Back

Replies (2)

More like this

Recommendations from Medial

Gargi Jain

Cloud | DevOps | Ill... • 1y

What's the best way to explain my Dad - Mutual Funds is better option than FD and MF gives higher returns. His statement is that "it is risky and might have to bare the loss sometimes and can't remove the cash whenever required (has lock in period)

See MoreRohan Saha

Founder - Burn Inves... • 8m

false marketing in finance 😞 Some fintech companies are really pushing the limits of misleading marketing these days. No names needed but you have probably seen the ones selling fixed deposits and credit cards with ads that feel too good to be tru

See MoreRohan Saha

Founder - Burn Inves... • 8m

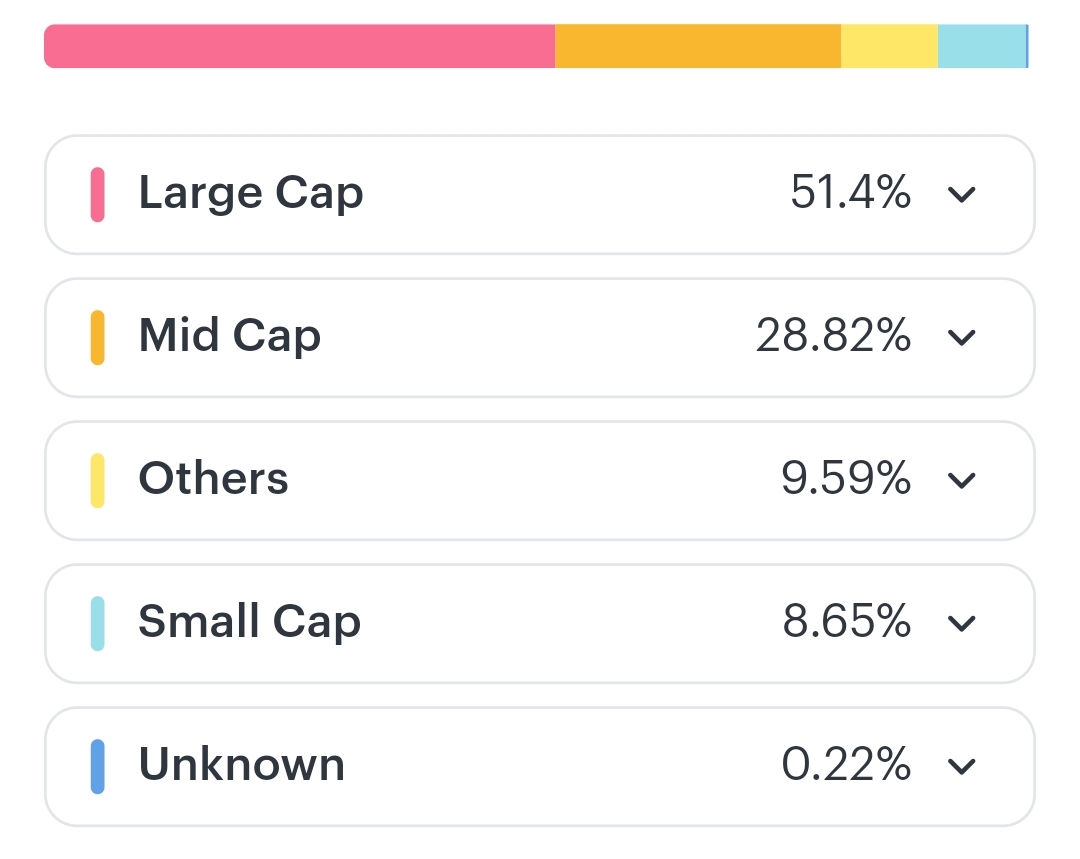

Over 51 percent of my portfolio is in large cap stocks yet I have delivered better returns this year than many mutual funds It makes me wonder what is it that holds fund managers back? Is it the way they manage cash or is there something else going o

See More

Dr Sarun George Sunny

The Way I See It • 4m

SEBI’s New Rule: Mutual Funds Must Say Goodbye to Pre-IPO Deals The Securities and Exchange Board of India (SEBI) has recently stepped in to bring a meaningful change in the way mutual funds invest in the IPO space. From now on, mutual funds can no

See More

PRATHAM

Experimenting On lea... • 7m

Top three investments with zero to low risk in which you can earn 7 to 9% are: first, FDs; second, Liquid Mutual Funds; and third, Arbitrage Funds. Liquid Fund is a day fund which invests in super ultra short-term instruments like T-Bills in the mon

See MoreAtharva Deshmukh

Daily Learnings... • 1y

The Stock Market Index When we want to know about the trends in the market, we need to analyze few of the important companies in each industry. The important companies are pre-packaged and continuously monitored to give you this information. This pr

See MoreMohd Rihan

Student| Passionate ... • 12m

Everyone should know 19 financial terms before any investment... Stock: A security that represents the ownership of a fraction of the issuing corporation. IPO: The first sale of the company's share to the public allowing it to raise capital by listin

See More

Download the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)