Back

Sahil

Hey I am on Medial • 1y

Business Overview: "I run a lending business where I provide small loans to individuals with easy, manageable repayment terms. The idea is simple: if you need a quick loan, you can borrow money from me and pay it back in weekly installments over a set period. The repayment amount each week is designed to be affordable, so it doesn’t put too much pressure on your finances." How It Works - Loan Amount: You can borrow an amount based on your needs. For example, if you borrow ₹2,000, you'll repay it in weekly installments. Repayment Plan: The repayment period is 12 weeks. Each week, you pay back a portion of the loan. For a ₹2,000 loan, you would pay ₹200 each week for 12 weeks. For a ₹3,000 loan, the weekly payment would be ₹300 for 12 weeks. Flexible and Simple: The payments are structured to be straightforward and easy to manage. You always know exactly what you need to pay each week, making it easy to budget. It's been 1year I'm into this doing profitably

Replies (6)

More like this

Recommendations from Medial

Sukhmeet Khurana

Hey I am on Medial • 1y

NEW IDEA FOR MAKE MY TRIP COMPANY::: Give daily n weekly Installments via Paytm or Google pay for customers. example... if Dubai package cost is 30000 rs. then a customer can give 2000 rs. per Sunday via Google pay or Paytm to MakeMyTrip and get pack

See MorePraveen Kumar

Start now or Regret ... • 1y

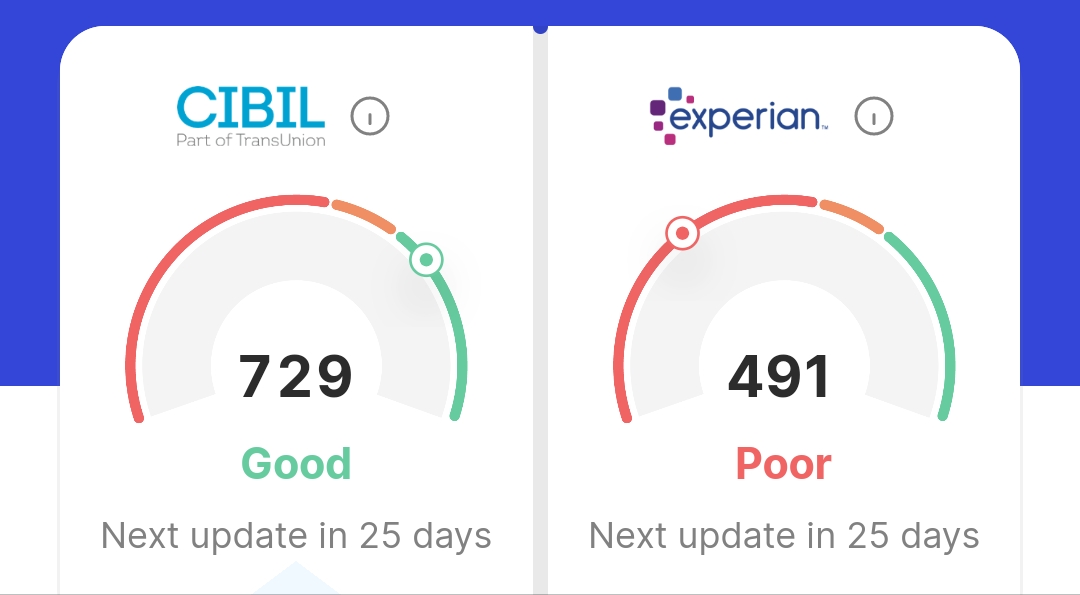

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

Gangesh Rameshkumar

Figure it out • 8m

Today's term of the day: Credit Credit is a kind of loan handed out by financial institutions to businesses and individuals. You can think of it as the ability you have to borrow resources from a lender to pay at a later date, with interest for usin

See MoreDivyansh Gupta

Founder @Internspace... • 1y

Hello medial community, please valudate this idea: Imagine you or a loved one suddenly needs severe medical attention, but you don't have the money to pay for it right away. In India, many families face this challenge because they don't have health

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)