Back

Rupesh Tiwari

In the Business of S... • 11m

How to become Rich sooner? Getting rich requires a combination of smart financial habits, strategic investments, and patience. Here’s a structured approach to building wealth: 1. Increase Your Income Develop High-Income Skills – Learn skills that pay well, like software development, sales, digital marketing, investing, or consulting. Start a Business – Entrepreneurship can scale your income far beyond a 9-to-5 job. Solve a real problem, build a strong brand, and reinvest profits. Advance in Your Career – Negotiate raises, switch jobs for better pay, or climb the corporate ladder. 2. Live Below Your Means & Save Aggressively Avoid Lifestyle Inflation – Just because you earn more doesn’t mean you should spend more. Save & Invest 50%+ of Your Income – The more you invest, the faster you build wealth. Eliminate Debt – High-interest debt (like credit cards) kills wealth-building. 3. Invest Wisely Stock Market – Invest in index funds (S&P 500), dividend stocks, or individual stocks after proper research. Real Estate – Rental properties, house flipping, or REITs can generate passive income. Business Investments – Owning or investing in businesses with strong cash flow. Crypto & Alternative Assets – Be cautious, but they can offer high returns with proper strategy. 4. Build Multiple Streams of Income Side Hustles – Freelancing, e-commerce, content creation, etc.

Replies (1)

More like this

Recommendations from Medial

Thakur Ambuj Singh

Entrepreneur & Creat... • 1y

Why the Rich Stay Rich 💰 💼 Invest in assets, not just income. 📈 Leverage debt smartly. 📊 Review finances daily. 📚 Never stop learning and adapting. 💡 Diversify with multiple income streams. 🎯 Set clear financial goals and plans. Wealth isn't

See More

Tarun Suthar

•

The Institute of Chartered Accountants of India • 1y

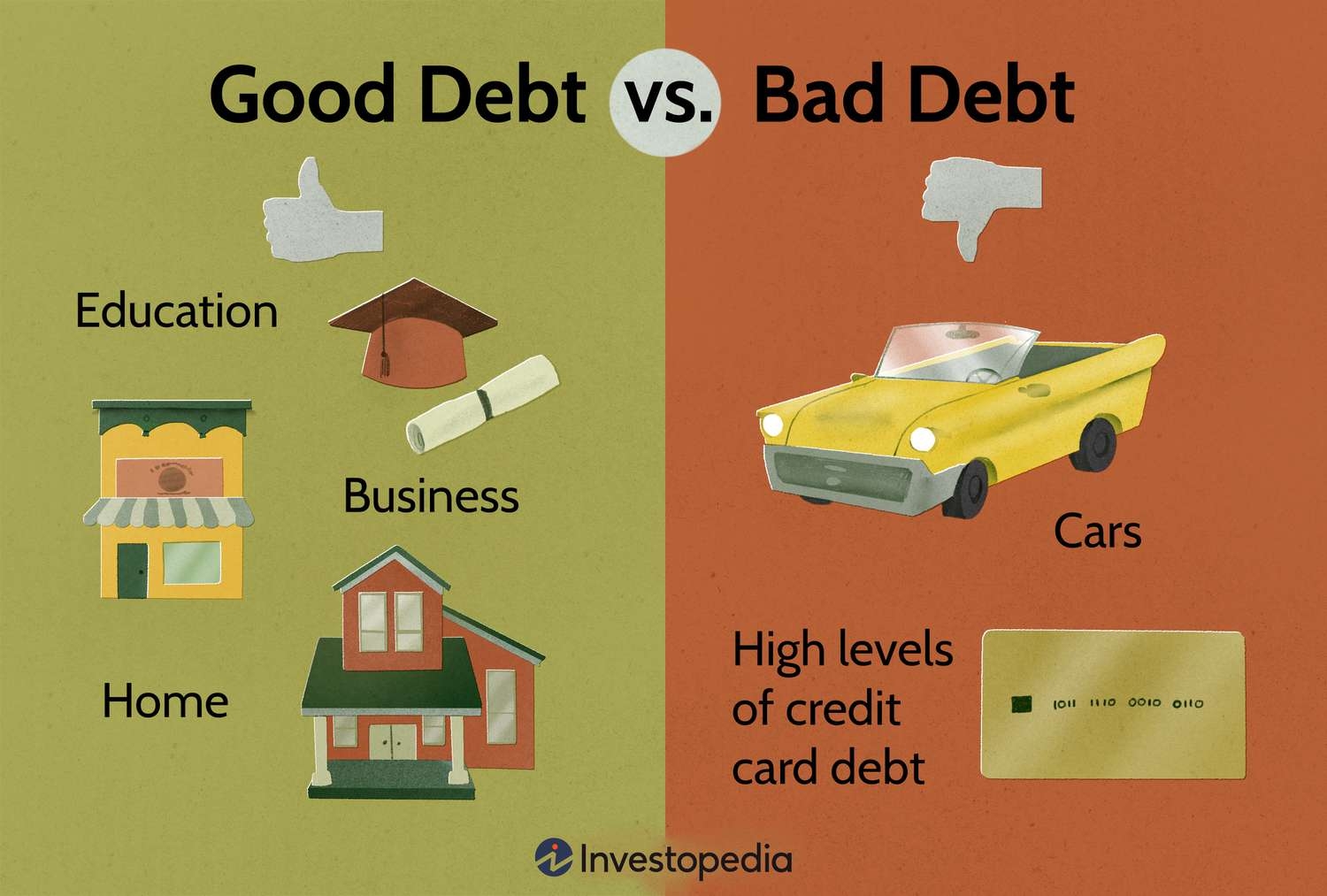

Have you read the book "Rich Dad, Poor Dad" written by "Robert Kiyosaki" . he is a genius. He admitted to having more than $1.2 billion in debt 🤯. you might have watched his yt Shorts claiming that. He views this debt as a strategic move and a par

See More

VIJAY PANJWANI

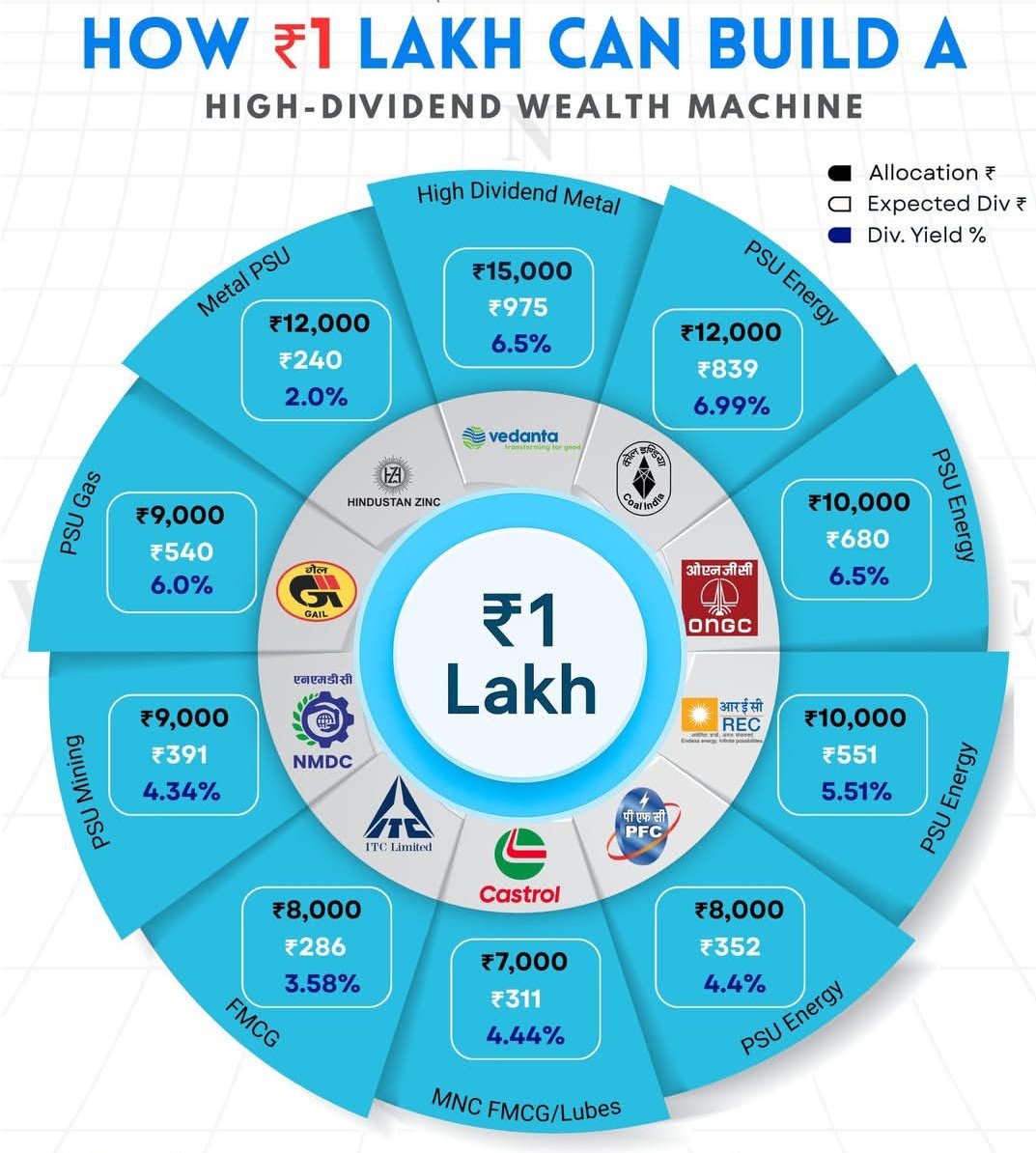

Learning is a key to... • 2m

💰 ₹1 Lakh → High-Dividend Wealth Machine! So many people think you need crores to earn passive income… ❌ Not true. 📊 With smart allocation in high-dividend stocks, even ₹1 Lakh can start generating regular cash flow. ⚙️ This portfolio focuses on

See More

Adarsh Patél

Hey I am on Medial • 1y

Mastering Personal Finance: A Comprehensive Guide to Building Wealth In today’s fast-paced world, understanding personal finance is no longer optional—it’s essential. Whether you’re saving for a home, planning for retirement, or trying to pay off de

See MoreVIJAY PANJWANI

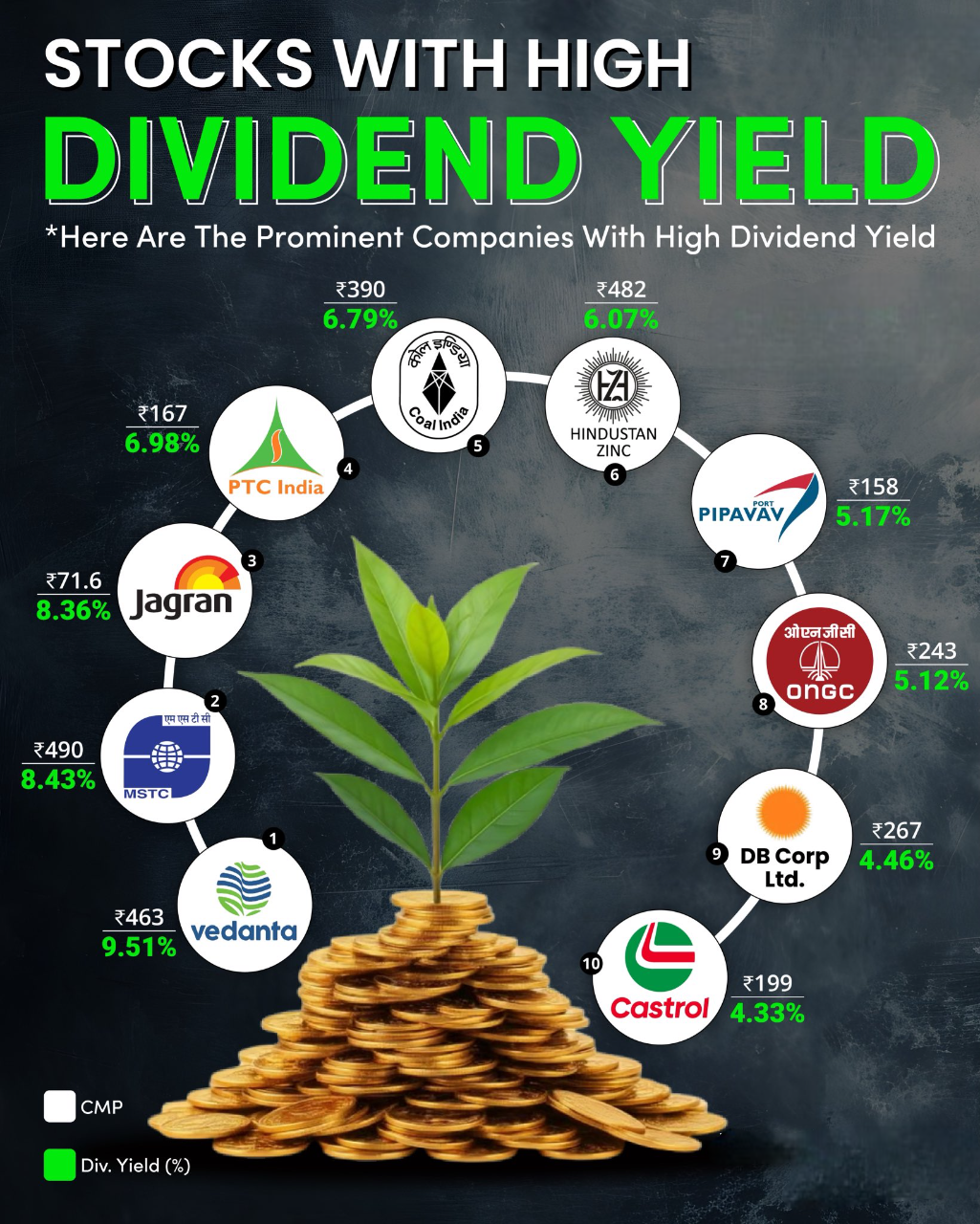

Learning is a key to... • 4m

Top 10 Dividend Paying Stocks in India! Want to earn steady passive income while investing? These stocks are giving high dividend yields in 2025 📊 Top Picks: 1️⃣ Vedanta – 9.51% 2️⃣ MSTC – 8.43% 3️⃣ Jagran – 8.36% 4️⃣ PTC India – 6.98% 5️⃣ Coal

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)