Back

Tushar Mishra

Founder & CEO - Crav... • 1y

No, 5% of the total loan amount. Fir example if someone takes a loan of 1 lakh then the intrest would be 5000 and we will charge only 1000 on it. Depending upon the time of repayment if the borrower delays then extra intrest will be charged from him and we will also give a credit score to the borrowers by which the lendors will know about the past records of the borrowers.

More like this

Recommendations from Medial

SettleMate NextGen

Pathway to Prosperit... • 1y

Introducing Our Innovative Startup: Loan Settlement with Blockchain Technology In today’s financial world, many loan borrowers, from individuals to large-scale clients, struggle with timely repayments. This often results in legal complications, high

See MoreShivam Malhotra

Founder of stockkhat... • 1y

Hey everyone! I'm developing a fintech app with a unique concept: offering 0% interest loans to users. While this sounds great for borrowers, I'm seeking your input on the biggest challenge - ensuring loan repayment. Here's the idea in a nutshell:

See Moreaaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MorePraveen Kumar

Start now or Regret ... • 1y

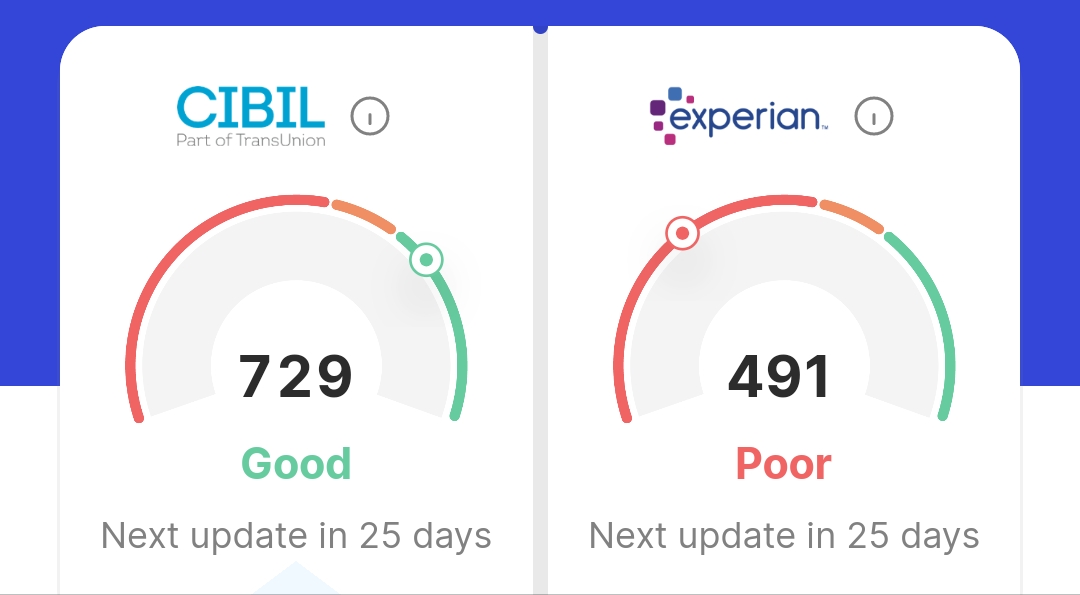

hii , At the age of 19 I have unfortunately taken a loan for my friend in mpocket and the loan was never paid.I have neglected that time because I don't have money .Now I am salaried with 5.2 lpa but I have less credit scores , so no credit card are

See More

AVINASH JADHAV

Founder of rebuilt p... • 8m

Brief description of the Product : Normally when a customer takes a loan, not every time but sometimes they get the emi bounced due to some genuine reason. Our idea of this product is to solve that issue. In this we will make sure that the EMI is pai

See MoreRohan Saha

Founder - Burn Inves... • 8m

Good news for anyone taking gold loans and for gold loan companies too, The RBI has just increased the loan to value ratio from 75% to 85%. Simply put, if your gold is worth ₹1 lakh, you can now get a loan of up to ₹85,000 instead of the earlier ₹75,

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)