Back

NaamCheen

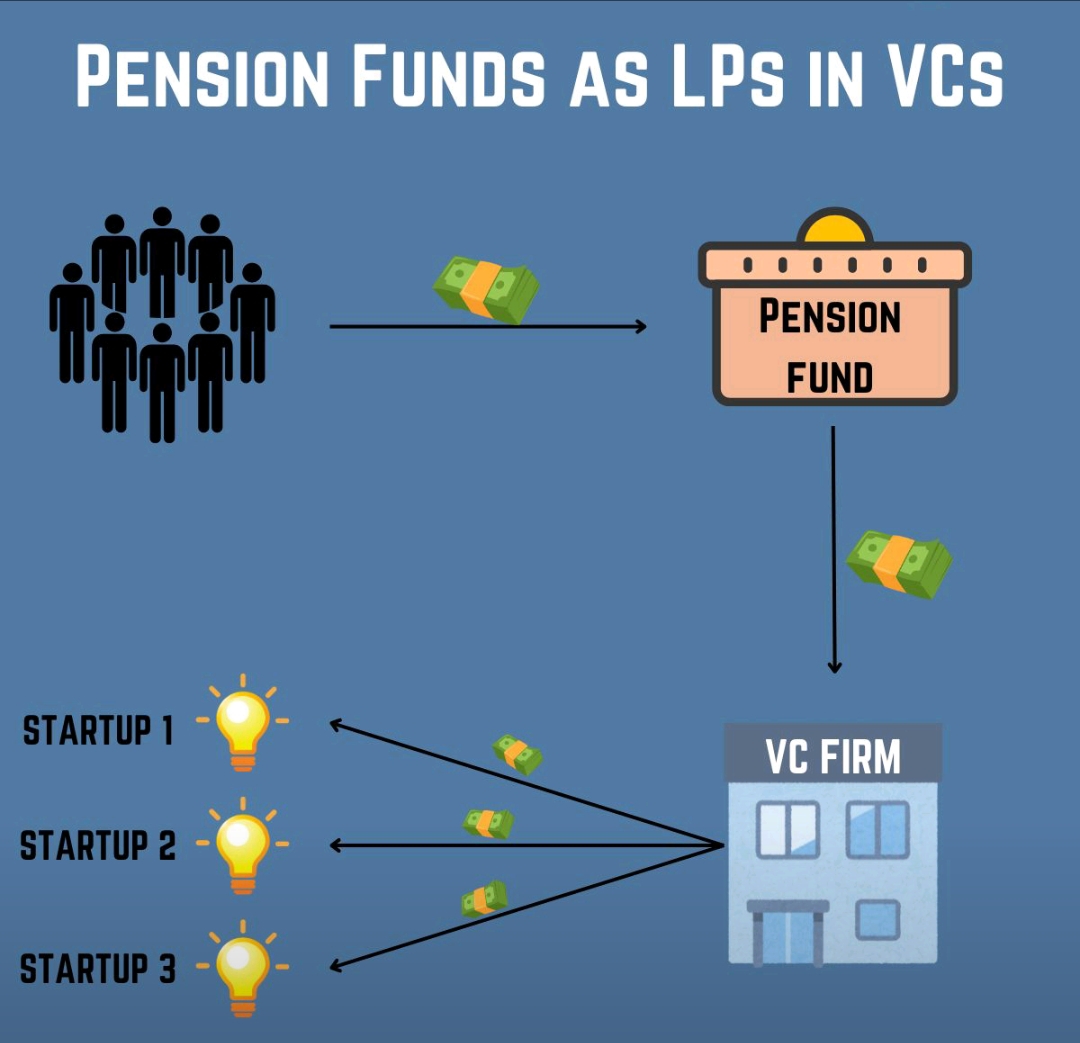

Never settle • 10m

Venture capitalists (VCs) typically get their funds from a group of investors known as Limited Partners (LPs). Here's a breakdown of the structure: 1. Limited Partners (LPs) These are the people or institutions who invest money into a VC fund. They include: Pension funds Endowments and foundations Family offices High-net-worth individuals Insurance companies Corporations Sovereign wealth funds 2. General Partners (GPs) These are the people who manage the VC fund. They decide: Which startups to invest in How much to invest When to exit an investment 3. VC Fund Structure LPs give money to the VC fund (typically locked in for 7–10 years). GPs manage and invest that money into startups. Profits from successful exits are shared: usually 80% to LPs and 20% to GPs (called "carried interest"). ----------------------------------------------- +-----------------------+ | Limited Partners | |-----------------------| | - Pension Funds | | - Endowments | | - Family Offices | | - HNW Individuals | | - Corporations | +----------+------------+ | | Capital (e.g., $100M) v +-----------------------+ | VC Fund (Managed by | | General Partners) | |-----------------------| | - Finds Startups | | - Invests Capital | | - Manages Portfolio | +----------+------------+ | | Investment (e.g., $1M-$10M) v +-----------------------+ | Startups | |-----------------------| | - Build Products | | - Scale Companies | | - Aim for Exit | +----------+------------+ | | Exit (e.g., IPO/Acquisition) v +-----------------------+ | Profits Returned | |-----------------------| | 80% to LPs | | 20% Carried Interest | | to GPs | +-----------------------+

More like this

Recommendations from Medial

Vamshi Yadav

•

SucSEED Ventures • 10m

VCs are exiting their funds at an increasing pace. The "Great GP Exit" is in full swing. More & more GPs are leaving big-name firms to build their ventures. And honestly? It’s not hard to see why. Here’s what’s driving the shift: 1. LPs Want Focus

See MoreAdithya Pappala

Busy in creating typ... • 1y

#9TDAYVC-DAY-2 😳Only 21 Indian VC Firms are there in 2013 So, Today’s VC topics are: 🎯Who Invests in Venture Capital? 🎯Definition & Difference between Private Equity & Venture Capital? 🎯Investors-VC also raises, We also raise but the di

See MoreVivek Joshi

Director & CEO @ Exc... • 8m

Venture Capital (VC) is a vital funding source for high-growth startups, typically those too risky for traditional bank loans. VCs pool capital from Limited Partners (LPs) to invest in promising early-stage companies with significant scaling potentia

See More

Adithya Pappala

•

Hustle Fund • 4m

You don’t need this to be a VC! -IIT or Ivy degree -MAANG Resume -Nor Altman or Elon Musk's brother At 19,I broke into VC.Was part of VC Lab & after evaluating 80+fund decks globally Here’s the truth:it boils down to three core skills. 1.Abilit

See MoreSWAYAM DAS

Hey I am on Medial • 1y

Mutual Fund Maestro Slogan: "Your guide to navigating the world of mutual funds." Description: Mutual Fund Maestro is a comprehensive platform dedicated to helping investors understand, research, and invest in mutual funds. It provides a one-stop-sho

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)