Back

More like this

Recommendations from Medial

Utkarsh

Every Trand Makes Ne... • 9m

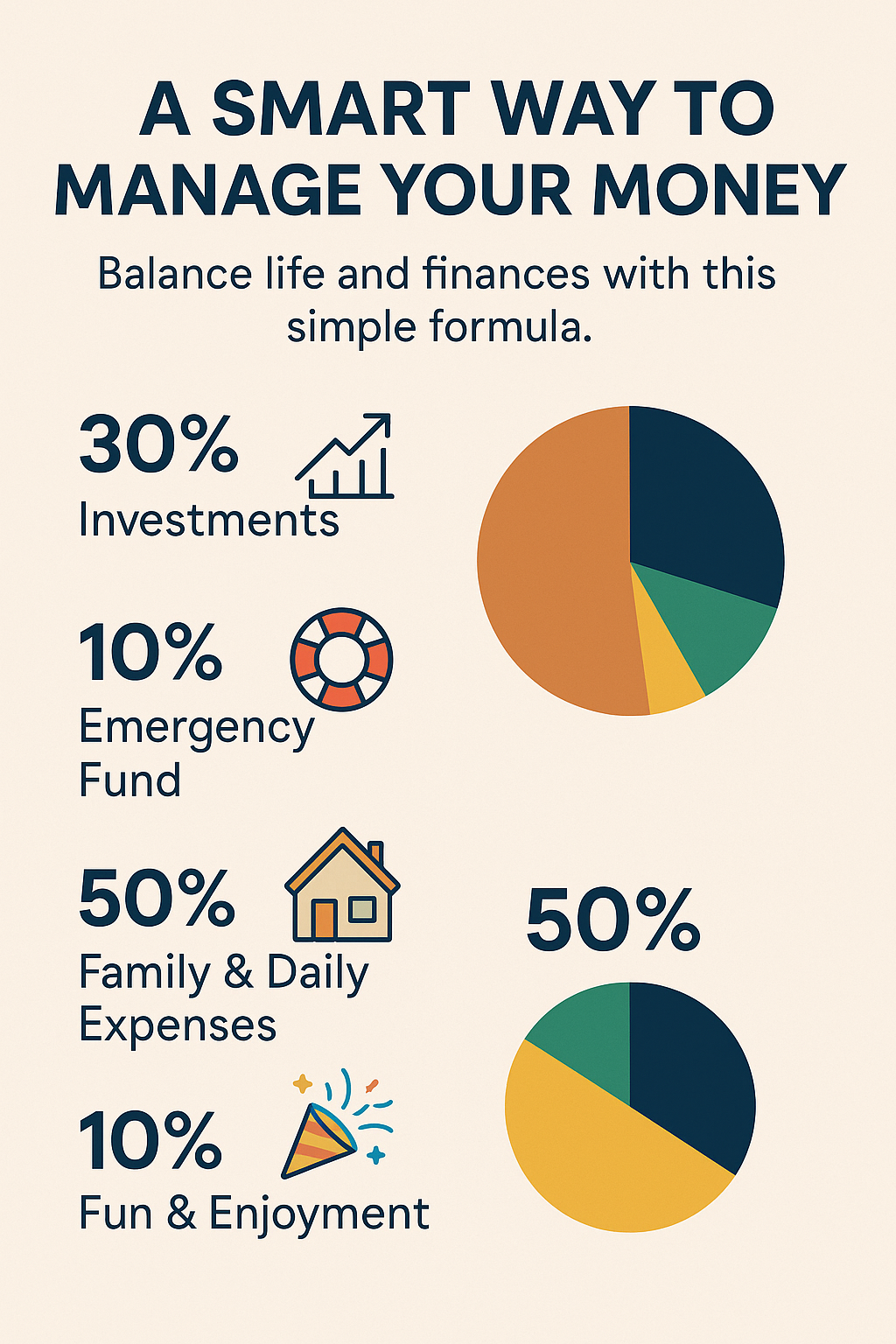

"Why Saving Feels Like a Burden? Let’s Fix That!" For many, especially salaried professionals, saving = stress. No thrill, no reward — just sacrifice. But truth is, saving isn't boring. It's just misunderstood. The problem isn’t saving. The problem

See More

Adarsh Patél

Hey I am on Medial • 1y

Mastering Personal Finance: A Comprehensive Guide to Building Wealth In today’s fast-paced world, understanding personal finance is no longer optional—it’s essential. Whether you’re saving for a home, planning for retirement, or trying to pay off de

See Moresujeeth challa

Hey I am on Medial • 7m

How many of you struggle to understand personal finances and investments? Imagine having an Ai powered personal finance copilot. It tracks and analyses expenses (via bank statement) gives you actionable insights - directs you to right kind of inves

See MoreOwl Maniac

Rethink and Breakdow... • 1y

Govt wants to uplift people from poverty to middle class. Actual Meaning: Govt wants more tax paying people while the current tax paying people can keep paying. Actual result: Middle class people can keep working like donkeys for the rest of thei

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)