Back

Prince

ur avg finance bro • 1y

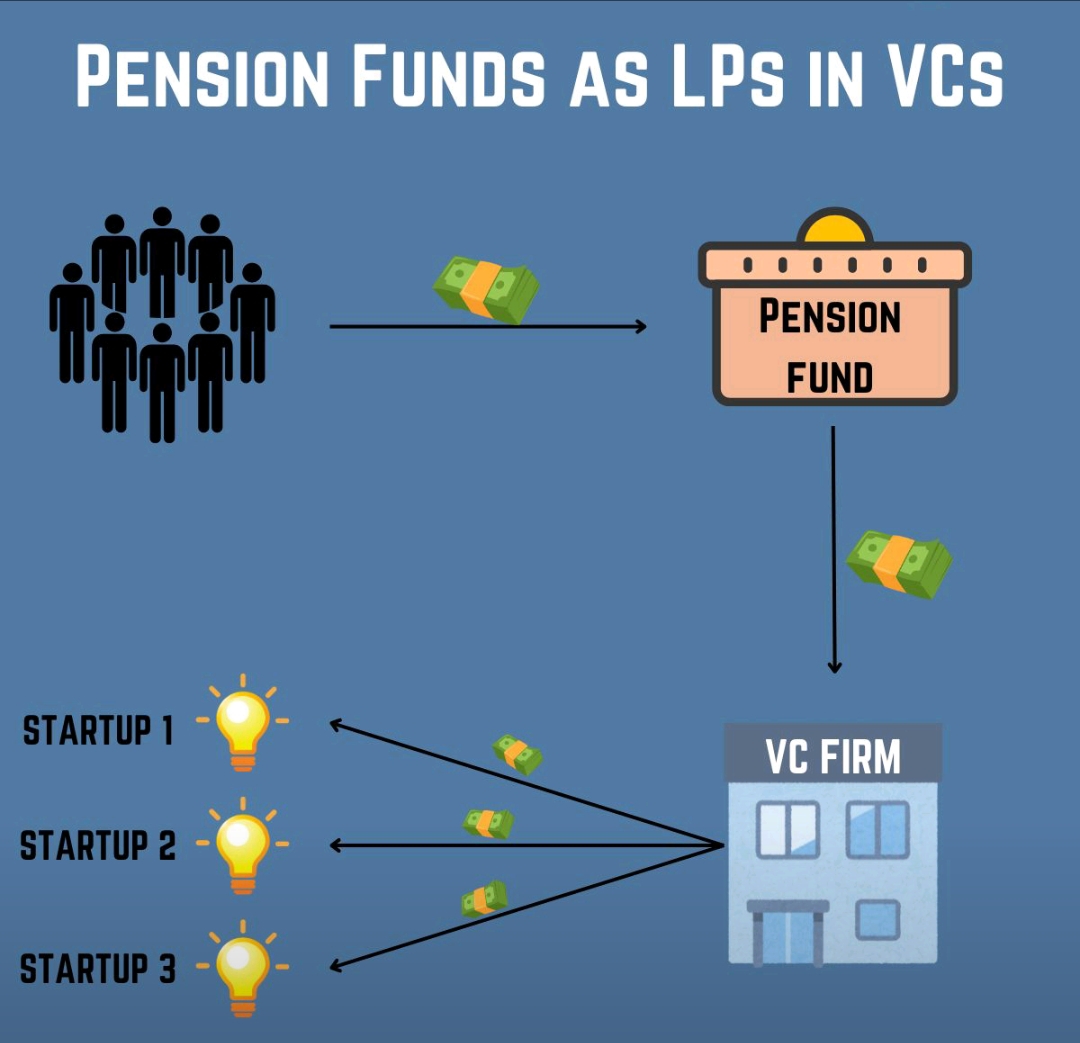

that's a good question. Private Equity Fund is a pool of money that is typically raised from institutions, family offices and pension funds. They use the funds to acquire controlling stake in underperforming private held companies (in most cases) and improve the business. The holding period for a fund like this is typically a decade or two. Once the business is improved, they sale their stake in the company at a higher valuation than what they acquired the company for. They make their cut and investors are happy with robust returns. Hope that answers your question :)

Replies (1)

More like this

Recommendations from Medial

Kevin Gohil

Helping startup in f... • 1y

So basically at Consultupindia, we help the startup to get the government funding, private funds,angel investors etc and the usp of us is that we apply on the particular field of the startup scheme so the chances to get the fund is high , is there an

See MoreVCGuy

Believe me, it’s not... • 10m

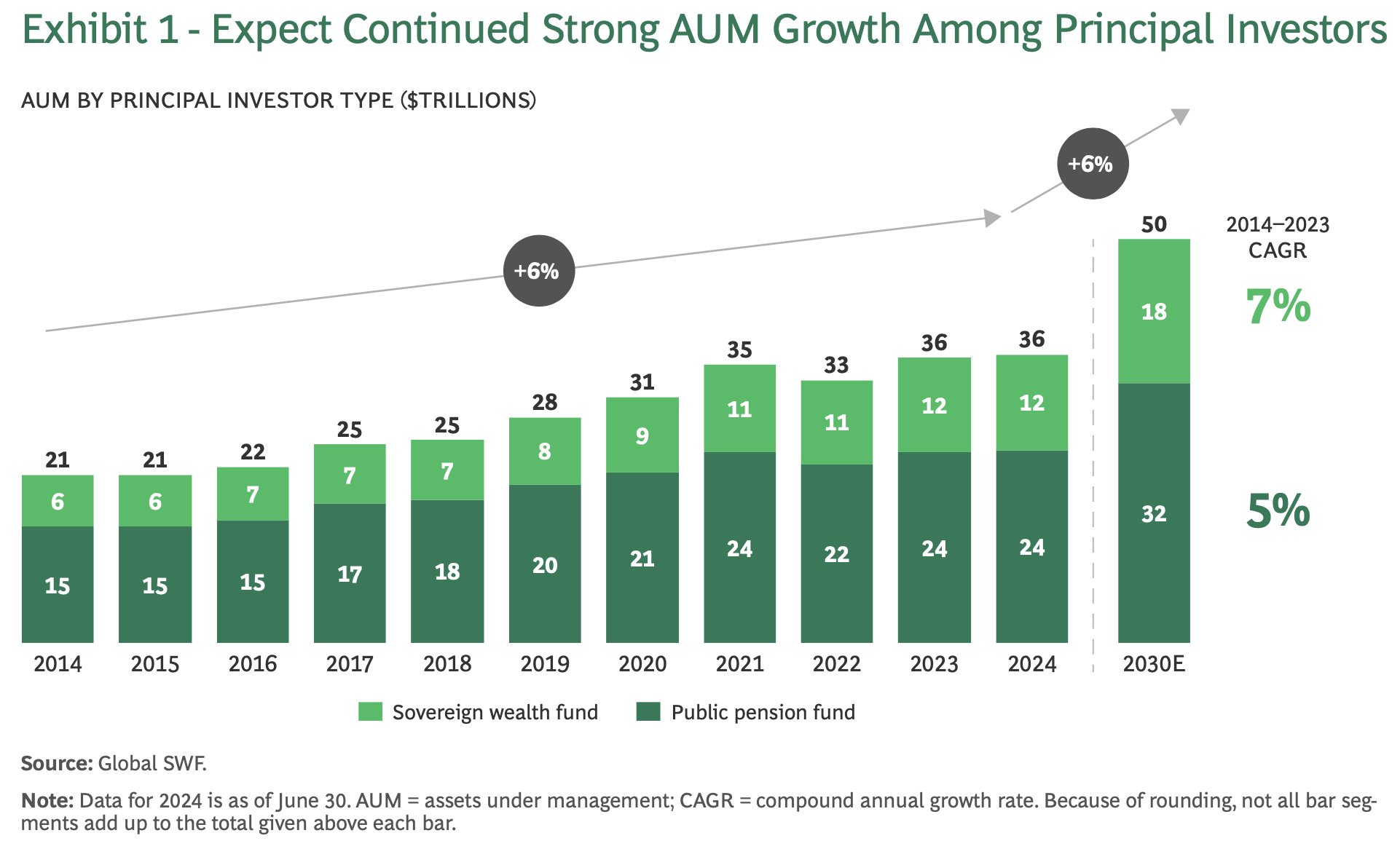

On Feb 3 - US Pres. Donald Trump ordered for the creation of a 'United States Sovereign Wealth Fund', possibly to facilitate the acq. of TikTok. What's a SWF? → SWFs are state-owned investment funds that manage a nation's excess reserves (Funds oft

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)