Back

Satyam Kumar

Pocket says nil.. Mi... • 10m

Google Pay's strong presence in India is driven by its seamless Android integration, user-friendly features, strong security, and strategic partnerships with banks and merchants. These factors may contribute to its widespread adoption despite local alternatives like Paytm and PhonePe.

Replies (1)

More like this

Recommendations from Medial

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See Moregray man

I'm just a normal gu... • 9m

Fintech unicorn PhonePe has launched an upgraded version of its smart speaker, aimed at boosting digital payments for offline merchants across the country. The latest Made In India device retains all the key features of its predecessor and comes wit

See More

Krishna Chaitanya

We are planning to s... • 11m

Despite the government's push for renewable energy and biogas under schemes like SATAT, banks are still demanding collateral for CGTMSE loans, making it difficult for startups to enter the sector. How can first-time entrepreneurs in the biogas indust

See MoreVinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: Paytm – India's Payments Pioneer Founded in 2010, Paytm revolutionized India's digital payments landscape. Stats: Users: 330M+ active Merchants: 21M+ partners Business Model: Payments, financial services, e-commerce. Revenue: FY18: $

See More

Only Buziness

Everything about Mar... • 1y

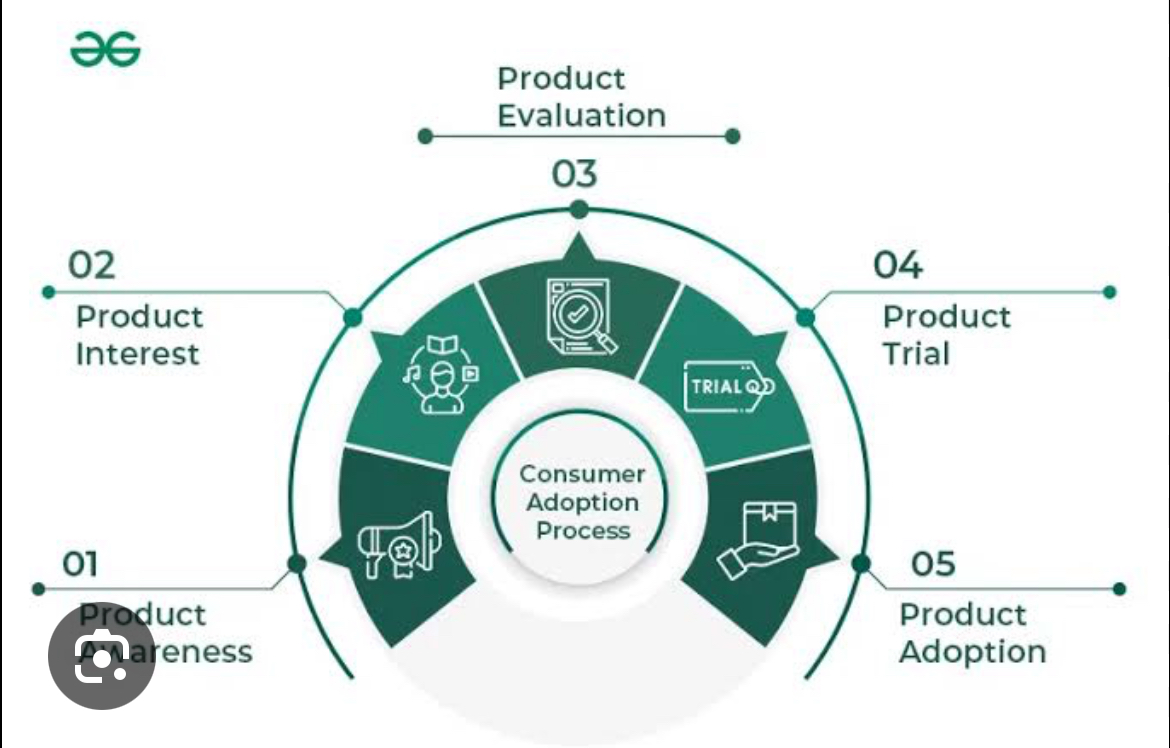

The Consumer Adoption Process The consumer adoption process involves five key stages: Awareness, Interest, Evaluation, Trial, and Adoption. 1. Awareness: Consumers first learn about the product. Example: Tesla created awareness for its EVs through

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)