Back

Replies (1)

More like this

Recommendations from Medial

Vikas Acharya

Building Reviv | Ent... • 11m

The A-Z Survival Guide to Entrepreneurship! C – Cash Flow Profitability sounds great, but if you run out of cash, your business dies—no matter how good your idea is. I learned the hard way that revenue doesn’t equal survival. Managing cash flow is

See MoreVivek Joshi

Director & CEO @ Exc... • 10m

Facing cash flow issues? You're not alone! In this video, we share “10 innovative ways” to troubleshoot common cash flow challenges that can hinder your business's success. From negotiating payment terms and invoicing promptly to diversifying revenue

See MoreKarnivesh

Simplifying finance.... • 1m

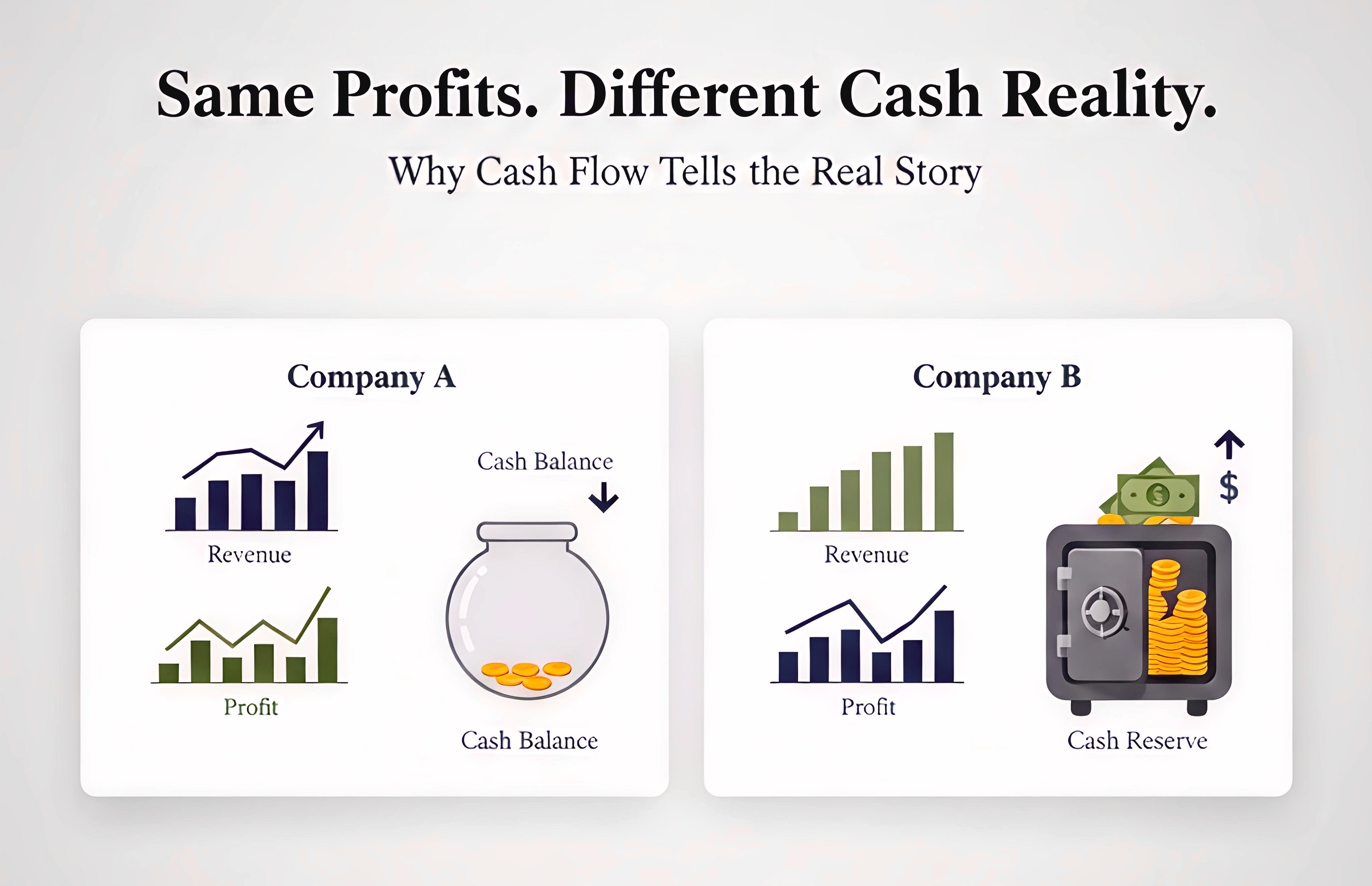

Two companies can report the same profit. Yet one constantly struggles with cash, while the other quietly builds a buffer. This used to confuse me until I started paying attention to how cash actually moves. Some businesses collect money quickly an

See More

VIJAY PANJWANI

Learning is a key to... • 1m

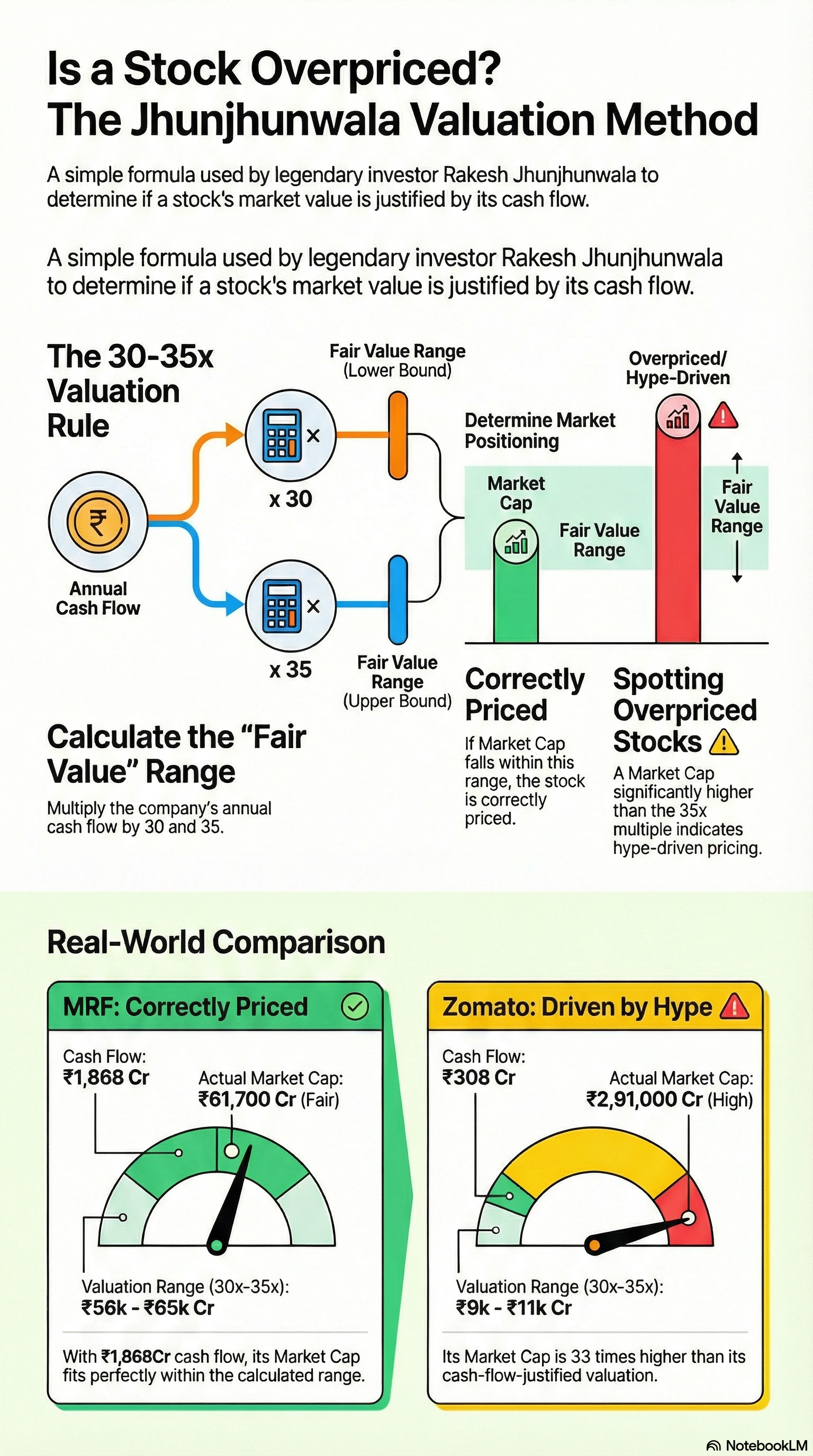

Is That Stock Really Cheap… or Just Hype? Most people buy stocks because: “Price is going up 🚀” But smart investors ask only ONE question: 👉 Is the market cap justified by CASH FLOW? Legendary investor logic: Fair Value = Annual Cash Flow × 30 t

See More

Sandip Kaur

Hey I am on Medial • 1y

Mastering Cash Flow: Simple Strategies for Indian Startups Cash flow can either make or break your startup, and managing it well is critical. Here are some practical tips to help your startup thrive financially: 1.Separate Business and Personal Fina

See MoreDebdip Gupta

Hey I am on Medial • 1y

My theory and Pracgical both are simple as far as business is concerned. Those. who buy from me must own the substantial part of the business.Bcoz nothing apart from the customers makes the cash flow. and balance sheet healthy. So they. must know tha

See MoreKarthik Sreedharan

Fintech CEO | Revolu... • 1y

Cash flow management and control is one of the biggest pain points of startup founders, stakeholders and CFOs. Would you like try out an AI Copilot that enables you manage and control your cash flows and manage your finance team through approval work

See MoreAccount Deleted

Hey I am on Medial • 9m

ARR vs MRR vs Cash Flow It’s easy to feel like things are going well when your ARR looks strong. Or when MRR keeps ticking up. But if your bank account is saying otherwise, something's off. Breakdown: 1) ARR shows the big picture. Great for invest

See MoreKarnivesh

Simplifying finance.... • 2m

For a long time, I assumed that profitability meant safety. If a business was making money, I believed it was stable. Over time, I realised profit alone can be misleading. Many businesses fail not because they aren’t profitable, but because deeper i

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)