Back

SHIV DIXIT

CHAIRMAN - BITEX IND... • 1y

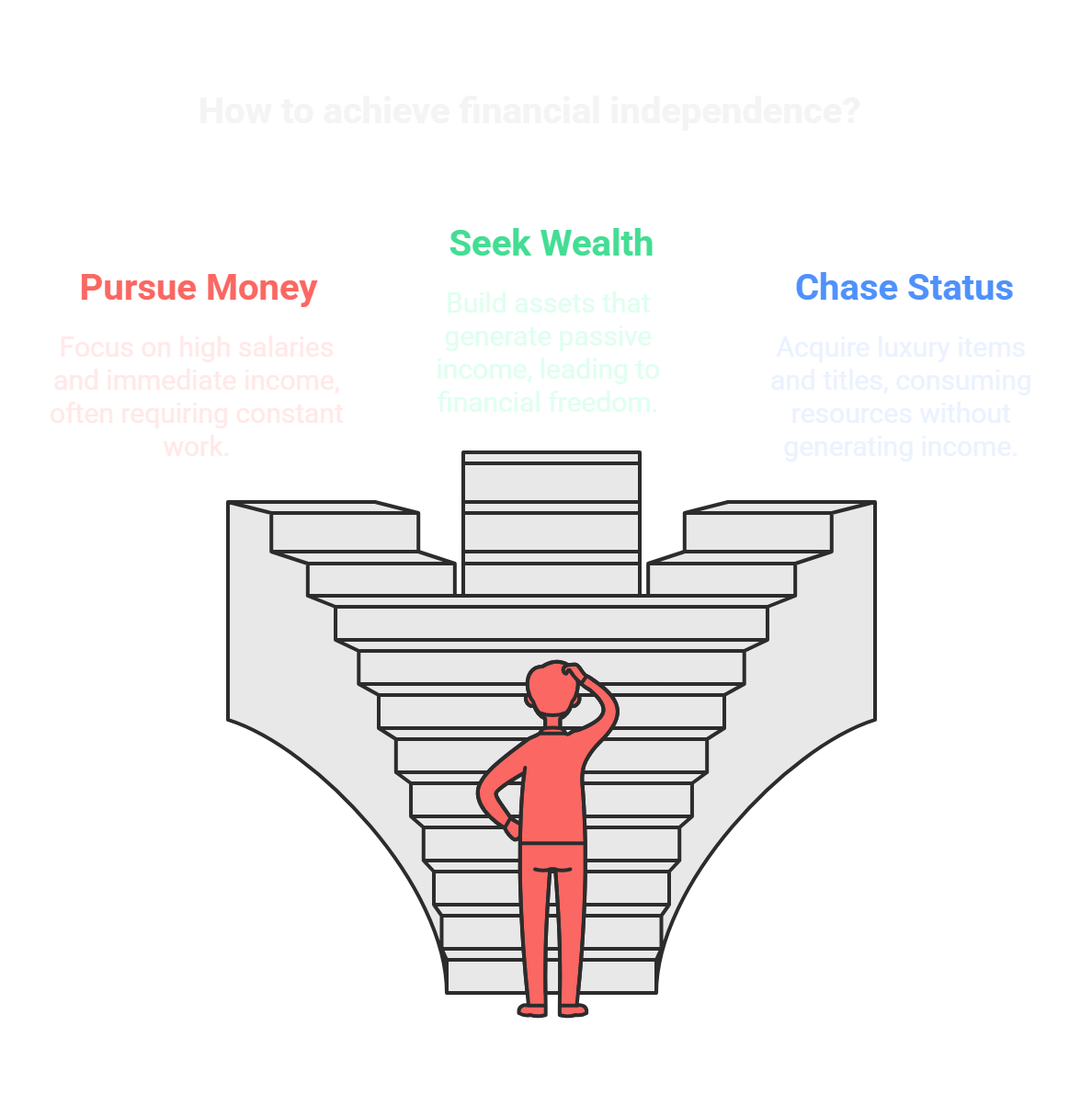

📖 DAILY BOOK SUMMARIES 📖 🔗 DIRECT FREE E-BOOK DOWNLOAD LINK AVAILABLE — https://drive.google.com/file/d/1xXOQOH7ecNfgQCbZN0-2tRu7QsaSNxfJ/view?usp=drivesdk 🔥The Millionaire Next Door 🔥 🚀 25 Lessons By 👉 ✨Thomas J. Stanley and William D. Danko✨ 1. Core Premise: • The book explores the habits, behaviors, and characteristics of self-made millionaires in America, debunking myths about wealth. Most millionaires are not flashy but live frugally, save consistently, and invest wisely. 2. Frugality is Key: • Contrary to popular belief, many millionaires live below their means. They are disciplined in their spending, avoiding lavish lifestyles and focusing on saving and investing. 3. Wealth Accumulation is About Discipline: • Building wealth is less about income and more about how money is managed. Millionaires prioritize long-term financial goals over short-term consumption. 4. Income Does Not Equal Wealth: • High income does not necessarily result in high net worth. Many high-income earners spend excessively and save little, while millionaires focus on accumulating assets rather than showcasing wealth. 5. PAWs vs. UAWs: • PAWs (Prodigious Accumulators of Wealth): These individuals have a high net worth relative to their income because they save and invest wisely. • UAWs (Under Accumulators of Wealth): These individuals may earn high incomes but have little wealth due to poor saving and spending habits. 6. Budgeting and Planning: • Millionaires meticulously budget and plan their finances. They track expenses and avoid unnecessary debt, sticking to a plan that allows them to accumulate wealth over time. 7. Time, Energy, and Money Allocation: • Millionaires allocate their time and resources to activities that build wealth, such as investing, managing personal finances, and learning about financial markets. 8. Avoiding Status Symbols: • The book highlights that true millionaires avoid conspicuous consumption. They rarely buy luxury items like expensive cars or designer clothes, preferring instead to invest in appreciating assets. 9. Self-Sufficiency and Financial Independence: • Millionaires are financially independent and rely on their own resources. They don’t depend on inheritances or windfalls but build their wealth through hard work, saving, and smart investing. 10. Education and Financial Literacy: • While many millionaires are well-educated, they emphasize financial literacy and practical money management skills over prestigious degrees or flashy titles. 11. Invest in Appreciating Assets: • Most millionaires invest in stocks, real estate, and other appreciating assets. They avoid speculative investments and focus on long-term wealth accumulation. 12. Economic Outpatient Care: • The book warns against "economic outpatient care," where affluent parents financially support adult children. This often leads to dependency and poor financial habits, preventing wealth accumulation.

Replies (6)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

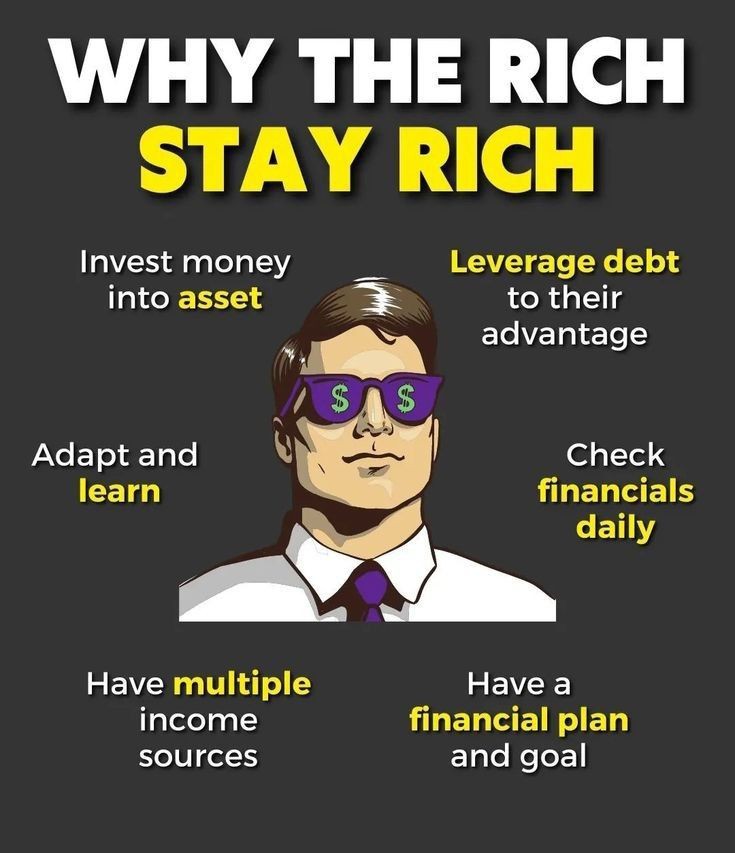

Why the Rich Stay Rich 💰 💼 Invest in assets, not just income. 📈 Leverage debt smartly. 📊 Review finances daily. 📚 Never stop learning and adapting. 💡 Diversify with multiple income streams. 🎯 Set clear financial goals and plans. Wealth isn't

See More

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

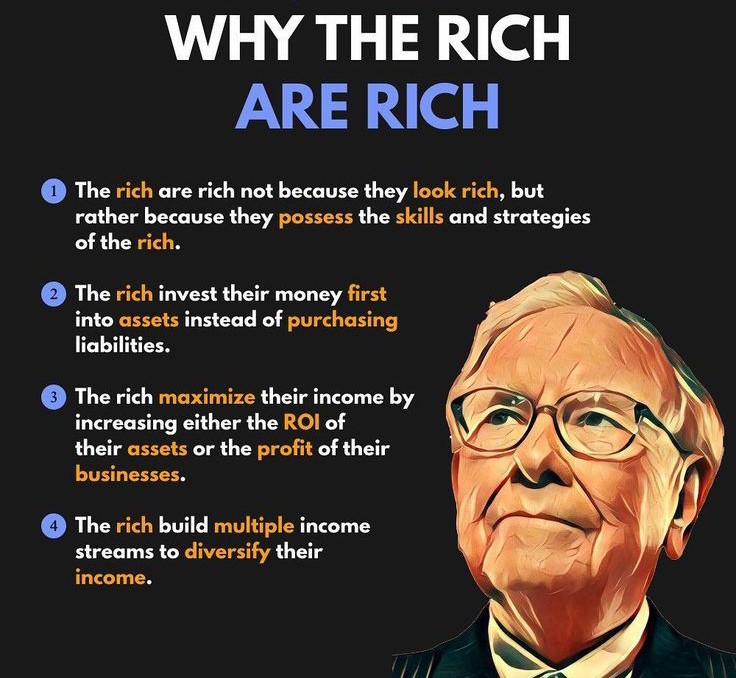

💼 Why the Rich are Rich 💼 It’s not just about looking wealthy it’s about the mindset and strategies that make a lasting difference. 💡 Here are some principles that set successful people apart 1️⃣ Skills & Strategies - True wealth comes from hav

See More

Suman solopreneur

Exploring peace of m... • 1y

Naval Ravikant on Freedom and Wealth: 1. Take More Risks: If you're sincere and keep trying, failure isn't a huge concern. 2. Own Equity: Ownership, not income, is the source of wealth. 3. Make Use of Leverage: Expand your work via code, media, or b

See MoreRupesh Tiwari

In the Business of S... • 12m

How to become Rich sooner? Getting rich requires a combination of smart financial habits, strategic investments, and patience. Here’s a structured approach to building wealth: 1. Increase Your Income Develop High-Income Skills – Learn skills that

See Morefinancialnews

Founder And CEO Of F... • 1y

"8 Powerful Assets to Help You Achieve Financial Freedom and Quit Your Job" Robert Kiyosaki's 8 Essential Assets to Achieve Financial Freedom Robert Kiyosaki, author of the bestselling book Rich Dad Poor Dad, is known for his unique approach to per

See MoreTarun Suthar

•

The Institute of Chartered Accountants of India • 1y

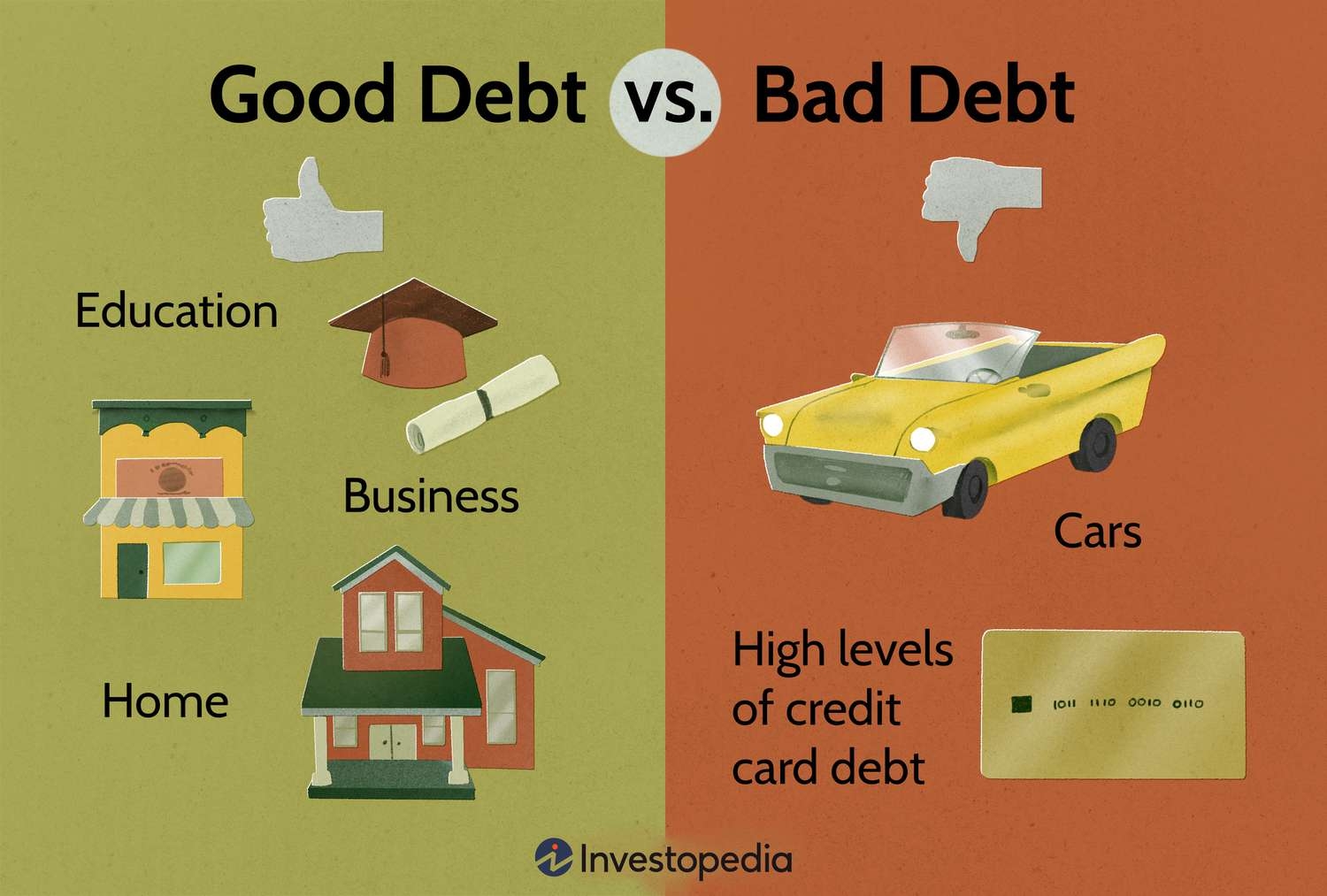

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)