Back

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

From ₹51 Cr to ₹1,272 Cr in a year—this Indian biotech’s revenue chart is insane. 💰 Molbio is going public targeting ₹22,000–24,000 Cr valuation. IPO expected in November 2025, raising ₹2,200–2,400 Cr. 🔬 Their Truenat platform, is a battery-powered real-time PCR system. PCR (Polymerase Chain Reaction) enables rapid amplification and detection of specific DNA sequences. 🏎️💨 It brought rapid TB, COVID-19, and infectious disease testing to 8,300+ clinics worldwide. WHO approved their TB testing. 💸 Molbio’s Massive Revenue Swings: - FY20: ₹51 Cr - FY21: ₹1,272 Cr (25x growth from COVID-19 testing) - FY22: ₹776 Cr - FY23: ₹332 Cr (post-pandemic dip) - FY24: ₹850 Cr - FY25 (Projected): ₹1,200 Cr Their main competitor in India & abroad is American company Cepheid. Cepheid (owned by Danaher) is one of the biggest players in molecular diagnostics. 💸 Cepheid’s Revenue (estimated from Danaher’s reports): - FY20: $2 billion → ₹16,600 Cr - FY21: $2.88 billion → ₹23,904 Cr - FY23: $2.9 billion → ₹24,070 Cr - FY24: $2.25 billion → ₹18,675 Cr Cepheid’s massive sales figures show how big Point-of-Care PCR diagnostics market can be. ❓With Molbio’s IPO raise, can they scale worldwide and challenge global giant Cepheid? ❓Would you invest in a biotech IPO over SaaS/Gig Economy companies? 👇 ---------------------------------- https://www.molbiodiagnostics.com https://bigteclabs.com

Replies (10)

More like this

Recommendations from Medial

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

boAt: Riding the Audio Wave (with a Recent Setback) Company: boAt (founded 2016) Industry: Consumer Electronics (Audio) Challenge: Stand out in a crowded audio market. Solution: Stylish, budget-friendly audio for young consumers. Results: Growt

See More

Vinayak Shivanagutti

🚀7M+ Post Impressio... • 1y

Case Study: Paytm – India's Payments Pioneer Founded in 2010, Paytm revolutionized India's digital payments landscape. Stats: Users: 330M+ active Merchants: 21M+ partners Business Model: Payments, financial services, e-commerce. Revenue: FY18: $

See More

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

Why qPCR & Phenotypic Testing Must Be Displaced? – Part III This is the third part of a deep dive into why qPCR & phenotypic testing need to be replaced. In Part I, I covered the limitations of current diagnostics & why incremental improvements aren

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who started a 12,000 CR company at 69. 1. Ashok Soota was famously known as the magic man of the IT industry. In 1978, he took over as CEO of Shriram Refrigeration, which posted losses for four consecutive years and turned it around to

See More

Aditya Arora

•

Faad Network • 1y

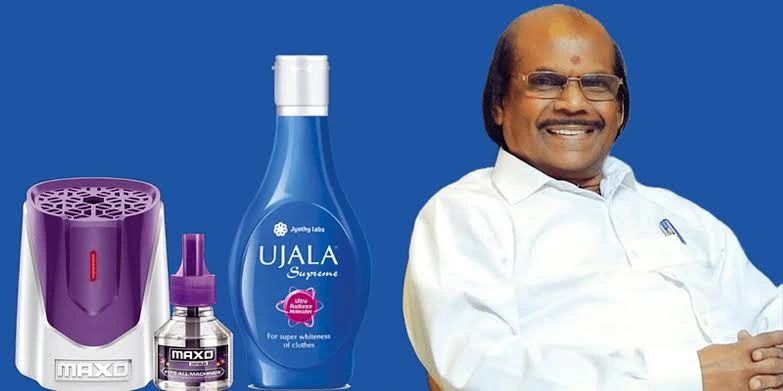

Took Rs 5000 loan from his brother and built a 16,000 CR FMCG empire. 1. Born in the cultural city of Thrissur in Kerala, Moothedath Panjan (MP) Ramachandran faced failures early on. While working as an accountant, he experimented with his whitener

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who was the son of a farmer but started a 9000 CR company. 1. Born to a Jain family in the small village of Padru in Rajasthan, Motilal Oswal's father had a fledgling grains trading business. But he wanted to leave the family trade and

See More

Aditya Arora

•

Faad Network • 1y

Meet the man who was the son of a farmer but started a 9000 CR company. 1. Born to a Jain family in the small village of Padru in Rajasthan, Motilal Oswal's father had a fledgling grains trading business. But he wanted to leave the family trade and

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)