Back

Rohan Saha

Founder - Burn Inves... • 8m

Good news for anyone taking gold loans and for gold loan companies too, The RBI has just increased the loan to value ratio from 75% to 85%. Simply put, if your gold is worth ₹1 lakh, you can now get a loan of up to ₹85,000 instead of the earlier ₹75,000. But there’s a small condition: to get the full 85%, your gold’s value must be under ₹2.5 lakh. If it’s more than that, the old 75% rule still applies. This move is mainly to help small borrowers.

More like this

Recommendations from Medial

aaquib mahfooz

Being innovative • 1y

i have idea of creating an online platform that connects lenders directly with borrowers is similar to peer-to-peer lending (P2P lending). P2P lending has become popular in recent years as an alternative to traditional banking and NBFC loans. To mak

See MoreSettleMate NextGen

Pathway to Prosperit... • 1y

Introducing Our Innovative Startup: Loan Settlement with Blockchain Technology In today’s financial world, many loan borrowers, from individuals to large-scale clients, struggle with timely repayments. This often results in legal complications, high

See MorePriyant Dhrangdhariya

Head of Finance @ Th... • 1y

India’s Gold Loan Market: A Glittering Opportunity The Sparkling Growth: Bajaj Finserv Ltd., a diversified NBFC, predicts India’s gold loan market—valued at $55.52 billion in 2022—will soar to $124.45 billion by 2029. A 12.22% annual growth fuels t

See MoreVIJAY PANJWANI

Learning is a key to... • 5m

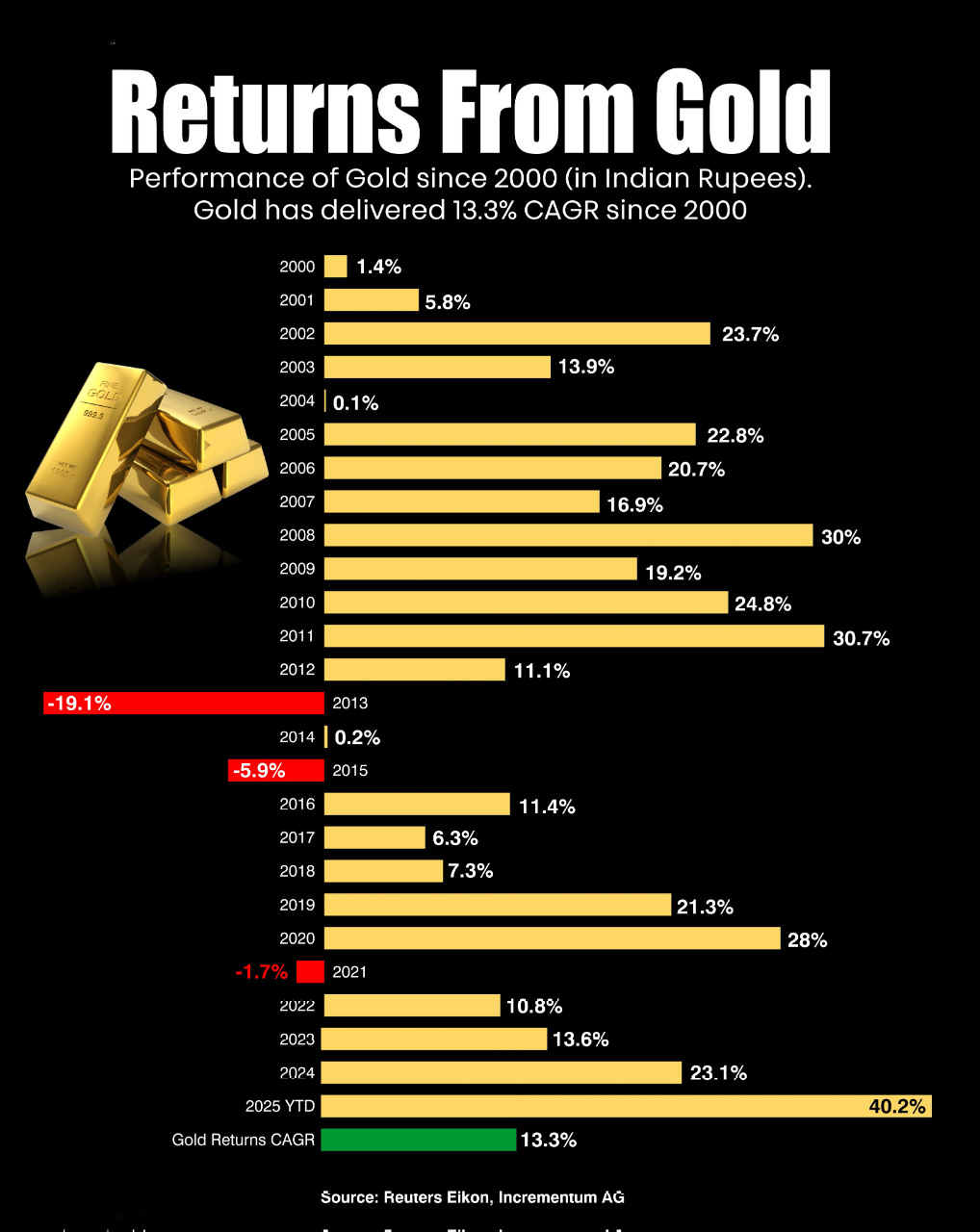

💰 Gold has delivered 13.3% CAGR since 2000 in India! 📈 From modest returns in 2000 (+1.4%) to massive surges like +30.7% in 2011 and +40.2% in 2025 YTD, gold has consistently proven itself as a long-term wealth preserver. Even with downturns (-19

See More

JATINKUMAR PARMAR

30K+|🤖 Radically im... • 8m

Mercor is now working with 6 out of the Magnificent 7 and all of the top 5 AI labs. Physicians, Pathologists, $140 - $160/hr Psychologists, $50 - $70/hr Medical and Health Services Managers, $65 - $85/hr Pharmacists, $65 - $85/hr Bioengineer

See MoreDownload the medial app to read full posts, comements and news.

/entrackr/media/post_attachments/wp-content/uploads/2021/08/Accel-1.jpg)