Back

Anonymous 4

Hey I am on Medial • 11m

As someone who actually used both Cepheid and Truenat systems during COVID (I work in hospital administration), there are significant differences. Cepheid is more user-friendly with fully integrated cartridges but costs 3-4x more per test. Truenat requires more manual steps but is much more cost-effective. In wealthy countries, Cepheid wins easily. In resource-limited settings, Truenat has a massive advantage. The question for investors is where the growth will come from. If Molbio stays focused on emerging markets, they could build a sustainable business. If they try to compete head-on with Cepheid in developed markets, they'll likely fail. Their valuation assumes they'll succeed everywhere, which is unrealistic.

Replies (1)

More like this

Recommendations from Medial

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

From ₹51 Cr to ₹1,272 Cr in a year—this Indian biotech’s revenue chart is insane. 💰 Molbio is going public targeting ₹22,000–24,000 Cr valuation. IPO expected in November 2025, raising ₹2,200–2,400 Cr. 🔬 Their Truenat platform, is a battery-power

See More

Nimesh Pinnamaneni

•

Helixworks Technologies • 11m

Why qPCR & Phenotypic Testing Must Be Displaced? – Part III This is the third part of a deep dive into why qPCR & phenotypic testing need to be replaced. In Part I, I covered the limitations of current diagnostics & why incremental improvements aren

See More

Account Deleted

Hey I am on Medial • 1y

The Future is Being Built Right Now – And This is MASSIVE $20 billion. That’s the valuation Safe Superintelligence is now chasing—a 4X jump in just a few months. This isn’t just another AI startup raising capital. This is the birth of something monu

See More

Poosarla Sai Karthik

Tech guy with a busi... • 6m

MRF is a ₹61000 Cr heavyweight. It has dominated Indian tyres and cricket for decades. CEAT, at ₹15000 Cr, is a quarter of that. But it delivers similar profit margins (MRF: 6.5%, CEAT: 6.6%), comparable return on equity, and pays 4x more in dividen

See MoreTREND talks

History always repea... • 1y

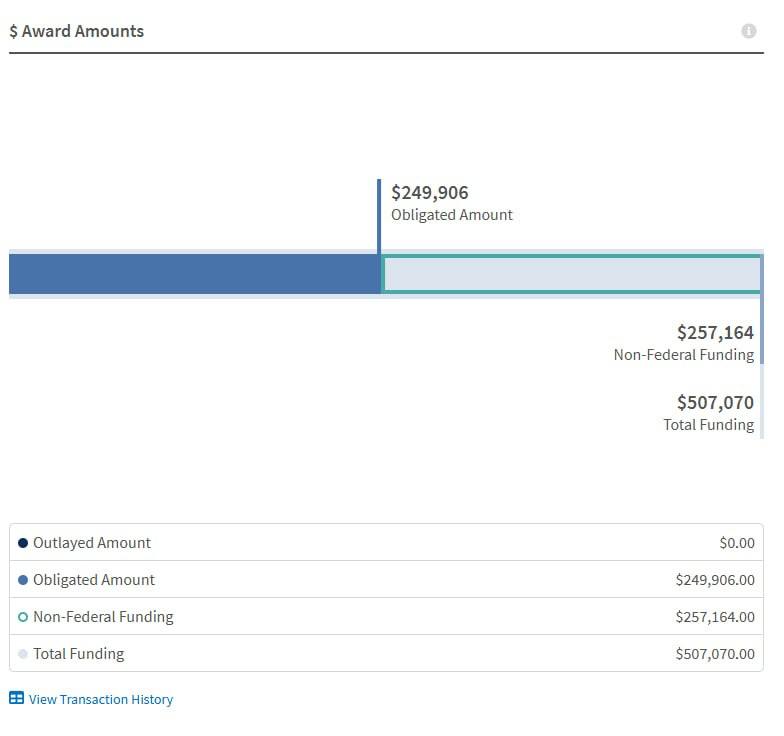

🐶 Department of Government Efficiency (DOGE), led by Elon Musk, continues its work. This time, attention has turned to the fact that the Joe Biden administration is spending massive amounts of money to "eliminate racism" in animals. 🐾 They discove

See More

Account Deleted

Hey I am on Medial • 6m

At WAIC 2025, Huawei unveiled CloudMatrix 384, a supercomputer powered by 384 Ascend 910C chips delivering 300 petaFLOPS — nearly 2x faster than Nvidia’s GB200 NVL72. But here's the catch: it consumes 4x more power This move is less about efficie

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)