Back

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

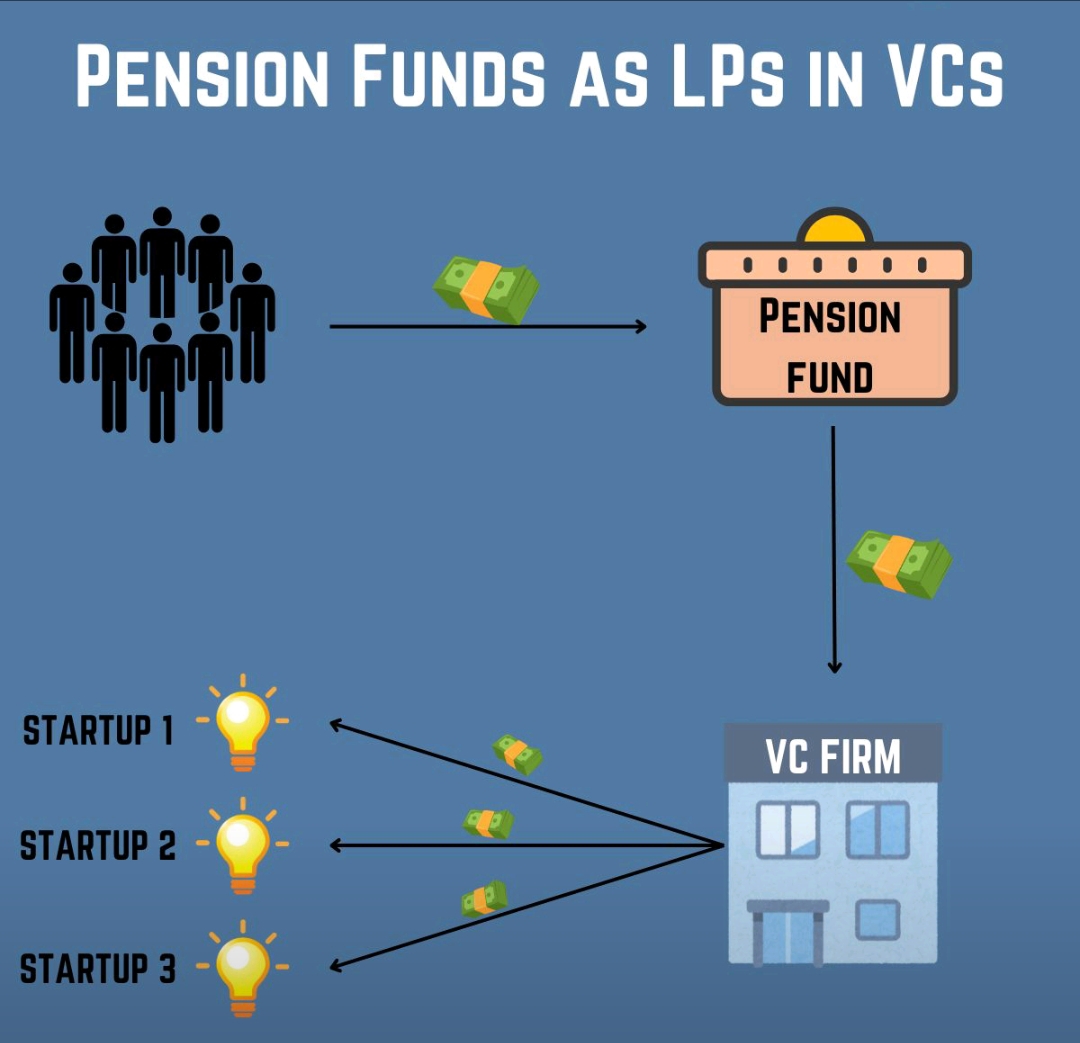

Startups don’t need to be profitable early—just valuable. Most fail, but VCs don’t need all of them to succeed—just a few outliers. Venture returns follow a power law: a tiny percentage of startups generate nearly all the returns. A typical VC fund invests in 50 companies—40 will fail, a few will break even, and 1-2 will be massive hits that return the entire fund. That’s why VCs chase high-risk, high-reward bets. They’re not looking for steady profits—they’re hunting for unicorns (or Indicorns). Also, VCs get paid regardless. They earn management fees (2% per year of the fund size) and take 20% of the profits (carry) from exits.

More like this

Recommendations from Medial

Vishwa Lingam

Founder of Simulatio... • 6m

🚫 Why VCs Reject Your Pitch — Even If It’s a Solid One 💡 You're not alone if your startup pitch got rejected by a VC. But here's the hidden truth most won’t tell you: VCs have limited capital from their LPs (Limited Partners) & they’re under pre

See MoreCodestam Technologies

We make automations ... • 2m

Most SOPs don’t fail because they’re missing — they fail because they’re never enforced. Written SOPs create comfort, not clarity. Real SOPs remove confusion, define ownership, and demand accountability. If two people can follow the same SOP and ge

See More

Ayush

Let's build together... • 11m

Was talking to a founder few days back. Had a healthy talk and there was a line that deeply resonated in me - "VCs don’t fund ideas. They fund inevitabilities. Make your startup something the world can’t ignore." Niket Raj Dwivedi, you are the bes

See MoreIncorpX

Your partner from St... • 9m

🚀 Introducing Indicorns 2025: India's New Vanguard of Profitable Startups In a bold move to redefine startup success, Titan Capital (backers of Ola, Urban Company, Mamaearth) has unveiled the Indicorns 2025 List at India Internet Day. This initiati

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)