Back

Ayush Maurya

AI Pioneer • 1y

No credit card of BNPL yet but using UPI is like you don't know how much you are spending and just you type in the pin and "paytm pe 150 rs prapt hue" At the end, it's a lot of money spent.. So, sometimes I prefer cash and keep a check on my spending habits online By the way where do you work

Reply

1

More like this

Recommendations from Medial

AjayEdupuganti

I like software and ... • 1y

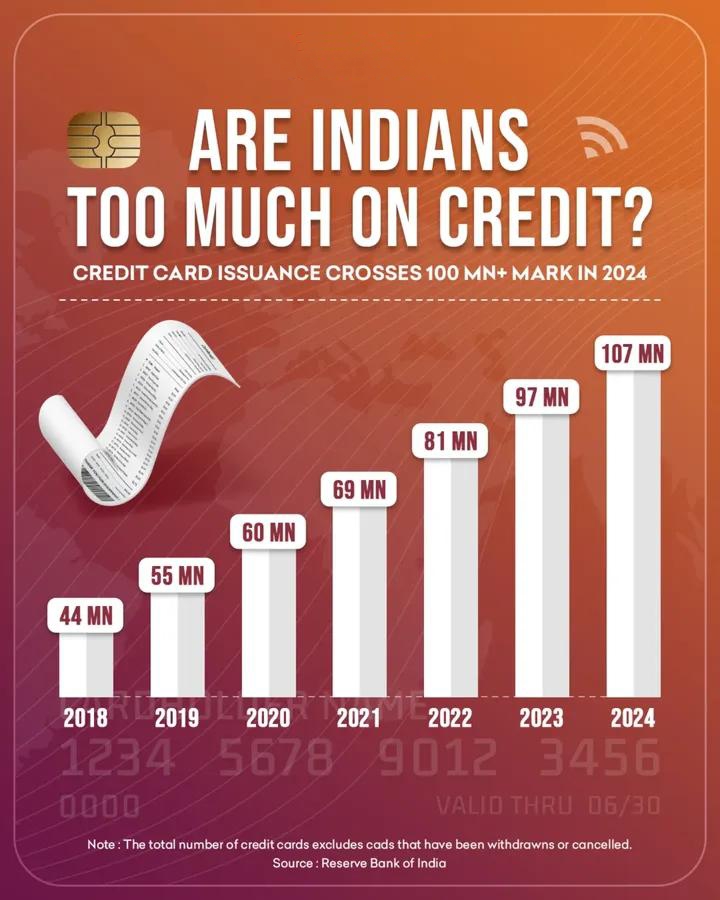

Do you use a RuPay credit card with UPI? How often does your credit card bill exceed your expectations? Are you spending more because of your credit card? I just want to understand whether this could become another potential debt trap for Indians

See More3 Replies

1

2

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)