Back

Mohammed Younoos Rahman M

Hey I am on Medial • 1y

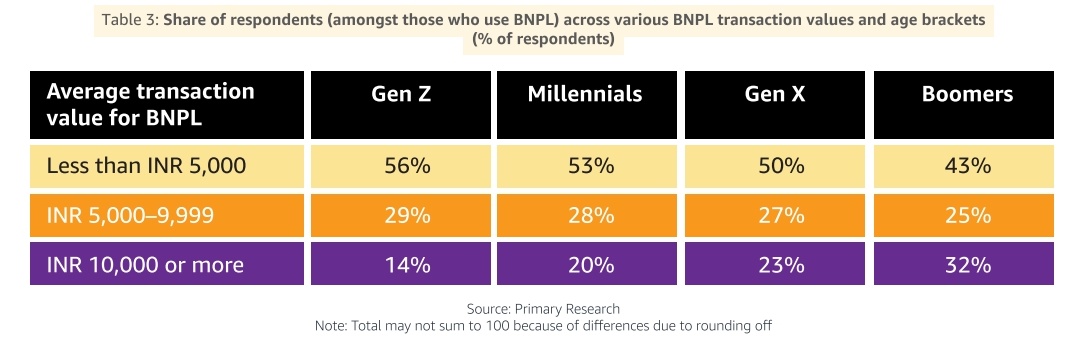

Buy Now, Pay Later (BNPL) services can indeed lead to some unhealthy financial habits if not managed responsibly. While they offer convenience, they can encourage overspending and the accumulation of debt without immediate consequences. The ease of deferred payments may make consumers more likely to purchase items they don’t truly need or can’t afford, which can lead to financial strain later. It's important for consumers to be aware of the potential risks and ensure they only use BNPL services when they are confident they can make the payments on time. Developing mindful spending habits and prioritizing long-term financial health is key to avoiding the pitfalls of BNPL.

More like this

Recommendations from Medial

Account Deleted

Hey I am on Medial • 2y

Today's Topic : Buy Now Pay Later Services Do You think BNPL Service will big ? E.g : Simpl,Lazypay etc. •Buy Now, Pay Later (BNPL) services are popular for splitting purchases into smaller, interest-free installments. •BNPL services are targeting

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)