Back

Replies (1)

More like this

Recommendations from Medial

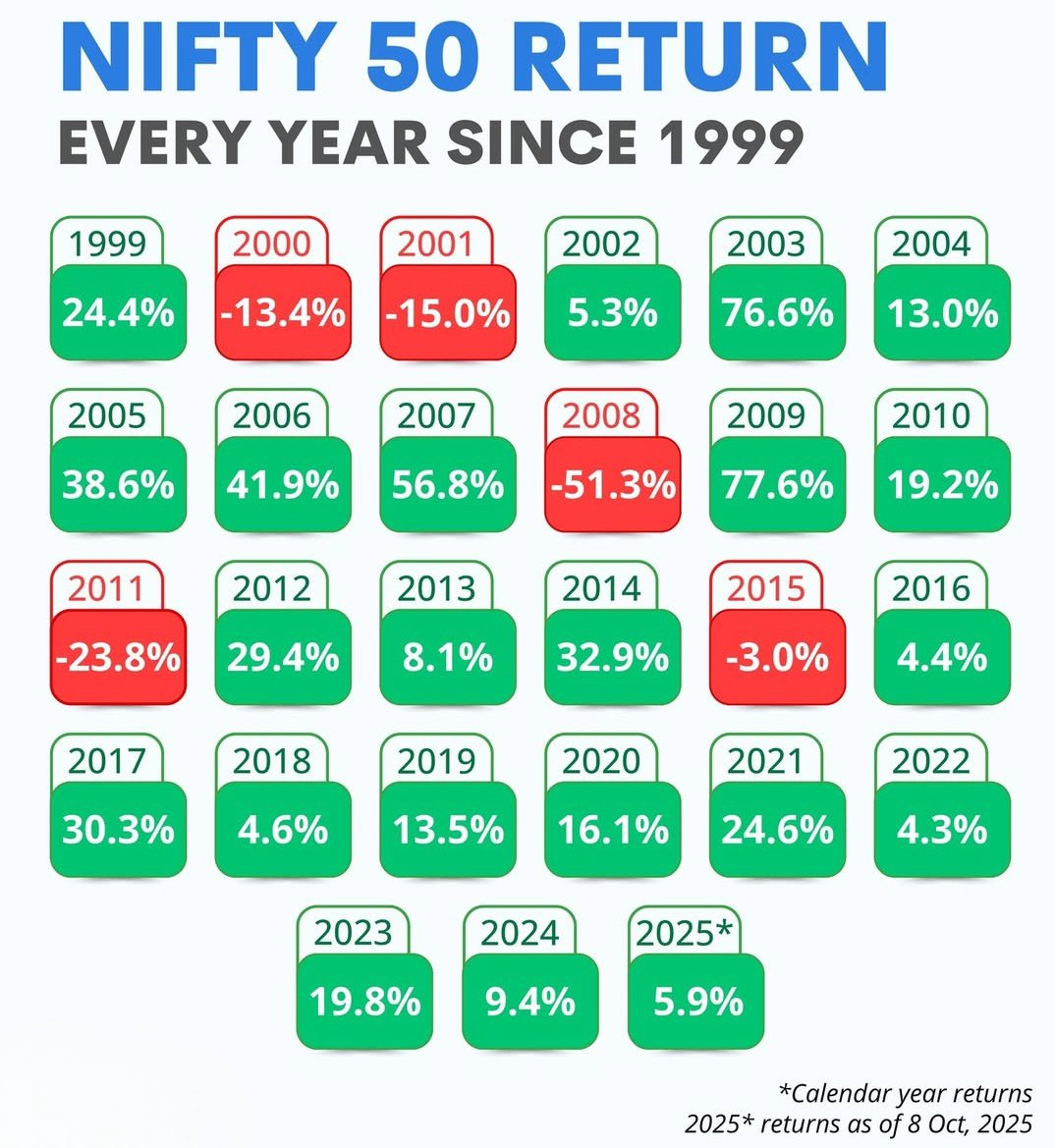

Ravi Handa

Early Retiree | Fina... • 1y

"Most active funds don't beat the benchmark" - got index funds after hearing this multiple times. AND NOW: Most of the active funds I have - have beaten the index funds (Nifty 50) I have. Quite comfortably. 🥲 Hoping the story changes soon otherw

See MorePulakit Bararia

Founder Snippetz Lab... • 11m

Most people obsess over rapid growth, chasing quick wins and short-term spikes. But the smartest entrepreneurs focus on endurance—building businesses that last, brands that compound, and systems that scale sustainably. In the long run, longevity

See MorePRATHAM

Experimenting On lea... • 7m

Top three investments with zero to low risk in which you can earn 7 to 9% are: first, FDs; second, Liquid Mutual Funds; and third, Arbitrage Funds. Liquid Fund is a day fund which invests in super ultra short-term instruments like T-Bills in the mon

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)