Back

More like this

Recommendations from Medial

Akshat Agarwal

Hey I am on Medial • 1y

Hi everyone.. I am Akshat and will sbe joining a tier 1 engineering college in july.. I have some ideas for unique products which may work out as profitable business.. but i don't know much about all this management process is done and i don't want t

See MoreVivek Joshi

Director & CEO @ Exc... • 4m

Investment Mandates I. Sector-Agnostic Early-Stage Investments • Focused on providing the first institutional check to startups. • Early signs of traction and revenue are required. • Typical investment size: ₹1-8 crore in exchange for 8-18% equi

See More

Account Deleted

Hey I am on Medial • 2m

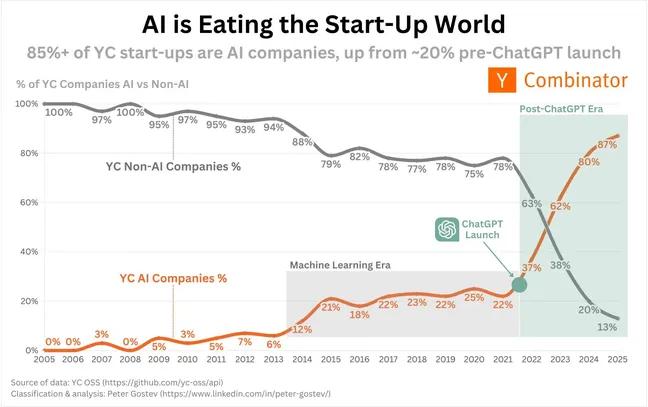

ChatGPT didn’t just launch a product • It cracked open a platform shift—like iPhone in 2007 or AWS in 2006 • Except this time, every product is getting rebuilt Think about what that means: • Every SaaS tool you know is getting cloned—smaller, sma

See More

SHIV DIXIT

CHAIRMAN - BITEX IND... • 8m

🚀 Medial Crossed 30 crores Valuation ? 🔥 let's breakdown how Medial crossed 30 Crores valuation In 1 months ? So guy's as of now Medial is just a business news and discussion plateform with additional features like networking , jobs and operate

See MoreAccount Deleted

Hey I am on Medial • 2m

How Amazon Quietly Built the World's Most Dominant Empire — Piece by Piece Behind the scenes, it’s a strategic empire built layer by layer. Bezos’s core idea: “Work backwards from the customer” Started with books because they were easy to ship, h

See More

Aarihant Aaryan

Prev- Founder & CEO ... • 1y

Soundbox - why is it a great product but not a great business? Soundbox is not just a speaker, it's configured to note debit and credit payments, it has an integrated sim in the speaker that notes the notification and communicates it Soundbox is de

See MoreDownload the medial app to read full posts, comements and news.