Back

Arcane

Hey, I'm on Medial • 1y

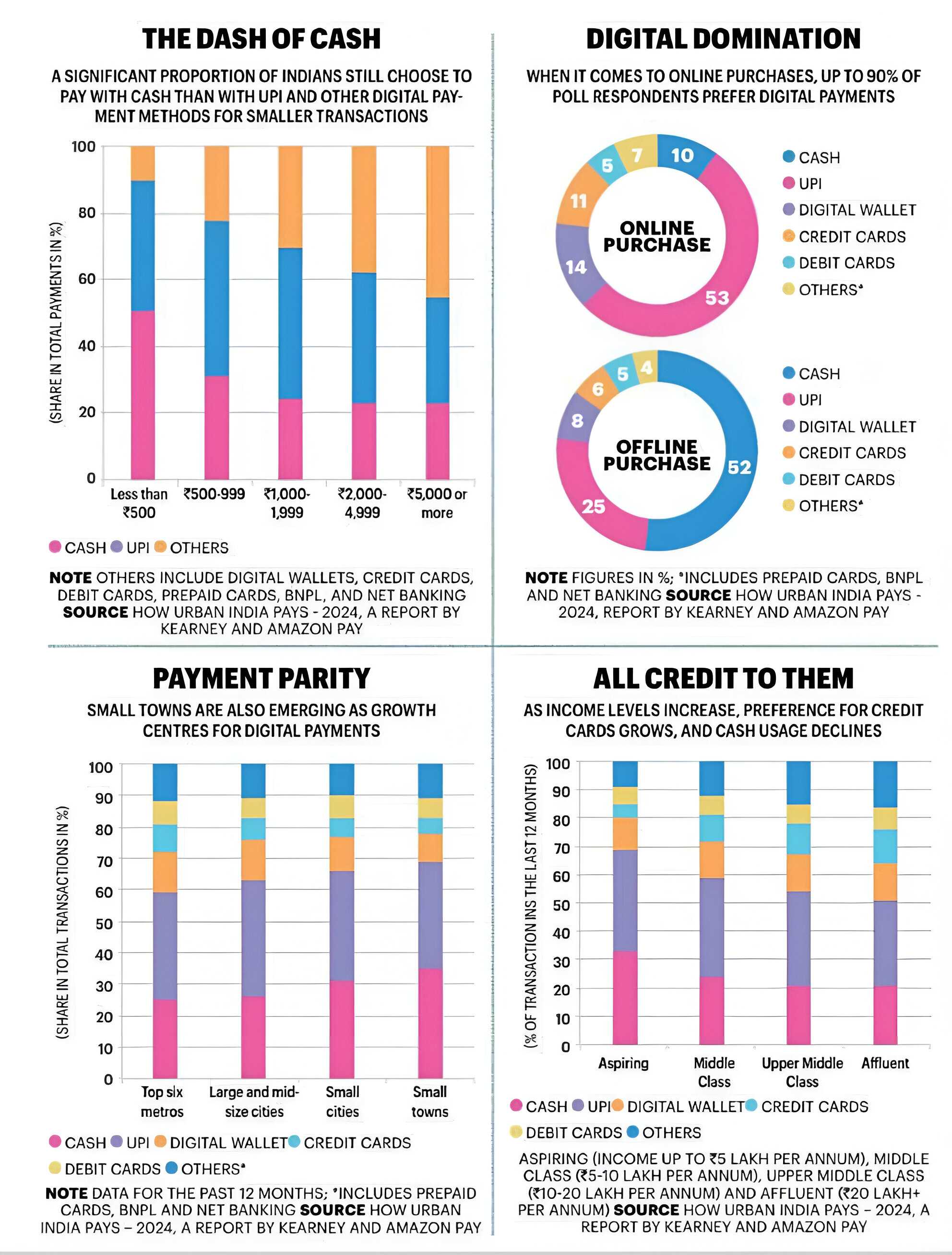

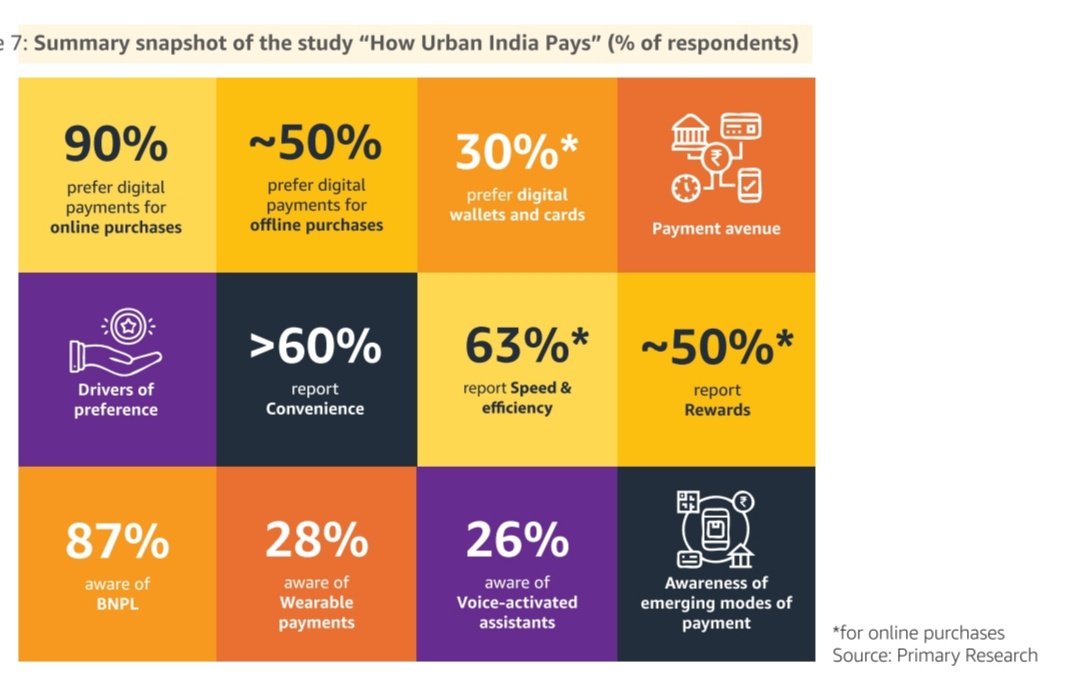

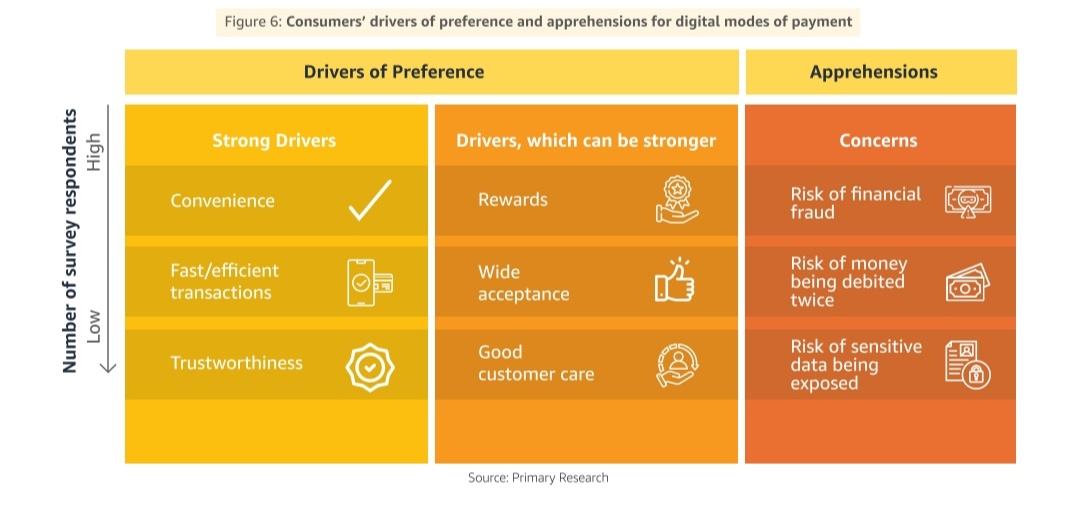

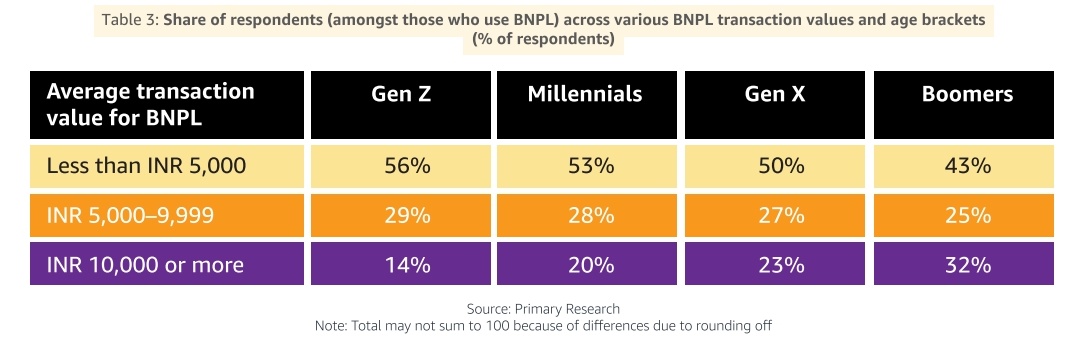

India's Urban Payment Landscape (Kearney India and Amazon Pay analysis) 🔹Cash is still largely used for transactions of smaller value. On the other side, 68% of Total Digital payments come from UPI 🔹New payment methods such as BNPL are known to a lot of people but have slow adoption 🔹Digital payments in small towns are catching up so fast that they are now nearly as prevalent as in top metros 🔹Convenience and speed are top drivers for digital payments. Rewards is not as strong a driver yet, hence there's opportunity here to drive further adoption 🔹Millenials and Gen X lead BNPL adoption, with ~40% actually using it. Additionally, BNPL is used for less than INR 5,000 in transaction value across ages Refer images for more insights : )

Replies (8)

More like this

Recommendations from Medial

VIJAY PANJWANI

Learning is a key to... • 3m

Top Digital Payment Stocks to Watch in 2025! 🚀 India’s digital payment ecosystem is booming, and these companies are playing a major role in shaping the future of cashless transactions. Here are some key players👇 ✨ AGS – Transaction processing, m

See More

Vedant SD

Finance Geek | Conte... • 1y

The Rise of Digital Payments in India India's digital payments landscape has witnessed a remarkable transformation in recent years, driven by government initiatives, technological advancements, and changing consumer behavior. The country's large popu

See MoreDataSpace Academy

Learn, Secure & Earn • 10m

What is the Importance of Cybersecurity for Digital Payments? Digital payment frauds are rising and that too in alarming numbers. Worse, the integration of advanced technologies like AI has only aggravated the crime scene. In that light, it’s more t

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)