Back

Replies (2)

More like this

Recommendations from Medial

CA Dipika Pathak

Partner at D P S A &... • 1y

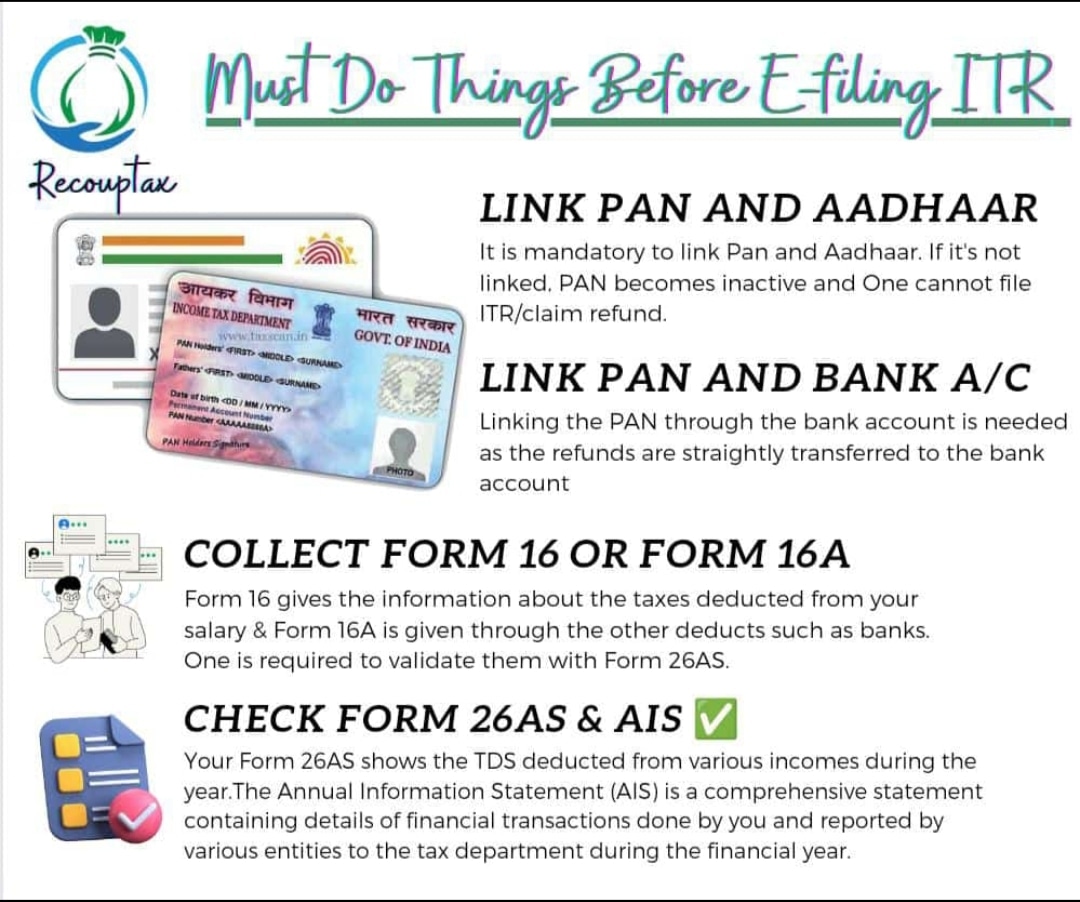

Here’s a real- lesson from July 2024: Many salaried employees, while filing their ITR, realized too late that they had missed out on crucial tax planning and investment opportunities because the financial year had already closed. Don’t let this hap

See More

Sanjeev Antal

OG Founder & CEO - P... • 1y

🚨 GST Council Introduces 'Track and Trace' Mechanism 🚨 The GST Council has approved a 'track and trace' system to combat tax evasion in specific industries. Cigarettes and pan masala are expected to be the initial focus of this initiative. Key H

See MoreSai Vishnu

Income Tax & GST Con... • 11m

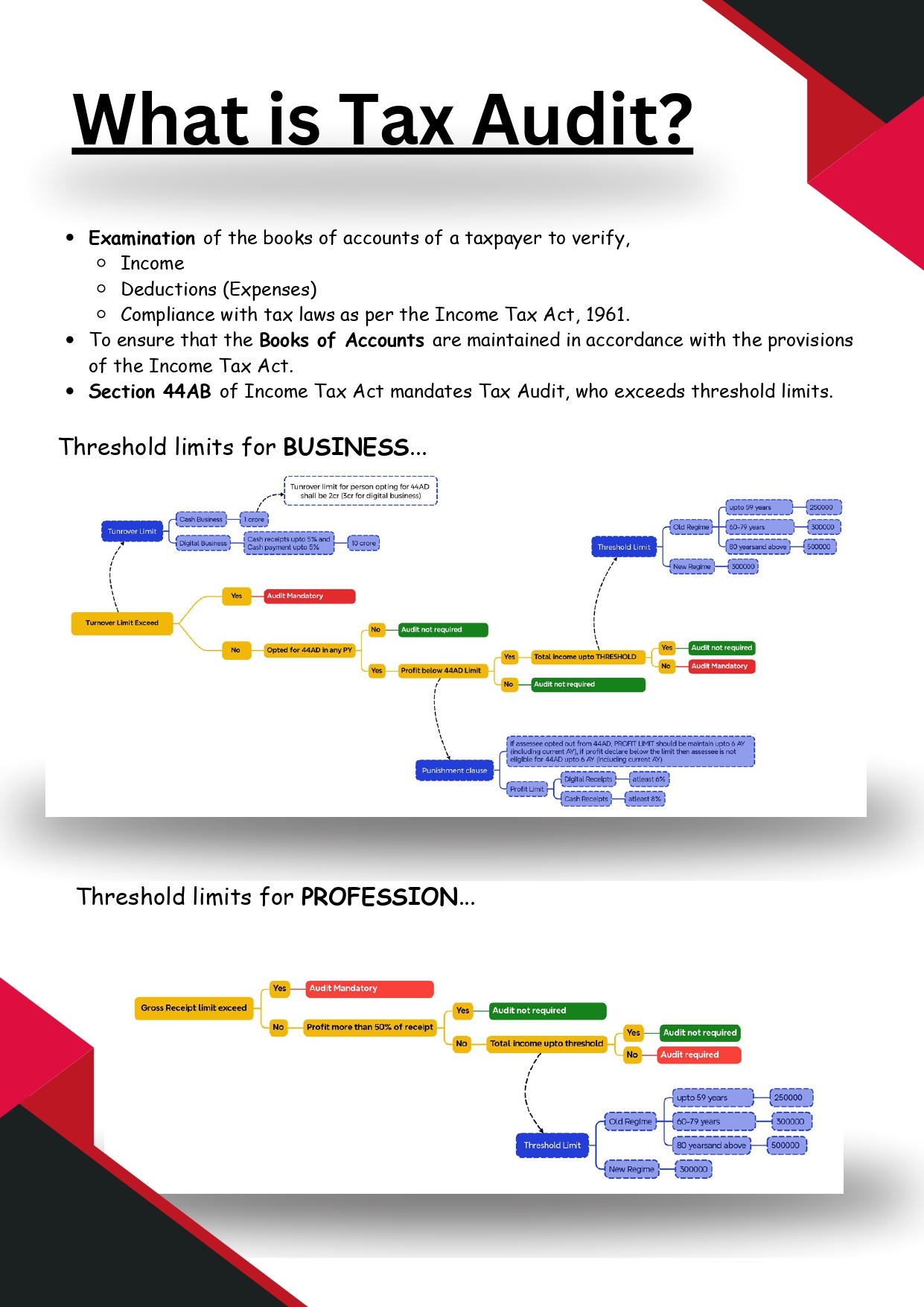

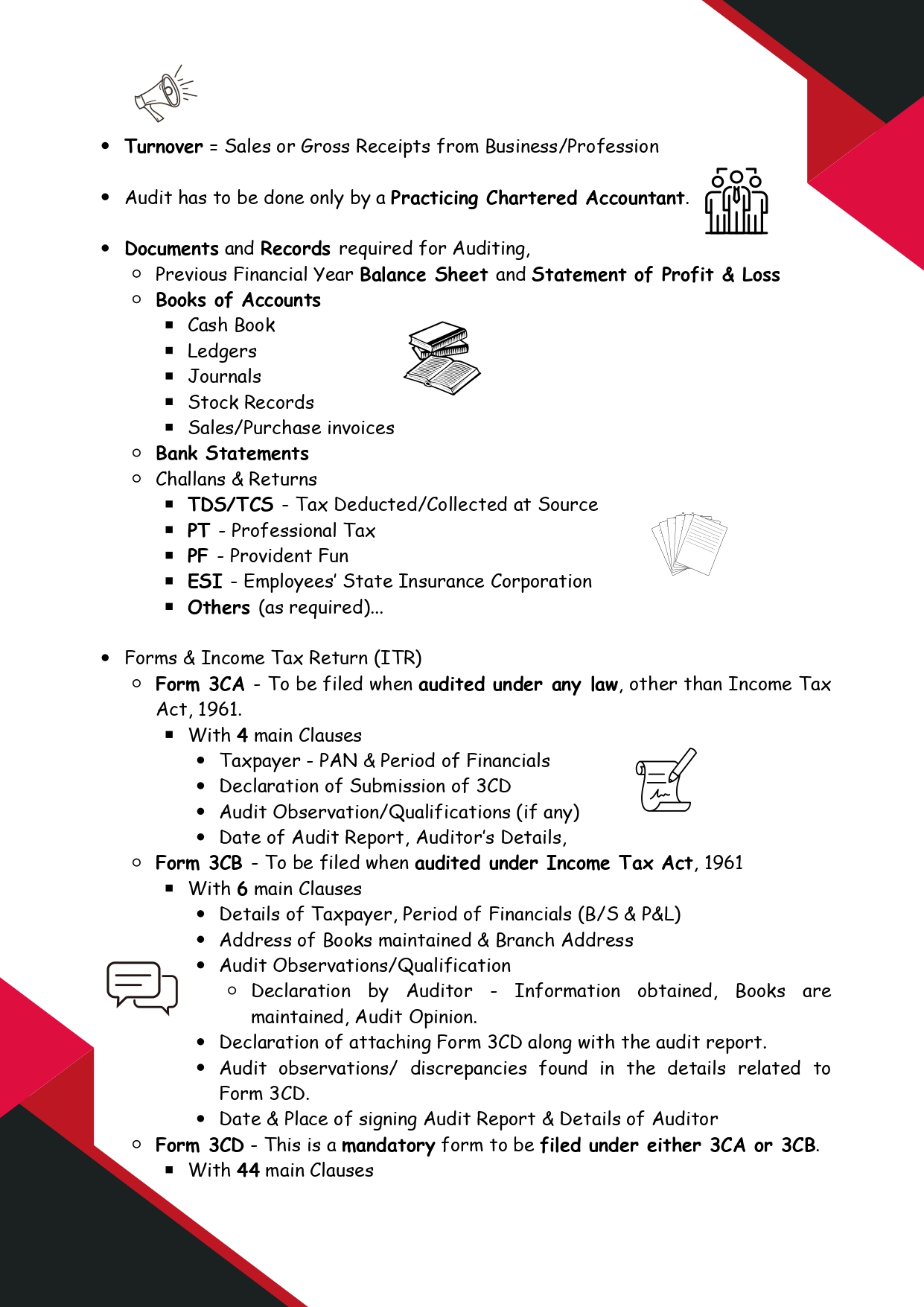

🚀 Everything You Need to Know About TAX AUDIT in Just 5 Minutes! 📊💡 🔎 What is a Tax Audit? A tax audit is a detailed examination of a taxpayer’s books of accounts to verify: ✅ Income & Deductions ✅ Compliance with the Income Tax Act, 1961 ✅ Prop

See More

Sameer Patel

Work and keep learni... • 1y

PAN Card The PAN (Permanent Account Number) card is a ten-digit alphanumeric identifier issued by the Income Tax Department of India. It's crucial for various financial transactions such as opening a bank account, filing income tax returns, and buyin

See MoreSourav Mishra

•

Codestam Technologies • 10m

Job Title: Part-Time Blog Writer / SEO Gladiator Requirements: – Must consistently write to an audience that never replies – Must emotionally survive 0 views on launch day – Must rank #1 on Google without a backlink budget – Must act like “Content i

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)