Back

More like this

Recommendations from Medial

Anirudh Gupta

CA Aspirant|Content ... • 7m

Daily dose of financial ratios by Anirudh Gupta Debt/equity ratio =Total debt/Shareholders equity Purpose: It helps users of financial statements understand how much debt the company is using for every ₹1 of equity invested by shareholders. Cred

See MoreOm Tripathi

Writer | Creator | C... • 1y

ALWAYS SAY LESS THAN NECESSARY When you are trying to impress people with words, the more you say, the more common you appear, and the less in control. Even if you are saying something banal, it will seem original if you make it vague, open-ende

See MoreOmkart

A SMM posting useful... • 10m

what does Burn rate mean in startup ecosystem? It is the rate at which the startup is using its raised capital to fund its overheads before generating any positive cash flow/sales. what does Debt Financing mean? A company can raise funds by issue

See MoreSairaj Kadam

Student & Financial ... • 1y

I recently posted about debt financing and got some interesting responses. I want to dig a bit deeper into this topic. For those new to startups or even those with some experience, how do you feel about using debt financing? Robert Kiyosaki, from "R

See More

Mindless Castle

Code with the flow • 8m

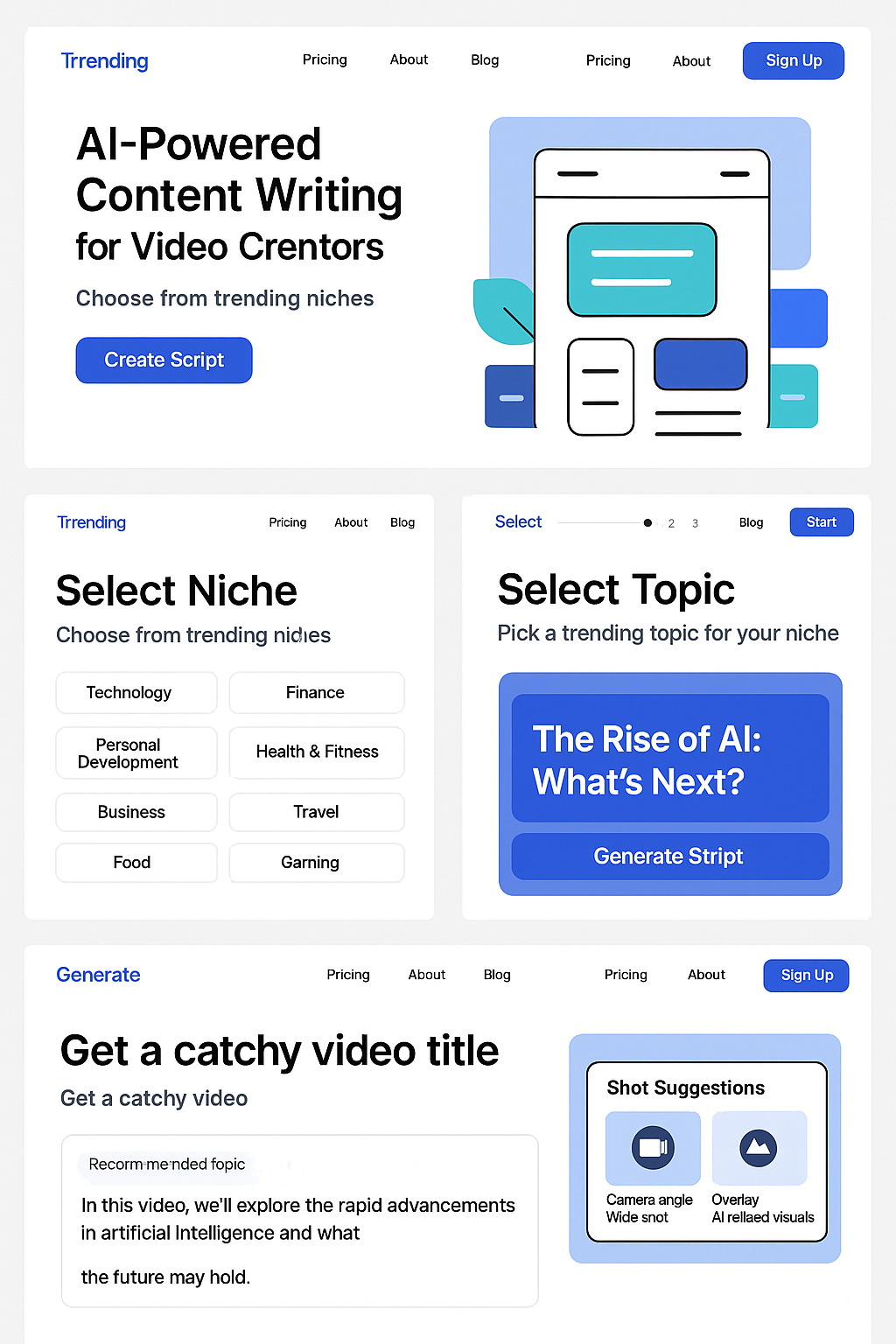

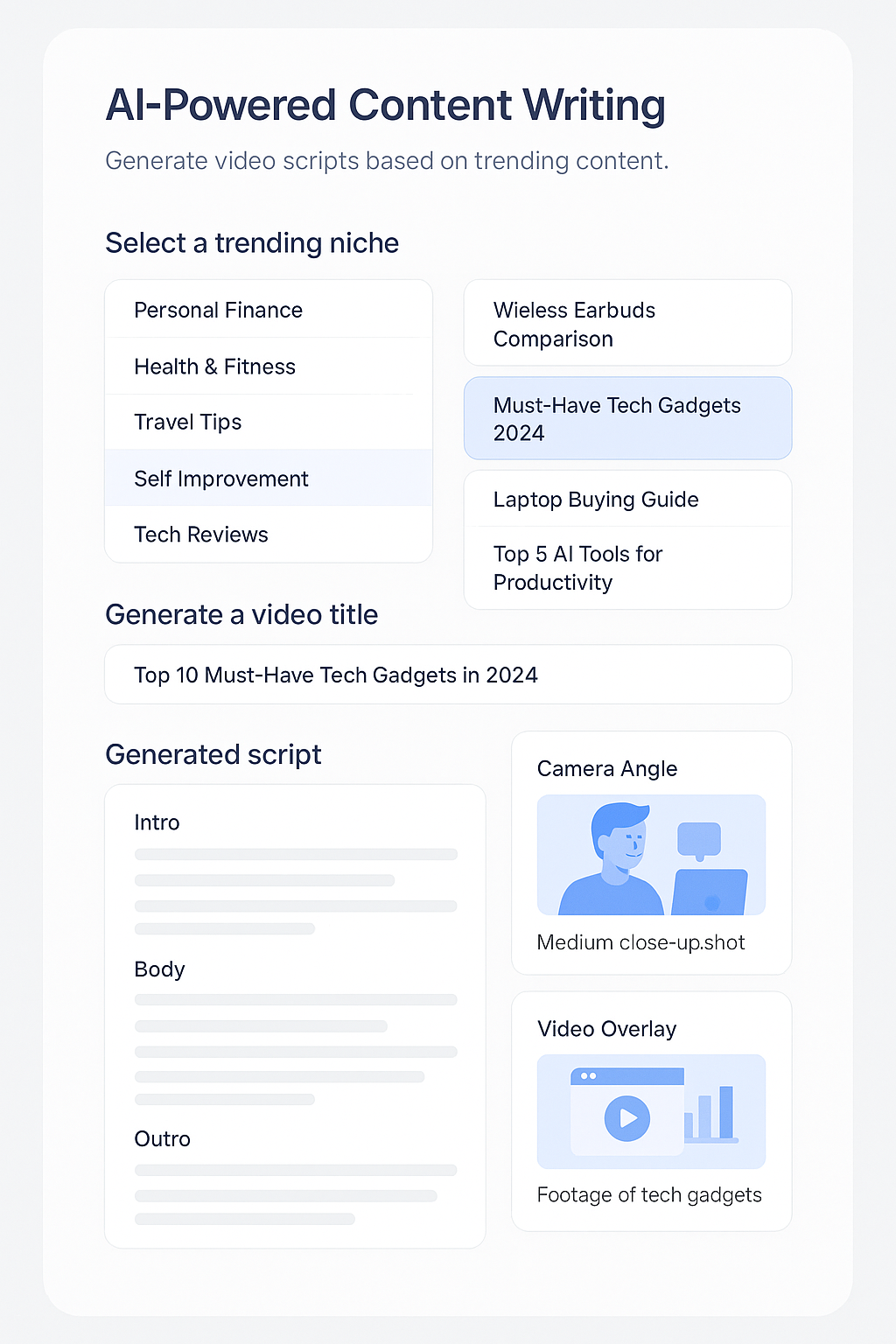

Tired of content block? Let AI take over. Say hello to ViralVision — the ultimate AI tool that helps content creators and influencers write high-performing video scripts based on real-time trends. 1. Choose a trending niche 2. Select a hot topic

See More

Account Deleted

Hey I am on Medial • 11m

We all know the loud unicorns; the ones making headlines with every funding round. But what about the Silent Unicorns? The billion-dollar startups you’ve never heard of. • They don’t do PR. • They don’t chase hype. • They don’t care about being on

See MoreRohan Saha

Founder - Burn Inves... • 7m

We always say the mobile gaming industry can’t survive without India and honestly that’s not entirely wrong. But let’s be real apart from WCC, WCC2, WCC3, and the Real Cricket series, we have not really made any big titles that stand out. Sure there

See MoreDownload the medial app to read full posts, comements and news.