Back

Prince

ur avg finance bro • 1y

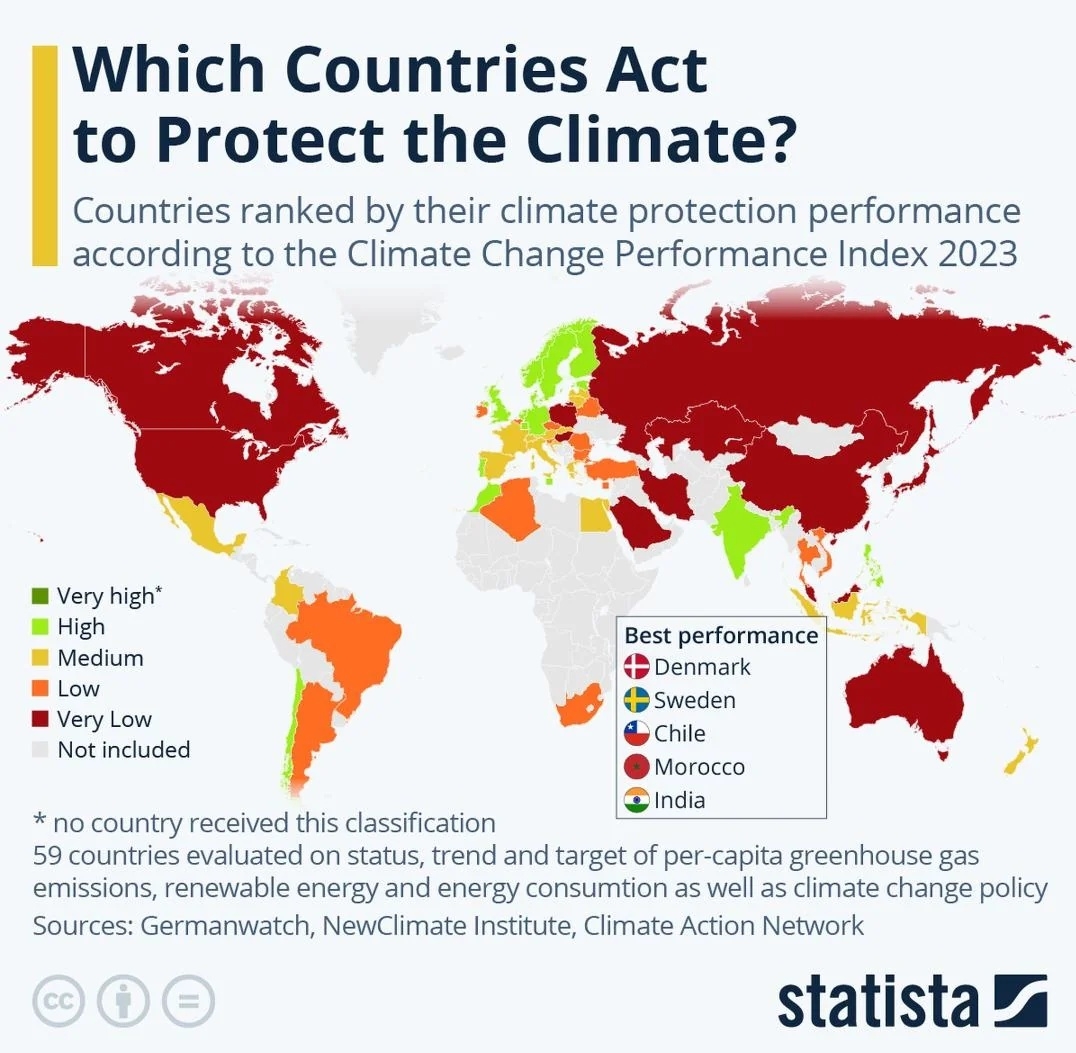

I've always wanted to build something. But sadly, I am not as creative as most people out there. So i thought of something What if, instead of building or innovating something, you buy something that's been built or innovated? And then scale it up. For context: I'm talking about buying the business. So here's the idea: Imagine a PE fund that acquires sustainable green/climate tech startups. Scale it up and sell later at a higher valuation. And here's the catch: we raise the money from middle class families and retail investors. Why Green/Climate tech? Throughout the past year, I've noticed that ESG and sustainable investing hasn't got enough traction. And since most investors look for humongous returns, they often tend to overlook the environmental impact. The main idea of this fund is to promote sustainable practices and decarbonization. And since this industry is slow, expect low returns but not in terms of valuation. What do you think? Is this feasible?

Replies (13)

More like this

Recommendations from Medial

Sandip Kaur

Hey I am on Medial • 1y

Green Startups: Leading the Charge in Sustainable Business Imagine a world where every business decision considers its impact on the planet. Enter green startups—companies that prioritize sustainability while seeking profit. These innovators tackle c

See MoreNiran Nagasai

Hey I am on Medial • 1y

I have 1L capital, I'm looking for good mutual fund to invest after some research me and my friend decided to invest lumsum in "Aditya Birla PSU equity" since it's last year returns were great and this fund performing the best among top 5 PSU equity

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)