Back

Anonymous 1

Hey I am on Medial • 10m

someone said it. Indian VCs want US-style exits but play like SBI loan officers. You can’t 100x your fund by only backing “mature” ideas with 3-month revenue.

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 2m

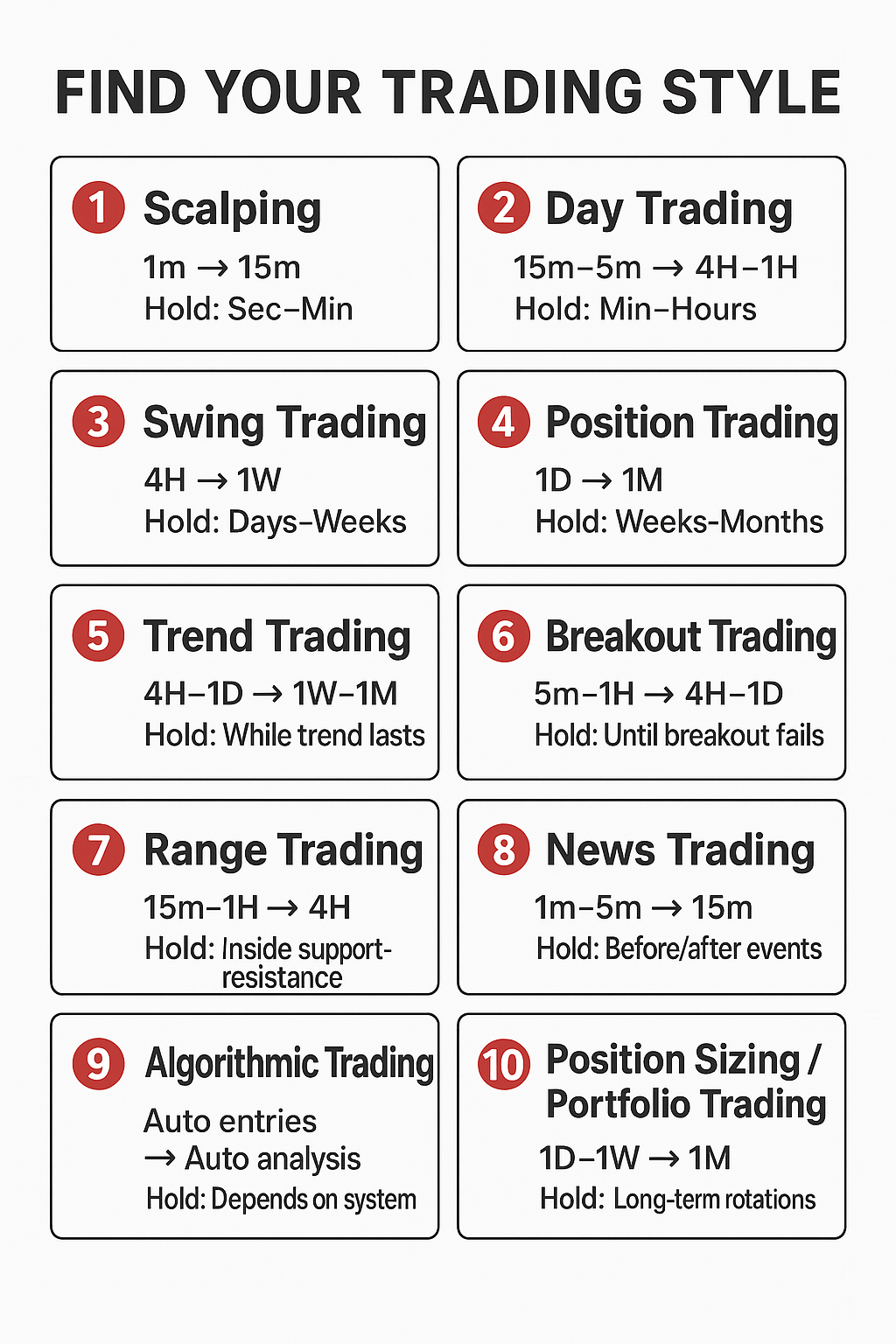

FIND YOUR TRADING STYLE IN 15 SECONDS! 🔥 Not every trader is the same — and that’s your superpower. Swipe 👉 to discover which style fits YOU! 📌 Scalper? Fast entries, fast exits. 📌 Day Trader? Ride intraday trends. 📌 Swing Trader? Catch multi-da

See More

Ayush

Let's build together... • 11m

Was talking to a founder few days back. Had a healthy talk and there was a line that deeply resonated in me - "VCs don’t fund ideas. They fund inevitabilities. Make your startup something the world can’t ignore." Niket Raj Dwivedi, you are the bes

See MoreAditya Arora

•

Faad Network • 8m

We turn ten years old. 🎂 What started as a one-stop shop to help entrepreneurs became a 300 CR early-stage fund backing some high-quality startups and promising founders. 💵 The journey was not easy - we had no fixed office for nine months and not

See More

Ankush Sharma

Business Consultant ... • 8m

If your business is performing well, forget fundraising. Here’s the thing: Venture Capital is not looking for good to great companies. They're looking for outliers. We're talking: → 100x–1000x potential → Category creators → Can this become a mo

See MoreGargi Jain

Cloud | DevOps | Ill... • 1y

What's the best way to explain my Dad - Mutual Funds is better option than FD and MF gives higher returns. His statement is that "it is risky and might have to bare the loss sometimes and can't remove the cash whenever required (has lock in period)

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)