Back

More like this

Recommendations from Medial

financialnews

Founder And CEO Of F... • 1y

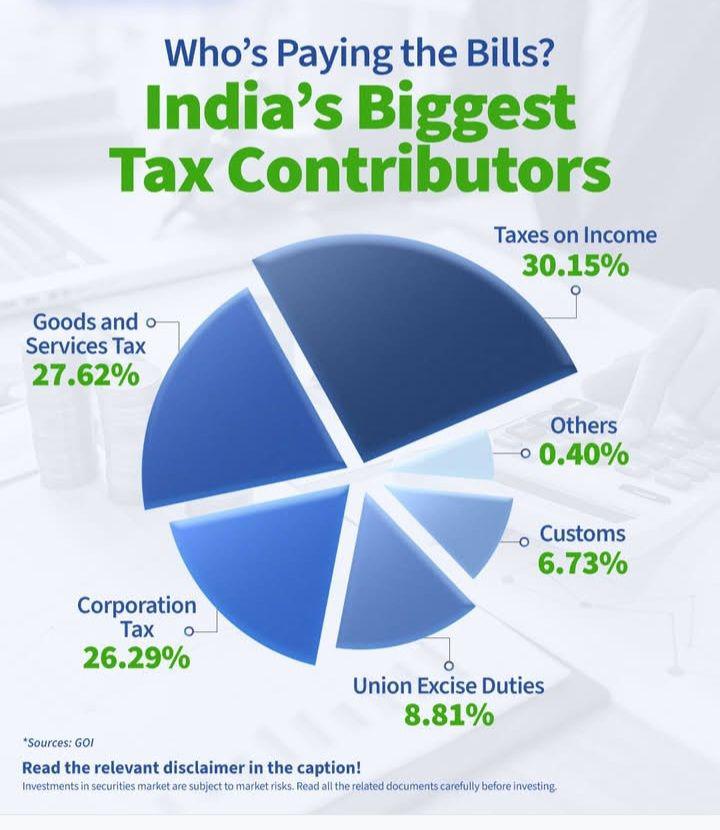

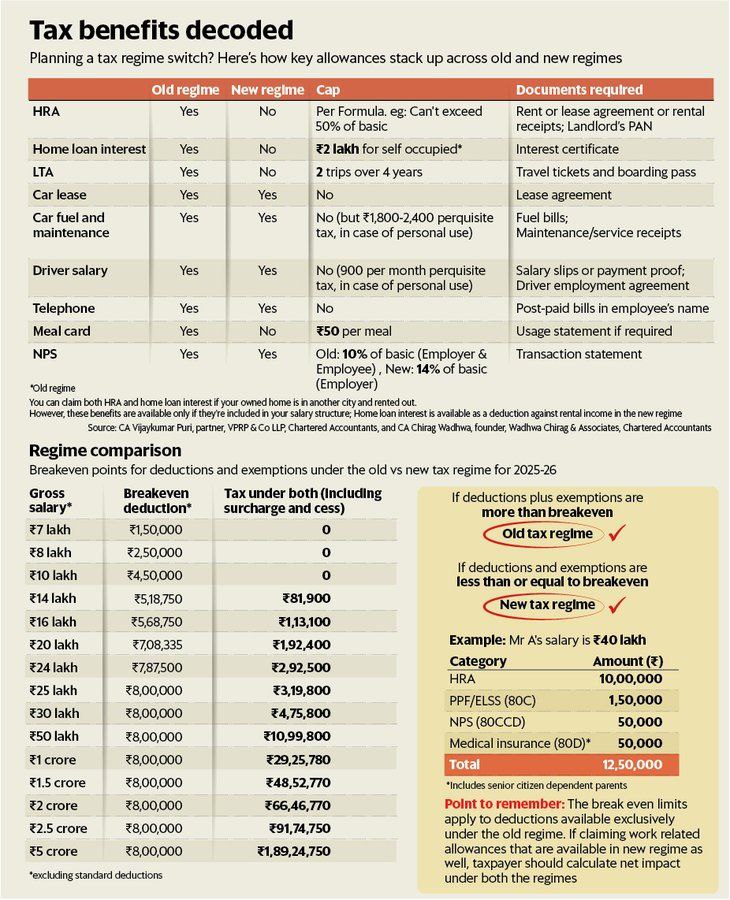

Budget 2025 expectations: Income tax relief buzz Speaking on the expected rationalisation of the income tax slab, Pankaj Mathpal, MD & CEO at Optima Money Managers, listed out the possible income tax slab for the new income tax regime, which may bri

See More3 Replies

2

Jayant Mundhra

•

Dexter Capital Advisors • 1y

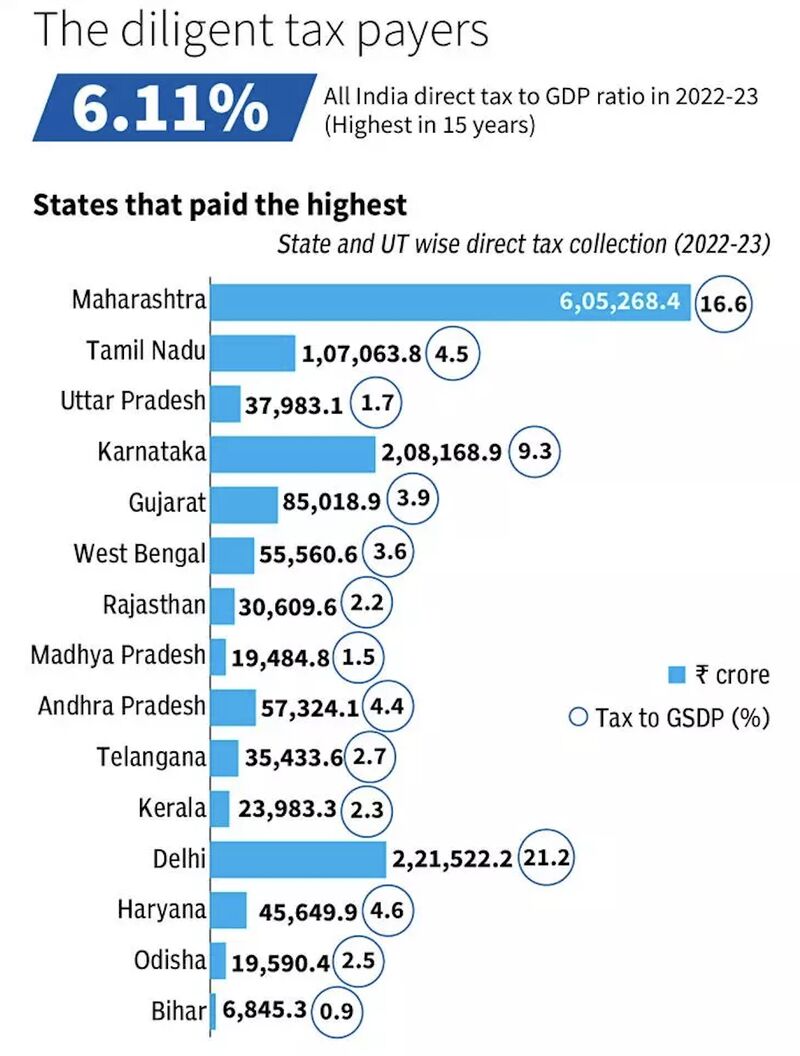

I know that Delhi, Maharashtra and Karnataka account for much of India’s income tax collections. But, the fact that Delhi’s direct tax to GDP ratio is as much as 21%, while for Bihar it’s 0.9% - That is staggering! 🤯🤯 Came across this fantastic H

See More

6 Replies

10

33

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)