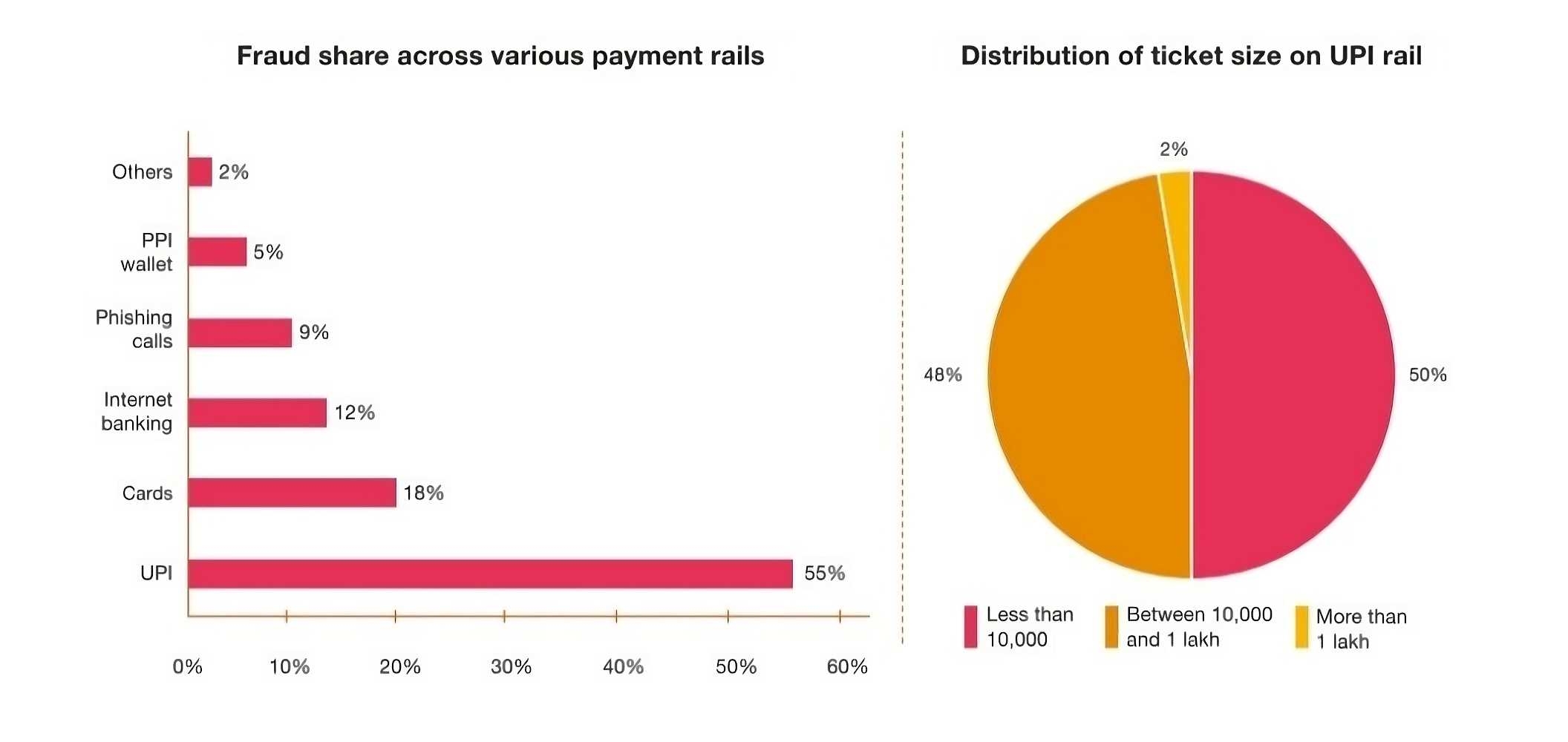

IPL Betting Surge Puts Pressure on Indian Banks as UPI Transactions Skyrocket to Trillions

Replies (2)

More like this

Recommendations from Medial

Rohan Saha

Founder - Burn Inves... • 7m

Indian banks had a strong run in FY25 with profits touching new highs public sector banks made over 1.78 lakh crore in profits and SBI alone made up nearly 40% of that. But things are starting to slow down loan growth was the weakest in four years a

See MoreDr Sarun George Sunny

The Way I See It • 6m

The National Payments Corporation of India (NPCI) is developing UPI 3.0, an upgrade to its UPI that will enable payments through smart devices. The new system will be Internet of Things (loT) -enabled, allowing automated transactions via devices such

See More

Account Deleted

Hey I am on Medial • 1y

NPCI, the name behind UPI & RuPay, plans to take its brand recognition to new heights in 2025! 🚀 Key updates: 📍 Big push for rural UPI adoption with Pankaj Tripathi as ambassador 💳 RuPay gears up to challenge global giants 📺 IPL sponsorship & di

See More

Account Deleted

Hey I am on Medial • 1y

Google Pay now charges 0.5% to 1% (plus GST) for bill payments made via credit and debit cards, while UPI bank transfers remain free. Competitors like PhonePe and Paytm also charge similar fees. Fintech firms face high UPI processing costs, totaling

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)