Back

Havish Gupta

Figuring Out • 11m

Borrow 1 Cr based on your startup's stock, use the money for an year, borrow a bigger amount and pay the previous loan with the new. You just end up paying 10% in Interest, get tax deduction and also let your stock grow.

Replies (1)

More like this

Recommendations from Medial

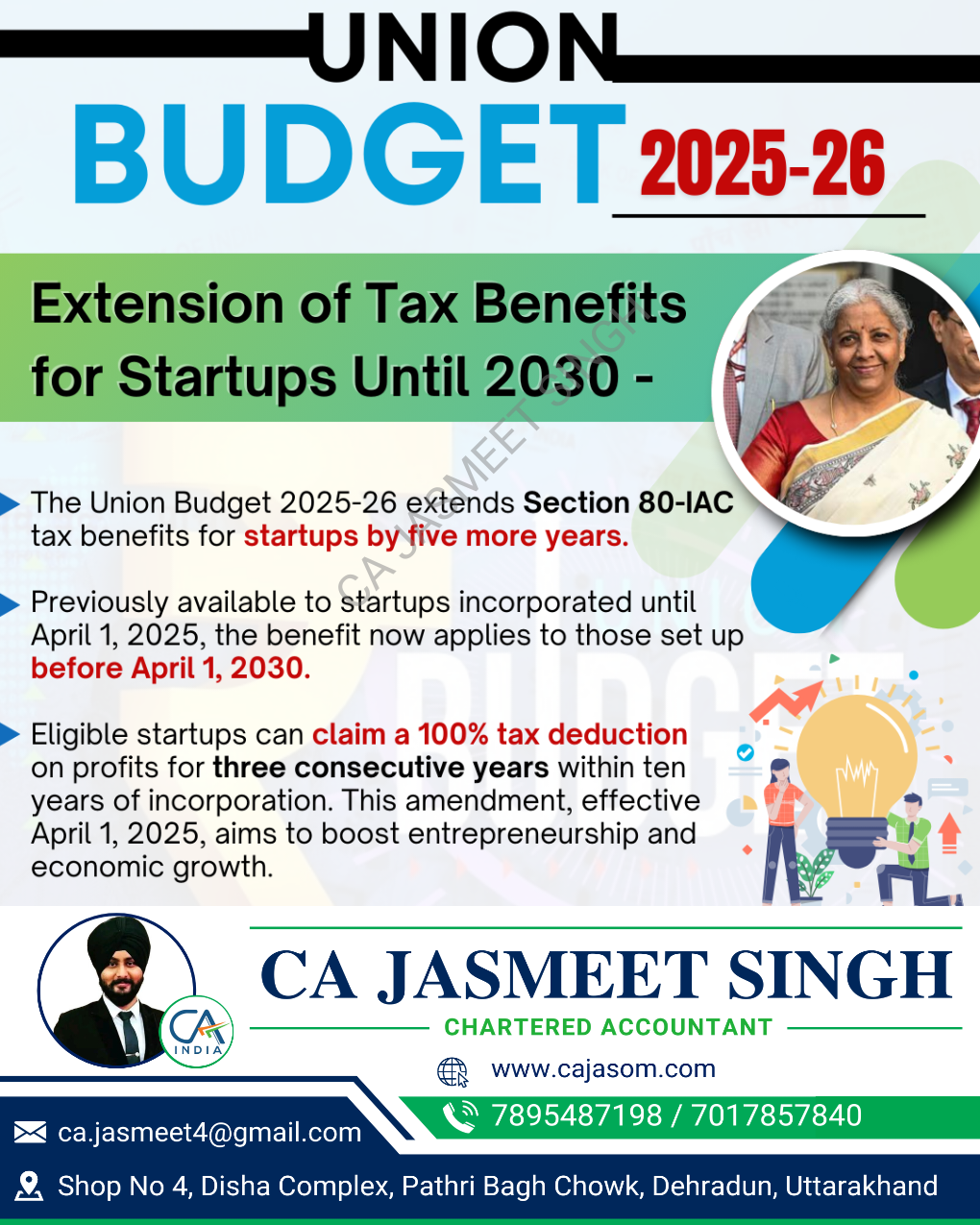

CA Jasmeet Singh

In God We Trust, The... • 11m

🚀 Section 80-IAC: Tax Exemption for Startups! 💡 If you're a startup recognized by DPIIT, you can claim a 100% tax deduction on profits for 3 consecutive years out of the first 10 years! 🎉 📌 Eligibility: ✅ Incorporated as a Private Ltd. Co. or L

See More

The Outlier

Hey I am on Medial • 11m

₹1 Cr salary? You take home ₹65L after taxes. ₹1 Cr business profit? You keep ₹80L after deductions. ₹1 Cr in stock growth? ₹₹87.65L remains after 12.5% tax. The system wasn’t designed for workers. It was built for owners. Still chasing promotions

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 10m

30+ Strategies How Billionaires Avoid Taxes. 🚀 1. Double Irish with a Dutch Sandwich 2. Tax Haven Residency 3. Offshore Shell Companies 4. Trust Funds 5. Carried Interest Loophole 6. Capital Gains Tax Rate 7. Intellectual Property Rights Shifts 8.

See MorePushpender Verma

Looking for VC fundi... • 1y

Hi, I am looking for Inverter for starting a Finance Company which will do secured lending to SOHO/Small Shopkeeper/Daily wage earner. Location - Lucknow loan Amount - Upto 5 Lac Rate of Interest - 24% - 30% Type - Home Loan / Loan Against Property

See MoreVIJAY PANJWANI

Learning is a key to... • 4m

Big Companies, Bigger CAPEX Plans! 💰 These top brands are gearing up for massive investments by 2030 & beyond 🚀 🔥 Highlights: ⚡ JSW Energy – ₹130K Cr 🏗️ Aditya Birla (Hindalco) – ₹83K Cr 🚗 Hyundai – ₹45K Cr 🏢 JSW Infrastructure – ₹30K Cr ⚙️ S

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)