Back

Anonymous

Hey I am on Medial • 1y

13. Importance of Self-Employment: Many millionaires are entrepreneurs or self-employed professionals. Owning a business allows them greater control over their finances and the ability to build significant wealth over time. 14. First-Generation Wealth: A large proportion of millionaires are first-generation wealthy, having built their wealth through hard work, discipline, and sound financial habits rather than inheriting it. 15. Spouses Play a Key Role: Spouses of millionaires often share the same financial values, such as frugality and saving. A united approach to money management is critical for building and maintaining wealth. 16. Delayed Gratification: Millionaires are skilled at delaying gratification. They invest their money rather than spending it on immediate pleasures, allowing their wealth to grow over time. 17. Living in Moderate Neighborhoods: Most millionaires live in modest homes in average neighborhoods, avoiding expensive areas where keeping up with the Joneses leads to higher spending. 18. Importance of Goal Setting: Wealthy individuals set clear financial goals and consistently work towards them. They are focused on accumulating wealth and maintaining financial security, not impressing others. 19. Hard Work and Persistence: The path to wealth is rarely glamorous or easy. Millionaires work hard, persist through challenges, and maintain a long-term focus on building financial independence. 20. Minimizing Taxes: Millionaires use legal strategies to minimize taxes, such as investing in tax-deferred accounts, taking advantage of deductions, and carefully planning their tax liabilities. 21. Teaching Financial Responsibility: Millionaires teach their children financial responsibility, encouraging them to work, save, and manage their money wisely rather than relying on parental support. 22. Risk Management: Wealthy individuals are cautious about taking unnecessary risks. They focus on investing in stable, long-term opportunities and avoid speculative, high-risk ventures. 23. Financial Independence as a Goal: For most millionaires, the ultimate goal is financial independence, not just the accumulation of material wealth. They aim to achieve security and freedom from financial stress. 24. Frugal vs. Cheap: The book differentiates between being frugal (spending wisely) and being cheap (cutting corners on everything). Millionaires prioritize value over cost but are willing to invest in quality where it matters. 25. Surprise Statistics: The book reveals that many of America’s millionaires don’t live flashy lifestyles and are often unassuming, living in modest homes and driving ordinary cars. This challenges the stereotype of millionaires as ostentatious spenders.

More like this

Recommendations from Medial

Suman solopreneur

Exploring peace of m... • 1y

(millionaire fastlane) Jobs constrain learning, offer modest income growth, and exchange time for money, all of which reduce wealth. Workers are subject to office politics, pay high taxes, and have no influence over their income. Since there are so f

See More

Suman solopreneur

Exploring peace of m... • 1y

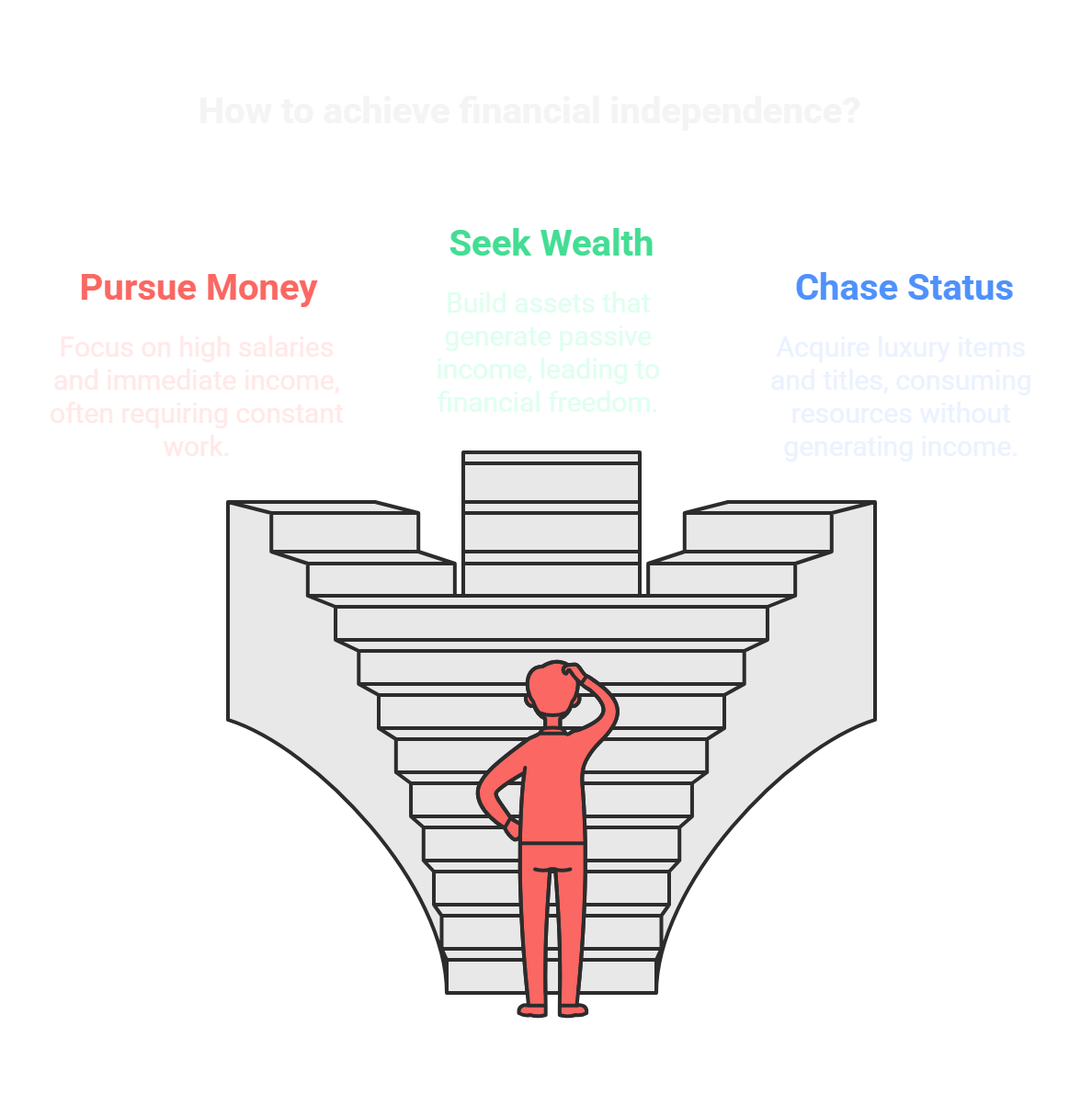

Many individuals function near the brink of financial ruin, ensnared by impulsive spending and materialism. Society's incorrect idea of wealth—accumulating possessions—imprisons lives in anxiety. Genuine wealth, however, is liberation: the capacity t

See MoreThakur Ambuj Singh

Entrepreneur & Creat... • 1y

💼 Why the Rich are Rich 💼 It’s not just about looking wealthy it’s about the mindset and strategies that make a lasting difference. 💡 Here are some principles that set successful people apart 1️⃣ Skills & Strategies - True wealth comes from hav

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)